3 Stocks Poised for Huge Growth Over the Next Decade

Investing in disruptive stocks targeting large addressable markets can be a ticket to market-trouncing returns, but finding these stocks can be tough. We asked three Motley Fool contributors to help, and after scouring their universes, they came back recommending Vivint Solar (NYSE: VSLR), JD.com (NASDAQ: JD), and CannTrust Holdings (NYSE: CTST) as top stocks with huge growth potential to own over the next 10 years. Are these stocks right for your portfolio? Read on to find out.

The solar growth play

Travis Hoium (Vivint Solar): The residential solar industry has been through its share of ups and downs, but today it's as stable as it has ever been. Vivint Solar is one of the companies that has settled into a steady business model of building residential solar systems, monetizing them by selling solar leases to customers, and mixing in some system sales along the way.

Image source: Getty Images.

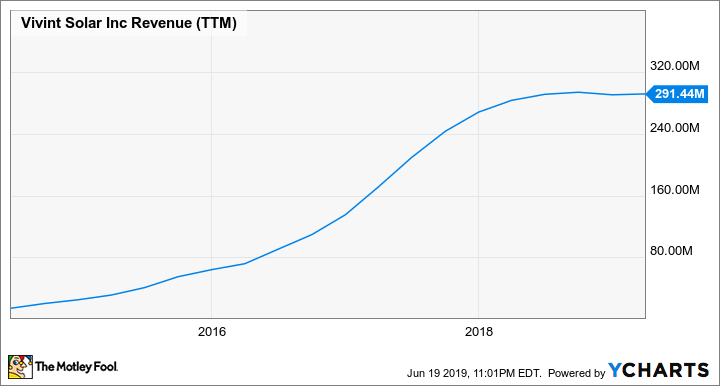

What makes this a great growth stock is that leases stack on top of one another, creating a natural growth business as the customer base increases. You can see below that the last decade has been high growth, up until the last year, when timing of system sales has flattened revenue.

VSLR Revenue data by YCharts. TTM = trailing 12 months.

As the value of projects stacks up, so does the value sitting on Vivint Solar's balance sheet. Management estimates that the net retained value of projects is currently $9.48 per share, more than a 25% premium from where shares are currently trading. A growth stock trading at a discount is just the kind of stock I want to own in today's market.

China's largest retailer

Leo Sun (JD.com): JD.com, China's largest direct retailer and second largest e-commerce player after Alibaba (NYSE: BABA), lost about 30% of its value over the past 12 months due to concerns about its slowing sales, inconsistent profits, the trade war's impact on the Chinese economy, and a rape allegation against its founder and CEO Richard Liu.

Yet several of those headwinds gradually waned. Its revenue stabilized last quarter with 21% year-over-year growth, its gross and operating margins expanded as it cut costs and offered its logistics services to third-party companies, and its free cash flow turned positive again as it divested several projects. Prosecutors also dropped the rape charges, although the alleged victim is still suing Liu and JD for damages.

Its near-term outlook is murky, but it still has room to run over the long term. Unlike Alibaba, which only facilitates purchases between businesses and individuals on Taobao and Tmall, JD takes ownership of its inventories and sells most of its products as a direct retailer.

It also uses its own logistics network, which includes drones and delivery robots, while Alibaba mostly relies on third-party courier services. JD has plenty of support from other tech and retail giants -- its biggest backers include Tencent, Walmart, and Alphabet's Google.

JD's stock currently trades at less than 0.5 times this year's sales, so it could rebound quickly on any good news about China. It will also dominate China's retail market alongside Alibaba for the foreseeable future -- which makes it a great long-term play on the People's Republic.

Image source: Getty Images.

Making the most of marijuana legalization

Todd Campbell (CannTrust): Following Canada's recreational marijuana laws going into effect last fall, CannTrust shares have fallen sharply as investors "sold the news." The drop in its share price, however, could offer investors a great opportunity to buy a top pot stock on sale.

People spend about $150 billion per year worldwide on marijuana, including about $4.5 billion in Canada and nearly $50 billion in the United States. Canada legalized recreational marijuana last year, and although it's still illegal federally in the U.S., 10 states (and counting) have created legal marketplaces, and momentum for federal legalization is building.

To capitalize on these changes, CannTrust owns hydroponic production facilities in Niagara, which positions it perfectly to serve Ontario and Quebec, where over 60% of Canada's population lives. If the U.S. legalizes pot nationally, it's proximity to the U.S. may help it respond quickly.

In the third quarter, CannTrust expects annual pot production will reach a 50,000-kilo run rate, and production could hit a 200,000-kilo pace next year because of new outdoor production.

It sold roughly 3,000 kilos in the first quarter, generating 16.9 million Canadian dollars ($12.8 million) in revenue, so if it hits its production targets, sales could be about to soar. Since CannTrust expects quarterly operating profits by the end of this year, it could be one of the first pot stocks to reward investors with earnings. Given that backdrop, I don't think it's a stretch to think this company's financial future over the next decade is bright.

More From The Motley Fool

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Leo Sun owns shares of JD.com and Tencent Holdings. Todd Campbell owns shares of Alphabet (C shares) and CannTrust Holdings Inc. His clients may have positions in the companies mentioned. Travis Hoium has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Alphabet (A shares), Alphabet (C shares), JD.com, and Tencent Holdings. The Motley Fool recommends CannTrust Holdings Inc. The Motley Fool has a disclosure policy.