3 Stocks Warren Buffett and Leon Cooperman Agree On

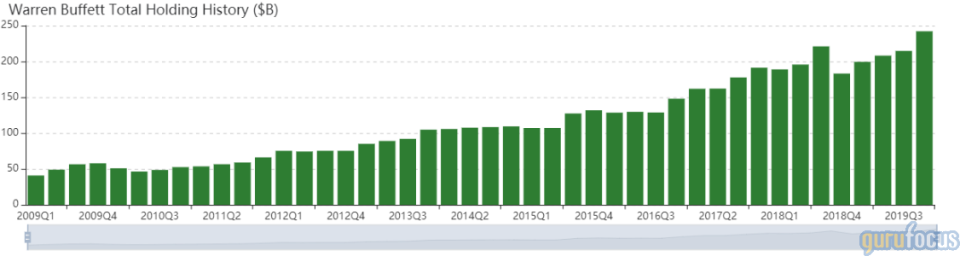

According to the Aggregated Portfolio, a Premium feature of GuruFocus, three stocks billionaire investors Warren Buffett (Trades, Portfolio) and Leon Cooperman (Trades, Portfolio) both own in their investment vehicles, Berkshire Hathaway Inc. (NYSE:BRK.A)(NYSE:BRK.B) and the Omega Advisors family office, are Wells Fargo & Co. (NYSE:WFC), United Airlines Holdings Inc. (NASDAQ:UAL) and Amazon.com Inc. (NASDAQ:AMZN).

Warning! GuruFocus has detected 2 Warning Sign with WFC. Click here to check it out.

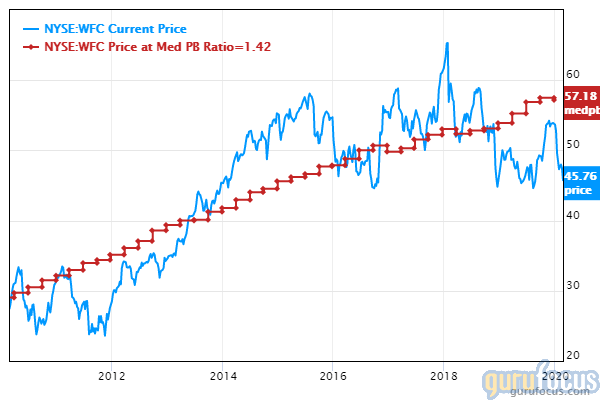

Peter Lynch Chart of WFC

Two patient investors take advantage of market selloff, remain net buyers

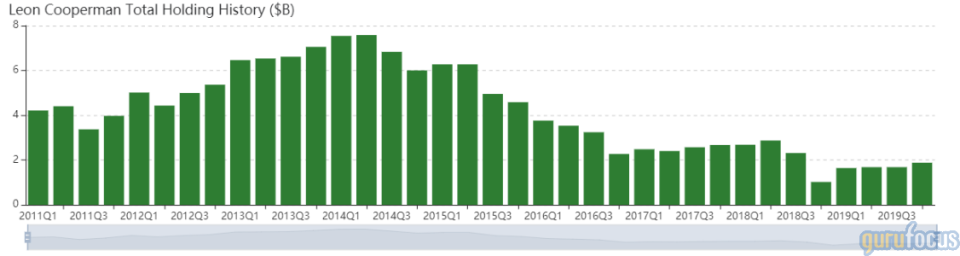

Buffett's conglomerate seeks investments in "good companies trading at fair prices," i.e., companies that meet his four-criterion approach to investing: understandable business, favorable long-term prospects, operated by honest and competent people and available at an attractive share price. Likewise, Cooperman's Omega Advisors, which the fund chairman converted into a family office in 2018, invests based on his macroeconomic views and fundamental valuations.

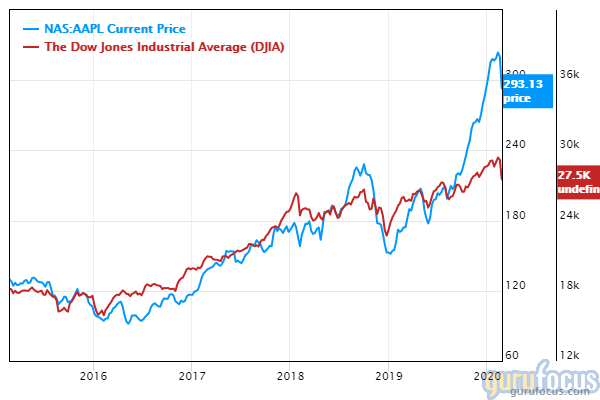

Buffett said in a CNBC "Squawk Box" interview that the Dow's 1,000-point drop on Monday is "good" for Berkshire, adding that the conglomerate is a "net buyer of stocks over time" and that "savers should want the market to go down" so that they can buy at lower prices.

Cooperman joined "Squawk Box" on Wednesday, saying that he is also a "net buyer" and seeing high value potential in the market. The Dow Jones Industrial Average continued its decline for the week, trading 123.77 points lower than Tuesday's close of 27,081.36 despite reaching an intraday high of 27,542.78 around midday.

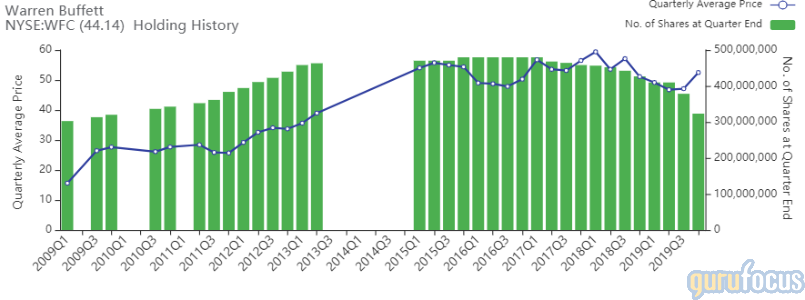

Wells Fargo

Buffett and Cooperman's equity portfolios have a combined weight of 8.31% in Wells Fargo. The San Francisco-based bank represents 7.18% of Berkshire's portfolio, the fifth-largest position in terms of portfolio weight.

Despite his conglomerate selling shares in Wells Fargo during the December 2019 quarter, Buffett said to CNBC's Becky Quick that he still feels "very good about the banks" Berkshire owns shares in. Buffett added that banks are "attractive compared to most other securities" he sees. According to top 10 holdings statistics, a Premium feature, Berkshire's top bank holdings also include Bank of America Corp. (NYSE:BAC) and JPMorgan Chase & Co. (NYSE:JPM).

GuruFocus lists a few good signs for Wells Fargo, including a price-book ratio and a price-sales ratio near a five-year low. Despite this, Wells Fargo's equity-to-asset ratio of 0.10 underperforms 51.10% of global competitors.

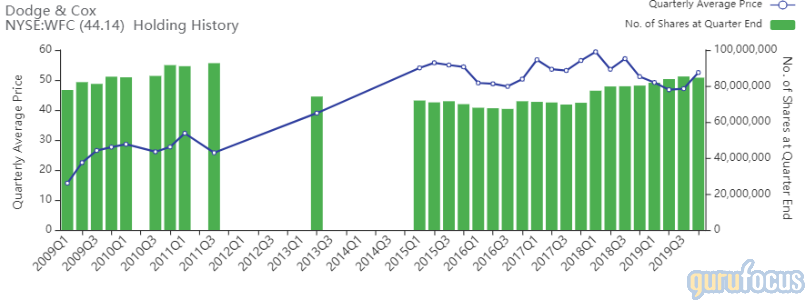

Other gurus with holdings in Wells Fargo include Dodge & Cox and PRIMECAP Management (Trades, Portfolio).

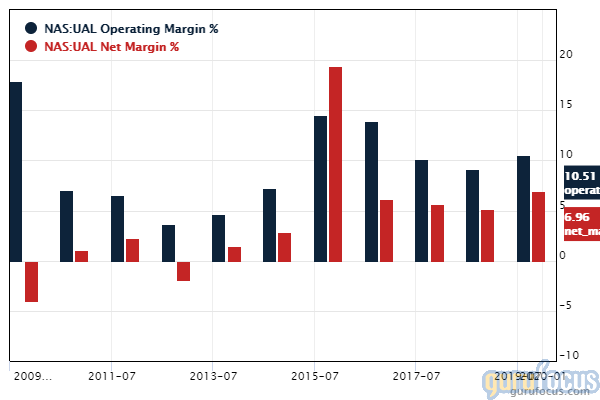

United Airlines

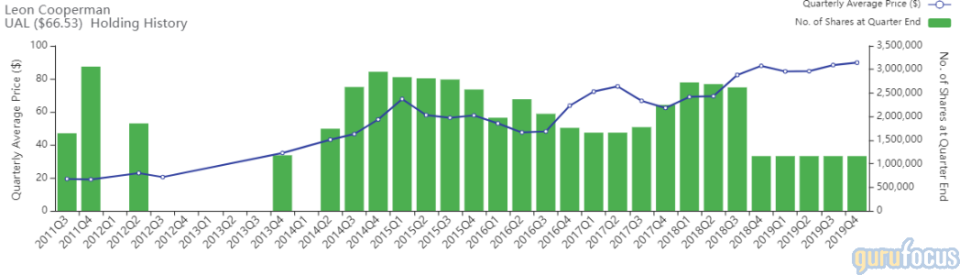

Buffett and Cooperman's equity portfolios contain a combined weight of 6.25% in United Airlines. The Chicago-based airline represents 5.45% of Omega's portfolio, the fourth-largest position in terms of portfolio weight.

Cooperman said that he added to his holding in United in light of the market plunge, commenting that the stock is "trading at six times" the company's expected earnings for this year. United withdrew on Monday its guidance for 2020 due to the uncertainty surrounding the virus outbreak. Shares of the airline closed at $66.53 on Wednesday, down over 5% from Tuesday's close and approximately 0.97% higher than its 52-week low.

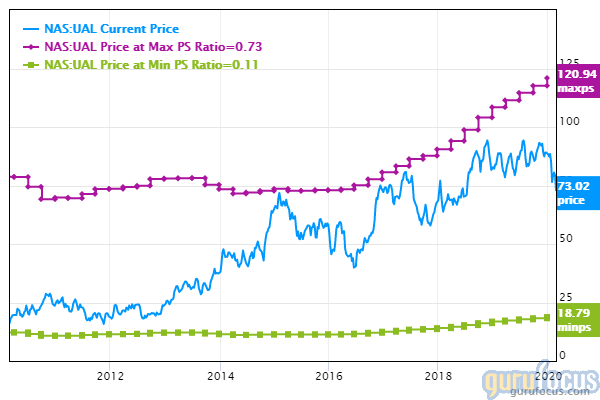

GuruFocus ranks United's profitability and valuation 8 out of 10 on several positive investing signs, which include expanding profit margins, a high Piotroski F-score of 7 and price valuations close to multiyear lows.

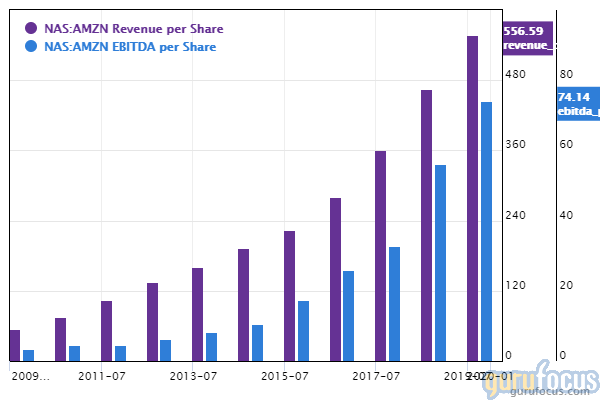

Amazon.com

Buffett and Cooperman's equity portfolios have a combined weight of 1.54% in Amazon. GuruFocus ranks the Seattle-based retail giant's profitability 8 out of 10 on several positive investing signs, which include expanding profit margins and a 4.5-star business predictability rank, suggesting strong and consistent revenue and earnings growth over the past 10 years.

Disclosure: No positions.

Read more here:

4 Warren Buffett Holdings Trading Near 52-Week Lows

Leon Cooperman's Top 6 Buys for the 4th Quarter

The 4 Most-Bought Guru Stocks of the 4th Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.