3 ‘Strong Buy’ Stocks Needham Analysts Are Raving About

International investment banker Needham & Company is home to a suite of Wall Street’s best analysts. They monitor the markets, giving Needham’s clients the benefit of their experience and insight. In the past week, three of Needham’s analysts have issued reports on a series of exciting high-upside tech stocks.

We’ve looked up all three in TipRanks’ Stock Screener, and found out just what put these stocks on Needham’s radar. The end results can be summed up simply: all three stocks show tremendous potential for near- to mid-term growth. Let’s take a close look at them, and see exactly why they are compelling opportunities.

Uber Technologies (UBER)

We’ll start with Uber, the headline-grabbing ride-share app that is turning the taxi industry upside down. Based in San Francisco, home to many of the tech world’s innovators, Uber boasts operations in more than 780 cities world-wide. The app has more than 110 million active users, and has taken a 69% market share in the individual passenger transport niche in the United States. The ride share app quick to take advantage of new roles – in addition to its hefty transport market share, Uber commands 25% market share in the food delivery niche. The company’s rapid growth – it has achieved all of this in just 10 years – has been a magnet for investors and pushed the market cap past $54 billion.

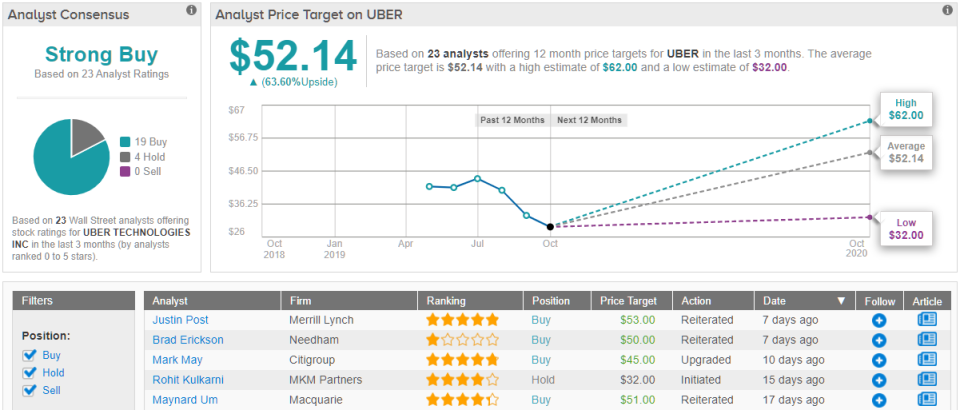

Needham’s Brad Eriskson has reviewed UBER, and reiterated his buy rating on the stock along with a $50 price target, indicating his confidence in over 50% upside. (To watch Eriskson's track record, click here)

Eriskson is forthright about recent problems the company has faced, saying simply, “We acknowledge further bookings deceleration will make near-term stock appreciation challenging…” He goes on to say that he believes these headwinds are starting to fade and that the stock will begin accelerating again in the mi-term outlook.

Getting to details, Erickson writes, “We view UBER as one of the best mega-cap value-creation opportunities in our universe given transportation's massive $5 trillion end market… We believe consumers have only just begun to use shared mobility to buy back time during their busy lives. In the U.S. and Europe alone, we estimate that the annual value of commuting is $829 billion and $1,627 billion, respectively, a rising portion of which we believe shared mobility can capture… our analysis of the value of people's time in the two regions based on stratified income levels suggests Uber is a compelling option for large portions of the population, which makes growth appear more sustainable than investors expect.”

In line with Eriskson's bullish stance, UBER stock holds a Strong Buy from the analyst consensus, based on 19 "buy" and 4 "hold" ratings assigned in the past three months. Importantly, the average price target of $52.14 implies over 60% upside from the current share price of $31.87. (See Uber stock analysis on TipRanks)

Medallia (MDLA)

Our second hot tech stock from Needham is Medallia. Based in San Francisco, like Uber above, Medallia has offices in major global hubs such as London, Buenos Aires, New York, and Tel Aviv. The company inhabits the Software-as-a-Service (SaaS) space of the cloud universe, offering business customers an advanced capability in monitoring social, mobile, contact center, and Web feedback. Medallia’s software monitors such contacts in real-time, and provides analysis to customer satisfaction and loyalty teams, allowing management to fine-tune goals and targets.

Medallia went public just this past July, and since then has gained 32% since opening on the markets. The company’s market cap is up to $3.5 billion, and MDLA caught the attention of Needham’s 5-star analyst Scott Berg right away. Back in August, after three straight bull sessions, Berg initiated coverage of this stock with a $45 price target, saying, “…the company’s profitable long-term model justifies a premium valuation.” (To watch Berg's track record, click here)

Since then, Berg remains bullish. He met earlier this week during investor meetings with CEO Roxanne Oulman, and came out with an optimistic view of the company’s future, writing, “Our meetings support our thesis that given MDLA's new management team's strong operational background the company can re-accelerate growth of its strong product platform… As a result, we look for durable 25% - 30% annual revenue growth.”

Getting down to details, Berg points out a series of factors that will boost Medallia’s niche performance and stock share value in the mid- to long-term. He writes, “With current enterprise customers only utilizing an average of two modules versus a portfolio containing 11 today… opportunity to cross-sell customers could accelerate… Medallia's acquisition strategy is focused on acquiring talent and technology to maintain the company's competitive advantage… Management highlighted a measured approach to investments in sales and product to deliver a long-term balance of growth + profitability.”

At the bottom line, Berg says that, with MDLA, patient investors are wise investors. He sums up the case by saying, “We believe investors with enough patience to let management execute on GTM and product investments over the next 12-18 months are likely to benefit from re-accelerating revenue growth and a solid land and expand model.”

Overall, analysts are equally bullish on this stock. MDLA holds a Strong Buy from the consensus, with 10 buys against just 2 holds. The average price target is $46, slightly higher than Berg’s, and suggests an upside potential of 67% from the current trading value of $27.87. (See Medallia stock analysis on TipRanks)

Okta, Inc. (OKTA)

Earlier this year, this cloud-based user authentication and identity control software company hit the 100 million user mark, an important milestone that justifies the nearly $13 billion market cap. OKTA trades robustly, and has quintupled in value since its IPO in May of 2017.

Needham’s Alex Henderson, another 5-star analyst, has covered OKTA regularly. Back in August, he wrote that this stock is a compelling buy, with strong prospects for growth, saying, “Expect 31-34% growth for the October quarter, which leaves plenty of room for upside.” (To watch Henderson's track record, click here)

Events since then have borne him out. In the Q2 report, released in August, Okta revealed a 49% sales jump, with total sales of $141 million; both numbers were well in excess of the company’s previous guidance. Over 1,200 companies have signed contracts worth more than $100,000, and the top 25 contracts doubled in size from the year previously. Okta’s financials also improved, as the cash burn fell from $5 million to $1 million.

We can leave the bottom line to Alex Henderson, who attended an investor day earlier this month. He met with the company’s COO/Founder Frederic Kerrest, and wrote afterward, “We come away from an NDR with OKTA COO/Founder and Okta's analyst event with renewed conviction that Okta has become the de facto standard in Identity. Identity is crucial to Cloud Direct Security and Zero Trust. This is a massive market. It’s several massive markets. Okta continues to innovate delivering roughly 40 software upgrades annually. According to management, Okta is seeing no impact from slowing macro conditions and may even be accelerating. The company expects to accelerate hiring from the 40% rate in the first half and still produce operating leverage. While investors have become increasingly concerned about high growth valuations, we remain steadfast. This is one of our top investment picks in Security.”

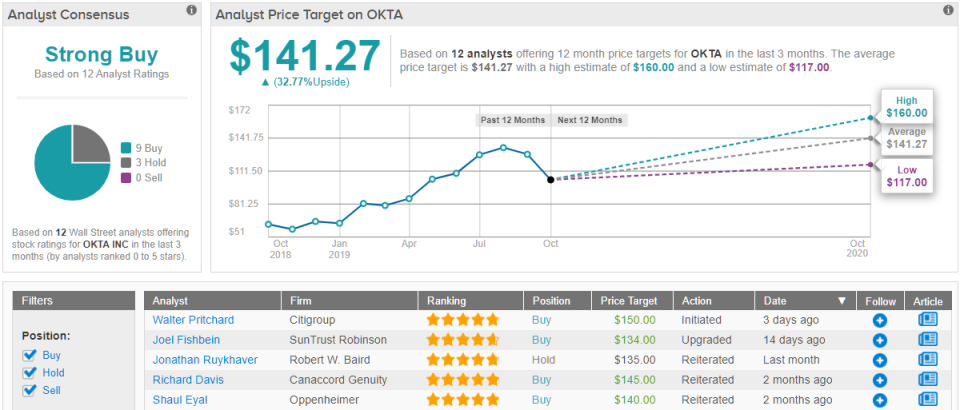

Henderson places a $154 price target on OKTA shares, suggesting he sees room for an upside of 43%. Shares are selling for $107, and the average price target, $141.27, indicates a 32% upside potential. The analyst consensus on OKTA is a Strong Buy, with 9 "buy" and 3 "hold" ratings (See Okta stock analysis on TipRanks)