3 Top Biotech Stocks With Major Catalysts in October

Along with healthcare stocks in general, biotechnology stocks are not hitting any near-term highs in terms of share price performance. Chalk it up to continued fears that the industry will see increased regulation on (largely unfounded) concerns on domestic drug pricing and how to effectively keep citizens with sufficient health insurance while keeping a lid on costs.

Regardless of the political climate, drug candidates with proven market potential will always put profits in investor pockets. Below are overviews of three biotech stocks that are far from their 52-week highs and have some potential near-term catalysts. Namely, they have important pending news flow from the Food and Drug Administration (FDA) regarding recent drug applications from their portfolios of promising drug candidates.

Agile Therapeutics (AGRX)

Agile Therapeutics has finally made it through the late stages of clinical trials for Twirla, its lead product that management is dedicating all of the company’s resources to currently. The latest official status on Twirla is that Agile submitted it for FDA review and received a complete response letter in December 2017. It resubmitted its new drug application (NDA) to the FDA in May of this year, and an advisory committee meeting is scheduled for October 30, followed by PDUFA date on November 16.

Twirla is a contraceptive (or more specifically, a low-dose combination hormonal contraceptive, or CHC) patch that, if and once approved, should be much easier to take than daily oral contraceptive pills, which, after many decades, is still the most popular form of birth control. Two of Twirla’s active ingredients are the same that have been used in contraceptives for the past 25 years. Twirla simply requires a weekly patch for three weeks out of every month. Competitors to Twirla include Ortho Evra and its generic equivalent, Xulane, but there is plenty of market share to be taken from the older products.

In a research note issued Friday, Maxim analyst Jason McCarthy stated: "Twirla has already received two CRLS, the most recent of which was in December of 2017 and has since been resolved with completion of the adhesion/wear test earlier in 2019. In addition, the company previously completed its third phase 3 trial, the SECURE trial, demonstrating pearl index (PI) and upper bound (UB) 4.8 and 6.06, respectively. The data are in-line with other products recently approved in the space like Slynd demonstrating more 'real-world' PIs and UBs." The analyst concluded, "A combination of activity in the space around contraceptives (regulators too), the steps taken by management to complete clinical work and other requests by regulators and a stronger balance sheet, point to a favorable risk/reward profile."

Oppenheimer analyst Leland Gershell shares a similar enthusiasm with McCarthy when it comes to Agile. If the approval plays out as hoped, Gershell sees $261 million in sales by 2024, and pegs Agile’s stock price at $5 per share – well above a current $1.12.

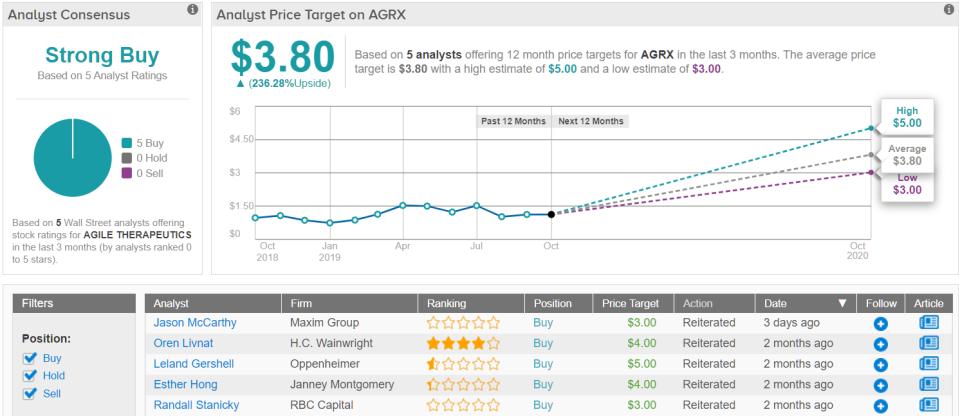

Of the five analysts tracked on TipRanks in the past 3 months, the consensus price target is $3.80, which suggests 236% upside from the current share price. Clearly, Agile’s success depend on Twirla, and investors should know later this month what the FDA’s conclusion on the current submission will be. (See Agile stock analysis on TipRanks)

Foamix Pharmaceuticals (FOMX)

Foamix Pharmaceuticals is also hopeful of getting to market and has two promising late-stage dermatological drugs in its pipeline. FMX101 targets the treatment of moderate-to-severe acne and has already had its NDA submitted. Management is also hopeful to hear some news from the FDA very soon. FMX103 targets moderate-to-severe rosacea, which has much less competition than competing acne treatments in the marketplace. It also made it through clinical three trials and an FDA decision is expected somewhere in the middle of 2020.

Cantor analyst Louise Chen reported on Foamix’s presentation at the firm's healthcare conference in early October, noting: "After listening to FOMX's presentation, we continue to look forward to the potential launches of FOMX's two late-stage products in the 2019/20 timeframe. We expect approval for the company's lead product candidate FMX101 for the treatment of moderate-to-severe acne." Chen rates FOMX an Overweight with $15 price target, which implies huge upside to the current share price of $2.80.

Research firm Cowen recently pointed out that Foamix is currently building out its sales force in anticipation of the potential launch of both dermatology candidates. Based off its price target of $30, it is effectively twice as bullish as Cantor.

Like many development-stage biotech firms, Foamix is in a precarious financial position and has accumulated a deficit above $200 million to bring these and related drugs to market. But with any positive FDA news, the share price will likely soar and open the gateway to plenty of opportunities to raise growth capital.

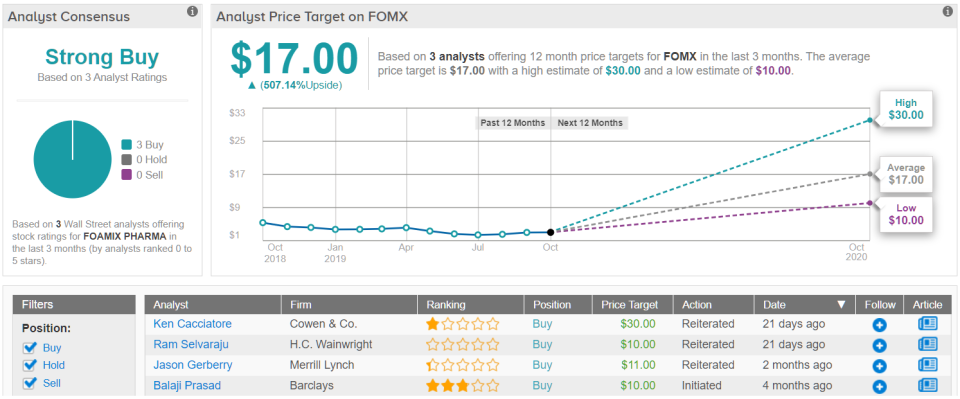

Returning again to TipRanks’ consensus analyst estimates, FOMX has received 3 "buy," ratings in the last three months, while the 12-month average price target lands at $17.00, or more than 500% ahead of the current share price. (See Foamix stock analysis on TipRanks)

Flexion Therapeutics (FLXN)

Rounding out the trifecta of appealing development-stage biotechs, Flexion just started pulling in sales from the successful launch of Zilretta for the treatment of osteoarthritis, or OA, in patient’s knees. Management has guided full-year sales of between $65 million and $80 million and has pointed out that OA is a type of degenerative arthritis that breaks down and causes the eventual loss of cartilage in the knee joints.

Meanwhile, Flexion is awaiting to hear back from the FDA today regarding its supplemental new drug application (sNDA) filing to remove the Limitation of Use (LOU) language from the Zilretta label and marketing materials regarding repeat administration.

Wells Fargo analyst David Maris was recently involved with Flexion’s meetings with investors in New York City and detailed that Flexion "continues to remain hopeful and “cautiously optimistic” that the FDA will approve the sNDA and remove the language given the body of data FLXN has generated regarding the safety of Zilretta and its repeat usage. However, FLXN stated that the sNDA is by no means a certainty and it has been scenario planning for all outcomes. In the best-case scenario if the FDA removes the LOU, FLXN stated that it does not expect an immediate inflection in sales but that the removal should provide a tailwind over the longer-term."

Maris rates Flexion stock an Outperform, along with a $26 price target, which implies about 95% upside from current levels.

Northland Capital's price target is a couple of bucks higher at $28. In a recent report, analyst Carl Byrnes suggested that Flexion’s “current valuation creates a compelling risk/reward scenario as FLXN shares currently trade at ~4.3x consensus 2020 sales, and less than 1x our peak sales forecast.”

Profitability isn’t projected until after 2021, but again revenue coming in makes Flexion much more in control of its own destiny. At the end of 2018, accumulated deficit on the balance sheet was $350 million.

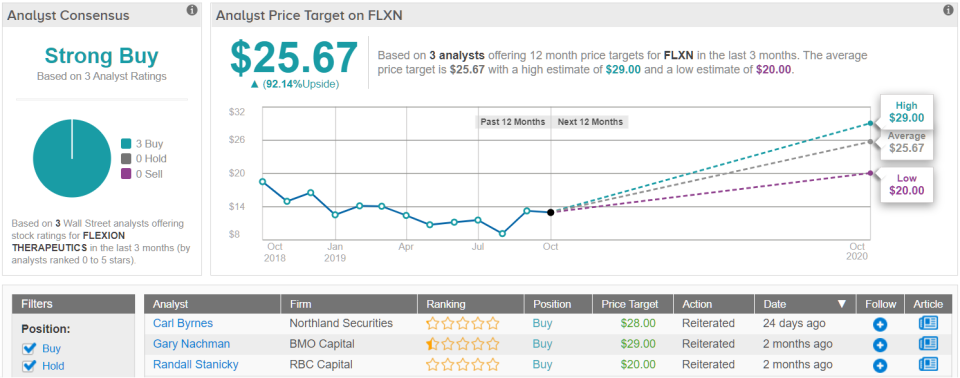

Rounding out the coverage, the TipRanks universe tracks three analysts (in the past 3 months) with an average price target just shy of $26, or a near double from the current share price of $13.36. (See Flexion stock analysis on TipRanks)