3 Top-Ranked Stocks Pushing 52-Week Highs

As we are all very aware, it’s been anything but smooth sailing in the market in 2022. Volatility has reigned supreme following a hawkish pivot from the Federal Reserve, geopolitical issues, and lingering COVID-19 disruptions.

However, believe it or not, there are stocks out there chugging along, and some are pushing 52-week highs.

And a few sport the highly-coveted Zacks Rank #1 (Strong Buy).

Stocks making new highs tend to make even higher highs, especially when favorable earnings estimate revisions push them into a Zacks Rank #1 (Strong Buy).

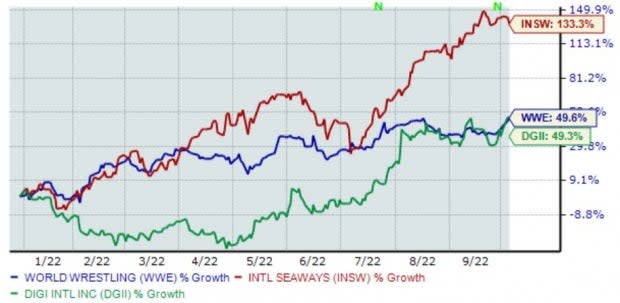

Three stocks fit the criteria – World Wrestling Entertainment WWE, International Seaways INSW, and Digi International DGII.

Below is a year-to-date chart of all three stocks.

Image Source: Zacks Investment Research

As we can vividly see, all three stocks have stopped for nobody in 2022, indicating that buyers have been out in full force.

Let’s take a deeper dive into each one.

World Wrestling Entertainment

WWE is primarily engaged in the production and distribution of unique and creative content via numerous channels.

WWE shares made a new 52-week high in late August ($75.23 per share), and shares are already preparing to bust that ceiling; WWE shares currently trade at a price of around $73.20 per share.

Analysts have been bullish across all timeframes over the last few months while also in full agreement.

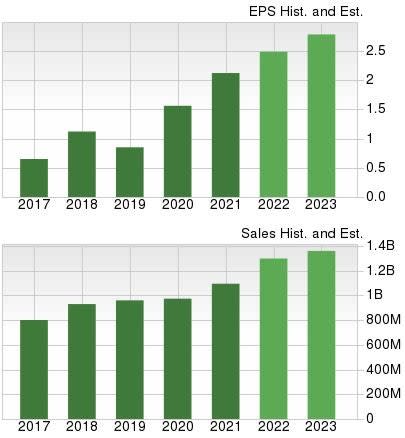

Image Source: Zacks Investment Research

The company has a stellar earnings track record; WWE has exceeded the Zacks Consensus EPS Estimate in 13 consecutive prints, with four triple-digit percentage surprises. Just in its latest print, WWE registered a nearly 10% bottom line beat.

Further, WWE carries a favorable growth profile; earnings are forecasted to soar by 17% in FY22 and another double-digit 12% in FY23.

Top line growth is also inspiring – WWE’s revenue is forecasted to climb by 18% and 5% in FY22 and FY23, respectively.

Image Source: Zacks Investment Research

International Seaways

International Seaways, Inc. is a tanker company providing energy transportation services for crude oil and petroleum products.

INSW shares made a 52-week high of $36.72 per share in late September, and shares are now trading in the $33.50 per share range.

The company’s earnings outlook has turned visibly bright over the last several months.

Image Source: Zacks Investment Research

Like WWE, International Seaways’ growth projections are fantastic; earnings are forecasted to skyrocket a triple-digit 300% in FY22 and a further 34% in FY23.

Revenue projections can’t be ignored either – INSW’s top line estimates call for 160% Y/Y revenue growth in FY22 and 2% in FY23.

For the cherry on top, INSW rewards its shareholders via its annual dividend that yields 1.4%.

While the yield is below its Zacks Transportation sector average, the company’s dividend growth picks up the slack; INSW carries a five-year annualized dividend growth rate of an impressive 25%.

Image Source: Zacks Investment Research

Digi International

Digi International is a leading global provider of business and mission-critical Internet of Things (IoT) products and services.

DGII shares are currently trading in the $36.50 per share range, slightly below 52-week highs of $38.60 per share.

Over the last 60 days, analysts have considerably raised their bottom line outlook for the company’s current and next fiscal year.

Image Source: Zacks Investment Research

DGII’s bottom line estimates indicate serious growth; the Zacks Consensus EPS Estimate of $1.61 for the company’s current fiscal year (FY22) reflects a triple-digit Y/Y uptick in earnings of more than 400%.

And in FY23, DGII’s bottom line is projected to tack on an additional 17% of growth.

Further, DGII carries an impressive earnings track record, exceeding the Zacks Consensus EPS Estimate by double-digit percentages in each of its last four prints. Just in its latest quarter, Digi International registered an 18.5% EPS beat.

Look out for DGII’s upcoming quarterly print; the Zacks Consensus EPS Estimate of $0.42 reflects Y/Y earnings growth of more than 220%.

Top line results paint the same positive story; DGII has beat top line estimates in nine consecutive quarters. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Bottom Line

While the price action of many stocks has been uninspiring in 2022, all three stocks above – World Wrestling Entertainment WWE, International Seaways INSW, and Digi International DGII – have entirely shaken off the market’s woes.

In fact, all three are pushing 52-week highs paired with a Zacks Rank #1 (Strong Buy), telling us that their near-term earnings outlook is bright.

That’s quite a stellar combination.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

World Wrestling Entertainment, Inc. (WWE) : Free Stock Analysis Report

Digi International Inc. (DGII) : Free Stock Analysis Report

International Seaways Inc. (INSW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research