$35 Billion Market! Positive Clinical Trial! Yet Shares Are Down?

In what was gearing up to be potentially the biggest binary event in 2019, Intercept Pharmaceuticals (NASDAQ: ICPT) released data on Tuesday for its late-stage Regenerate study, which was testing obeticholic acid (OCA) in patients with liver fibrosis due to nonalcoholic steatohepatitis (NASH).

Shares shot up as much as 19% but settled to just a 6% gain on Tuesday, and gave up all of that ground (and then some) on Wednesday after investors had time to digest the data -- at least as much as was provided; we'll get more when the full results are presented at the European Association for the Study of the Liver 2019 International Liver Congress in April.

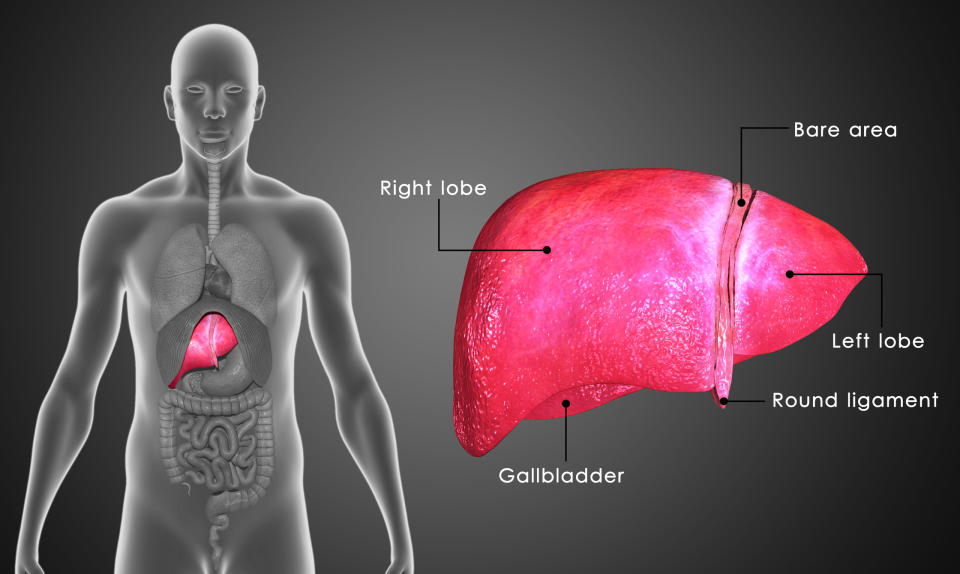

Image source: Getty Images.

With a clear unmet need in NASH -- there aren't any drugs approved to treat the disease -- and positive phase 3 data, it seems likely that Intercept will be able to get OCA, which is marketed as Ocaliva in another liver disease called primary biliary cholangitis, approved to treat NASH.

But Intercept's valuation will ultimately be set by how well OCA sells in NASH, and there are a few reasons why investors may be concerned enough to be hitting the sell button.

1. Not a cure

The Regenerate study had two main endpoints and the drug only had to hit one for the result to be positive. The higher dose clearly met one of the endpoints, improving patients' fibrosis by at least one stage with no worsening of NASH: 23.1% of patients taking the higher dose met the goal, compared to 11.9% of patients on placebo.

The trial also measured the ability of the drug to resolve NASH with no worsening of the stage of liver fibrosis, and while there was a numerical improvement, with 11.7% of patients taking the higher dose achieving the goal compared to 8% of patients receiving placebo, the difference wasn't statistically significant.

Resolving NASH was a large hurdle to clear in these midstage patients, and improving fibrosis should be enough to gain FDA approval, but a statistically significant improvement in NASH would clearly help convince doctors to prescribe the drug more frequently.

2. Big market (that will be broken up)

The NASH market is estimated to be as large as $35 billion in annual sales, but those numbers come from patients with NASH who are on a continuum of fibrosis from early stage 1 through 4, where cirrhosis of the liver sets in. Before NASH, patients are usually classified as having non-alcoholic fatty liver disease (NAFLD).

The Regenerate study had mostly patients with stage 2 and 3 fibrosis, but added some stage 1 patients who were included in a separate analysis. With those patients added, the fraction of patients who saw their fibrosis improve by at least one stage with no worsening of NASH went down from 23.1% in the aforementioned stage 2 and 3 patients to 21% of patients with stage 1-3. On the other hand, the second endpoint -- NASH resolution with no worsening of liver fibrosis stage -- improved from 11.7% of stage 2 and 3 patients to 14.9% of stage 1-3 patients.

How doctors will interpret the stage 1 data remains to be seen, but there's some evidence from doctors at the Karolinska Institutet in Sweden that fibrosis stage, but not NASH, predicts mortality in patients with NAFLD.

3. Side effects

More than half of patients taking the higher dose of the drug reported increased itching compared to just 19% of patients on placebo and 28% of patients on the lower dose. Most of those were mild to moderate, but severe itching, which resulted in patients being removed from the study, occurred in 5% of patients taking the higher dose versus less than 1% of those on placebo or the lower dose. In fact, 9% of patients discontinued due to itching (of any level).

Considering that NASH can eventually result in the need for a liver transplant, some added itching shouldn't be enough to keep the FDA from approving OCA for NASH, but it may dampen sales a bit if some patients find the side effect annoying enough.

4. Sell the news

Biotech investors may be selling simply because they're moving onto the next binary event. That could present an opportunity to get shares of Intercept on sale, but investors buying today will have to be patient. The company still has some number crunching to do before it can file for approval with the FDA and EU regulators in the second half of this year, setting up a likely approval in the first half of 2020.

Even then, given the lack of currently approved drugs for NASH, it could be slow going building a market of doctors who regularly diagnose and treat NASH. It'll take a while and multiple drugs treating the spectrum of patients to get to the $35 billion figure that analysts have predicted.

More From The Motley Fool

Brian Orelli and The Motley Fool have no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.