4 Homebuilders With the Strength to Weather Volatile Housing Market

According to the All-in-One Screener, a major GuruFocus Premium feature, four homebuilders with high financial strength are Cavco Industries Inc. (NASDAQ:CVCO), NVR Inc. (NYSE:NVR), PulteGroup Inc. (NYSE:PHM) and Skyline Champion Corp. (NYSE:SKY).

Homebuilding industry overview

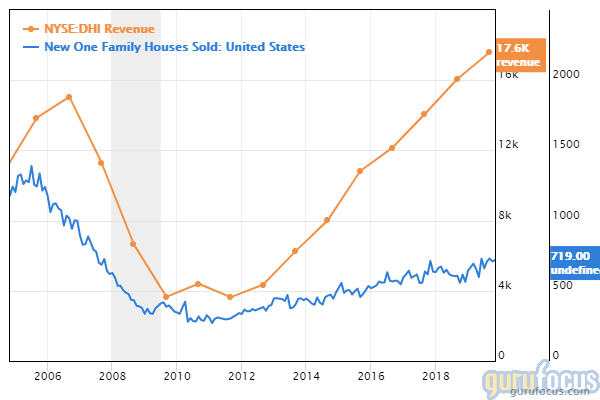

The homebuilding and construction industry includes companies that build and renovate a wide range of residential buildings, from single-family homes to multi-family apartments.

As the homebuilding industry lies in the consumer cyclical sector, the industry is sensitive to changes in the business cycle. During economic downturns, demand for luxury homes and residential apartments is due to decline. Additionally, the homebuilding industry is subject to changes in the housing market.

New home sales decline month over month to end 2019

The U.S. Department of Commerce said on Monday that new home sales for December 2019 were 694,000 on a seasonally-adjusted annual basis, down 0.4% from the revised total of 697,000 for November 2019 but up 23% from the December 2018 figure of 564,000. The December 2019 figure underperformed the consensus estimate of 730,000 according to Reuters.

To weather the volatile housing market, investors can look for homebuilders that have strong balance sheets. The Screener identified several residential construction companies that have a GuruFocus financial strength rank of at least 7 out of 9. Factors that determine the financial strength rank include interest coverage, the Altman Z-score and various leverage ratios like debt-to-equity, equity-to-asset and debt-to-Ebitda.

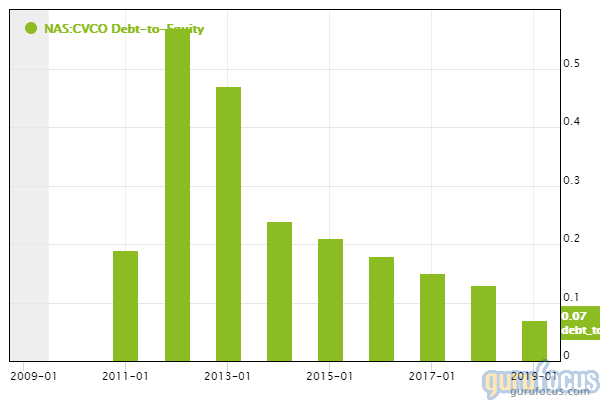

Cavco

Phoenix-based Cavco designs, manufactures and sells modular homes, commercial buildings and vacation cabins in the U.S., Canada, Mexico and Japan. GuruFocus ranks the company's financial strength 9 out of 10 on several positive investing signs, which include a strong Altman Z-score of 8.94 and debt ratios that are outperforming over 89% of global competitors.

Cavco's profitability ranks 7 out of 10 on the heels of operating margins that have increased approximately 8.10% per year over the past five years despite outperforming just over 58% of global competitors. Additionally, Cavco's return on assets outperforms 86% of global homebuilders.

Gurus with large holdings in Cavco include Mario Gabelli (Trades, Portfolio), Ken Fisher (Trades, Portfolio) and Jim Simons (Trades, Portfolio)' Renaissance Technologies.

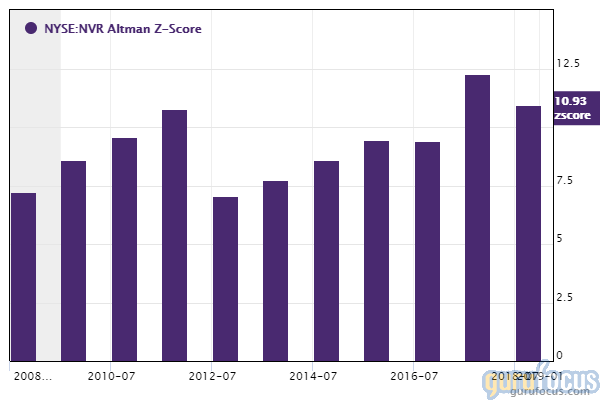

NVR

Reston, Virginia-based NVR builds single-family homes, town homes and condos across four U.S. regions: Mid Atlantic, Northeast, Mideast and Southeast. GuruFocus ranks NVR's financial strength 8 out of 10 on several positive investing signs, which include strong interest coverage, a robust Altman Z-score of 12.29 and a debt-to-Ebitda ratio that outperforms over 85% of global competitors.

The company's profitability ranks 9 out of 10 on the heels of a four-star business predictability rank, expanding profit margins and a return on equity that outperforms over 97% of global homebuilders.

Diamond Hill Capital (Trades, Portfolio) has the largest holding in NVR with 96,208 shares.

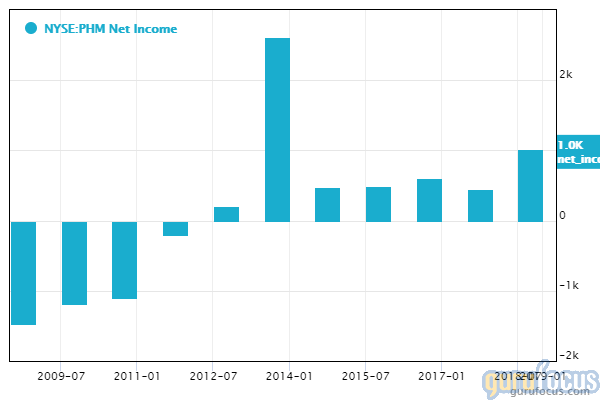

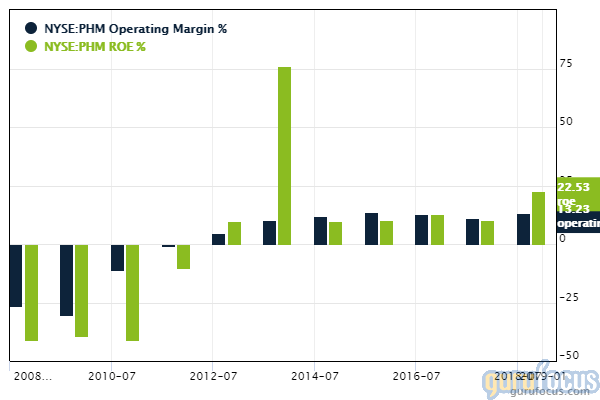

PulteGroup

Atlanta-based PulteGroup builds single-family homes for a wide range of homebuyers, including entry-level and move-up buyers. GuruFocus ranks the company's financial strength 7 out of 10 on several positive investing signs, which include robust interest coverage, a solid Altman Z-score of 3.92 and a high Piotroski F-score of 8.

PulteGroup said on Tuesday that net income for the three months ended December 2019 was $336 million, or $1.22 per share, compared with net income of $238 million, or 84 cents per share, in the prior-year quarter.

PulteGroup CEO Ryan Marshall said net new orders for the quarter were 5,691 homes, up 33% from the prior-year quarter on the back of the "recovery in housing demand," contributing to strong sales in all regions and buyer groups.

GuruFocus ranks PulteGroup's profitability 7 out of 10 on the heels of expanding profit margins and a return on equity that outperforms 82% of global competitors.

Shares of PulteGroup increased over 4% in morning trading on the heels of reporting revenues and earnings higher than consensus estimates. Revenue of $3.017 billion outperformed the estimate of $2.979 billion.

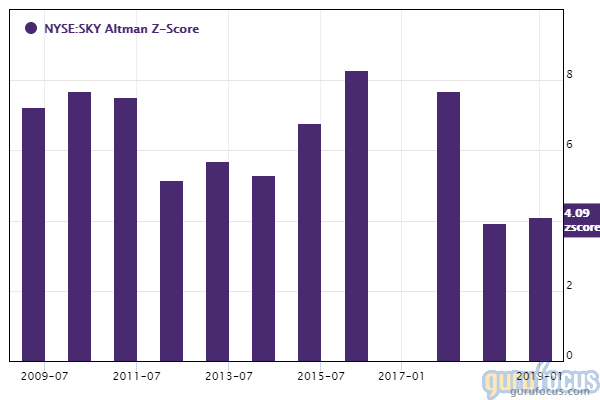

Skyline Champion

Elkhart, Indiana-based Skyline Champion offers factory-built housing in the U.S. and Canada. GuruFocus ranks Skyline Champion's financial strength 8 out of 10 on several positive investing signs, which include a high Piotroski F-score of 7, a solid Altman Z-score of 6.82 and debt ratios that are outperforming over 83% of global competitors.

Disclosure: No positions.

Read more here:

5 US and Asian Health Care Companies With Good Financial Strength

3 Peter Lynch Airlines That Outperformed Markets in 2019

5 European and Asian Net-Nets for the 1st Quarter of 2020

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.