These 4 Measures Indicate That AMAG Austria Metall (VIE:AMAG) Is Using Debt Extensively

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies AMAG Austria Metall AG (VIE:AMAG) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for AMAG Austria Metall

What Is AMAG Austria Metall's Net Debt?

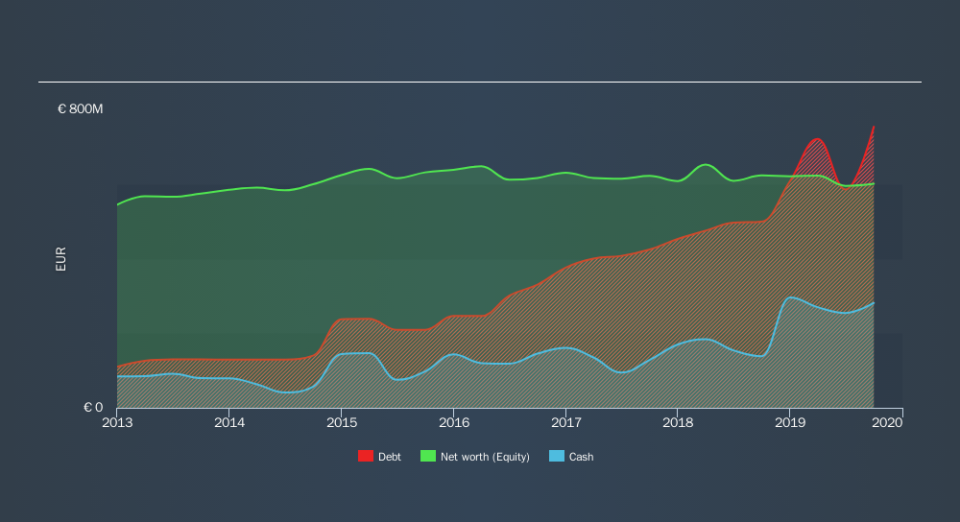

The image below, which you can click on for greater detail, shows that at September 2019 AMAG Austria Metall had debt of €751.3m, up from €498.8m in one year. However, it also had €281.2m in cash, and so its net debt is €470.1m.

A Look At AMAG Austria Metall's Liabilities

Zooming in on the latest balance sheet data, we can see that AMAG Austria Metall had liabilities of €208.9m due within 12 months and liabilities of €753.5m due beyond that. On the other hand, it had cash of €281.2m and €143.3m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by €537.9m.

This deficit isn't so bad because AMAG Austria Metall is worth €1.13b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

AMAG Austria Metall's debt is 4.2 times its EBITDA, and its EBIT cover its interest expense 3.9 times over. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. Worse, AMAG Austria Metall's EBIT was down 48% over the last year. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine AMAG Austria Metall's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. In the last three years, AMAG Austria Metall created free cash flow amounting to 4.1% of its EBIT, an uninspiring performance. That limp level of cash conversion undermines its ability to manage and pay down debt.

Our View

Mulling over AMAG Austria Metall's attempt at (not) growing its EBIT, we're certainly not enthusiastic. Having said that, its ability to handle its total liabilities isn't such a worry. We're quite clear that we consider AMAG Austria Metall to be really rather risky, as a result of its balance sheet health. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on its liquidity. Given AMAG Austria Metall has a strong balance sheet is profitable and pays a dividend, it would be good to know how fast its dividends are growing, if at all. You can find out instantly by clicking this link.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.