These 4 Measures Indicate That China Infrastructure Investment (HKG:600) Is Using Debt Safely

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, China Infrastructure Investment Limited (HKG:600) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for China Infrastructure Investment

What Is China Infrastructure Investment's Debt?

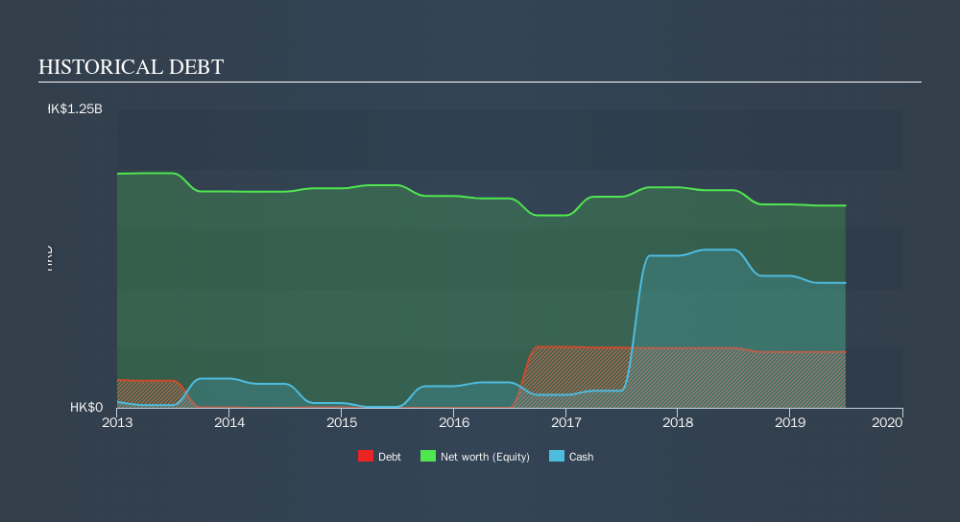

The image below, which you can click on for greater detail, shows that China Infrastructure Investment had debt of HK$234.0m at the end of June 2019, a reduction from HK$250.0m over a year. However, its balance sheet shows it holds HK$523.2m in cash, so it actually has HK$289.2m net cash.

How Strong Is China Infrastructure Investment's Balance Sheet?

We can see from the most recent balance sheet that China Infrastructure Investment had liabilities of HK$327.2m falling due within a year, and liabilities of HK$8.06m due beyond that. Offsetting these obligations, it had cash of HK$523.2m as well as receivables valued at HK$159.8m due within 12 months. So it actually has HK$347.9m more liquid assets than total liabilities.

This surplus liquidity suggests that China Infrastructure Investment's balance sheet could take a hit just as well as Homer Simpson's head can take a punch. With this in mind one could posit that its balance sheet is as strong as beautiful a rare rhino. Simply put, the fact that China Infrastructure Investment has more cash than debt is arguably a good indication that it can manage its debt safely.

Pleasingly, China Infrastructure Investment is growing its EBIT faster than former Australian PM Bob Hawke downs a yard glass, boasting a 101% gain in the last twelve months. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since China Infrastructure Investment will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. China Infrastructure Investment may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last three years, China Infrastructure Investment actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Summing up

While we empathize with investors who find debt concerning, the bottom line is that China Infrastructure Investment has net cash of HK$289.2m and plenty of liquid assets. And it impressed us with free cash flow of -HK$73.9m, being 467% of its EBIT. So is China Infrastructure Investment's debt a risk? It doesn't seem so to us. Even though China Infrastructure Investment lost money on the bottom line, its positive EBIT suggests the business itself has potential. So you might want to check outhow earnings have been trending over the last few years.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.