These 4 Measures Indicate That China State Construction International Holdings (HKG:3311) Is Using Debt Extensively

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that China State Construction International Holdings Limited (HKG:3311) does use debt in its business. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for China State Construction International Holdings

What Is China State Construction International Holdings's Debt?

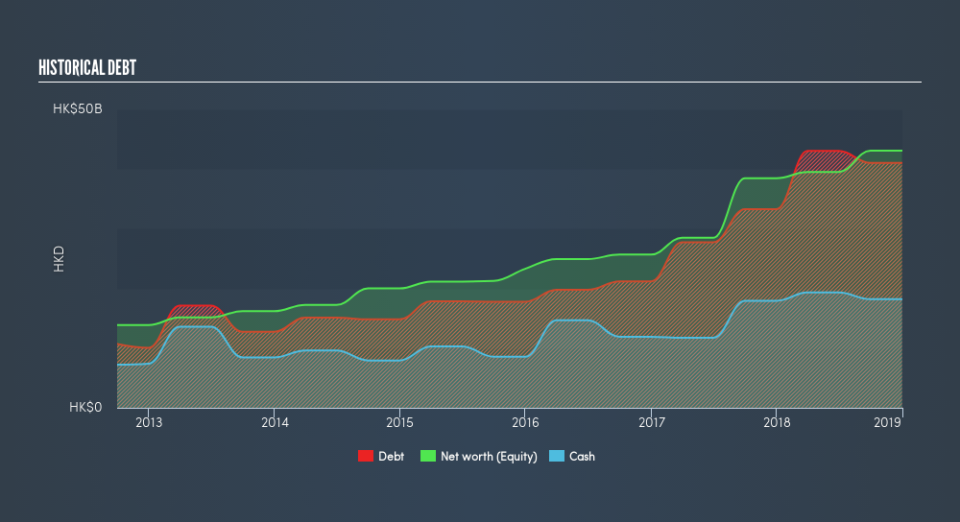

You can click the graphic below for the historical numbers, but it shows that as of December 2018 China State Construction International Holdings had HK$41.0b of debt, an increase on HK$33.3b, over one year. On the flip side, it has HK$18.2b in cash leading to net debt of about HK$22.8b.

How Healthy Is China State Construction International Holdings's Balance Sheet?

We can see from the most recent balance sheet that China State Construction International Holdings had liabilities of HK$53.6b falling due within a year, and liabilities of HK$39.4b due beyond that. Offsetting this, it had HK$18.2b in cash and HK$38.7b in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by HK$36.1b.

Given this deficit is actually higher than the company's market capitalization of HK$34.6b, we think shareholders really should watch China State Construction International Holdings's debt levels, like a parent watching their child ride a bike for the first time. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

China State Construction International Holdings has a debt to EBITDA ratio of 3.0 and its EBIT covered its interest expense 5.0 times. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. If China State Construction International Holdings can keep growing EBIT at last year's rate of 17% over the last year, then it will find its debt load easier to manage. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine China State Construction International Holdings's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, China State Construction International Holdings saw substantial negative free cash flow, in total. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

Mulling over China State Construction International Holdings's attempt at converting EBIT to free cash flow, we're certainly not enthusiastic. But at least it's pretty decent at growing its EBIT; that's encouraging. Overall, we think it's fair to say that China State Construction International Holdings has enough debt that there are some real risks around the balance sheet. If all goes well, that should boost returns, but on the flip side, the risk of permanent capital loss is elevated by the debt. In light of our reservations about the company's balance sheet, it seems sensible to check if insiders have been selling shares recently.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.