These 4 Measures Indicate That KuibyshevAzot (MCX:KAZT) Is Using Debt Reasonably Well

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Public Joint Stock Company KuibyshevAzot (MCX:KAZT) does have debt on its balance sheet. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for KuibyshevAzot

How Much Debt Does KuibyshevAzot Carry?

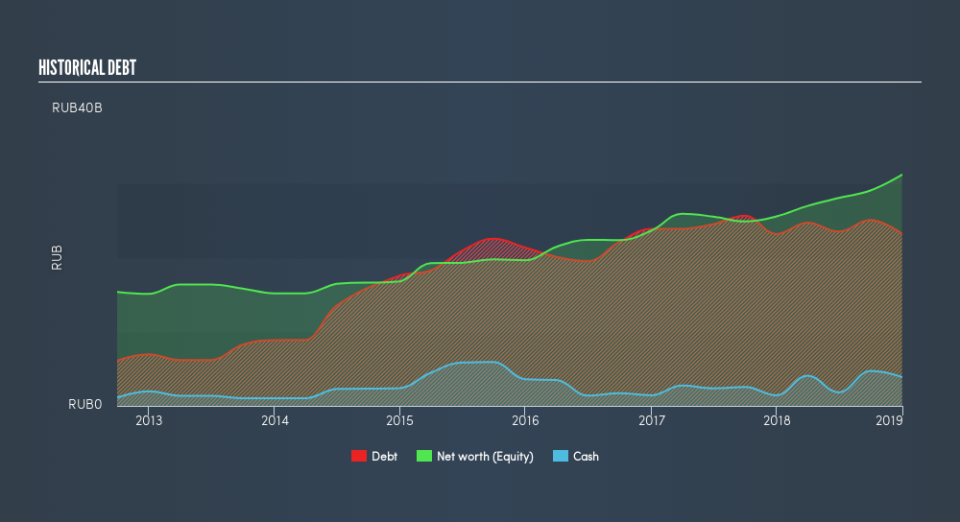

The chart below, which you can click on for greater detail, shows that KuibyshevAzot had RUруб23.2b in debt in December 2018; about the same as the year before. On the flip side, it has RUруб3.90b in cash leading to net debt of about RUруб19.3b.

A Look At KuibyshevAzot's Liabilities

We can see from the most recent balance sheet that KuibyshevAzot had liabilities of RUруб9.25b falling due within a year, and liabilities of RUруб22.1b due beyond that. On the other hand, it had cash of RUруб3.90b and RUруб5.36b worth of receivables due within a year. So its liabilities total RUруб22.1b more than the combination of its cash and short-term receivables.

This is a mountain of leverage relative to its market capitalization of RUруб27.7b. This suggests shareholders would heavily diluted if the company needed to shore up its balance sheet in a hurry.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

With net debt sitting at just 1.4 times EBITDA, KuibyshevAzot is arguably pretty conservatively geared. And it boasts interest cover of 9.3 times, which is more than adequate. Notably, KuibyshevAzot's EBIT launched higher than Elon Musk, gaining a whopping 180% on last year. When analysing debt levels, the balance sheet is the obvious place to start. But it is KuibyshevAzot's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. In the last three years, KuibyshevAzot created free cash flow amounting to 8.1% of its EBIT, an uninspiring performance. That limp level of cash conversion undermines its ability to manage and pay down debt.

Our View

When it comes to the balance sheet, the standout positive for KuibyshevAzot was the fact that it seems able to grow its EBIT confidently. But the other factors we noted above weren't so encouraging. For instance it seems like it has to struggle a bit to convert EBIT to free cash flow. Looking at all this data makes us feel a little cautious about KuibyshevAzot's debt levels. While we appreciate debt can enhance returns on equity, we'd suggest that shareholders keep close watch on its debt levels, lest they increase. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of KuibyshevAzot's earnings per share history for free.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.