These 4 Measures Indicate That Les Hôtels Baverez (EPA:ALLHB) Is Using Debt Safely

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Les Hôtels Baverez S.A. (EPA:ALLHB) does carry debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Les Hôtels Baverez

How Much Debt Does Les Hôtels Baverez Carry?

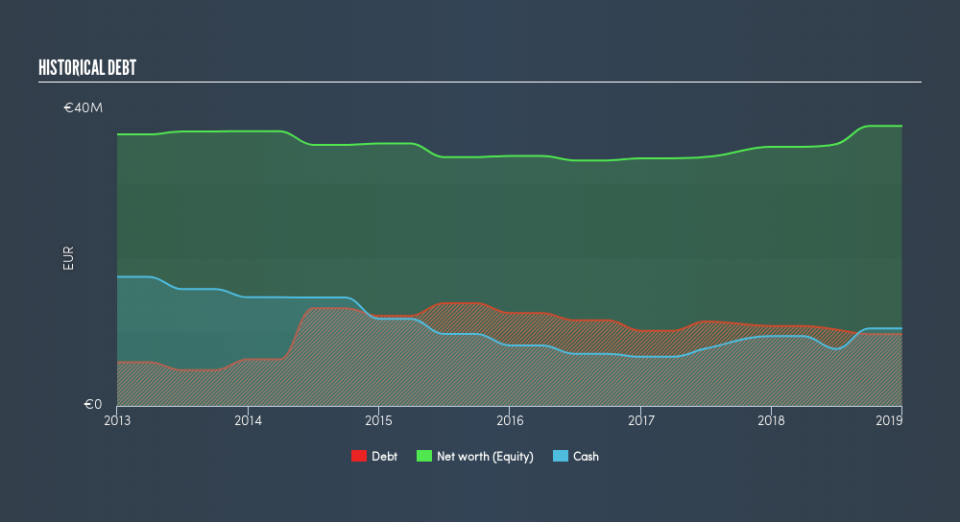

You can click the graphic below for the historical numbers, but it shows that Les Hôtels Baverez had €9.68m of debt in December 2018, down from €10.8m, one year before. However, it does have €10.5m in cash offsetting this, leading to net cash of €781.2k.

How Strong Is Les Hôtels Baverez's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Les Hôtels Baverez had liabilities of €8.09m due within 12 months and liabilities of €9.60m due beyond that. Offsetting these obligations, it had cash of €10.5m as well as receivables valued at €3.00m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by €4.23m.

Since publicly traded Les Hôtels Baverez shares are worth a total of €151.8m, it seems unlikely that this level of liabilities would be a major threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. While it does have liabilities worth noting, Les Hôtels Baverez also has more cash than debt, so we're pretty confident it can manage its debt safely.

In addition to that, we're happy to report that Les Hôtels Baverez has boosted its EBIT by 98%, thus reducing the spectre of future debt repayments. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Les Hôtels Baverez will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. Les Hôtels Baverez may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Happily for any shareholders, Les Hôtels Baverez actually produced more free cash flow than EBIT over the last two years. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Summing up

While it is always sensible to look at a company's total liabilities, it is very reassuring that Les Hôtels Baverez has €781k in net cash. The cherry on top was that in converted 120% of that EBIT to free cash flow, bringing in €1.9m. So is Les Hôtels Baverez's debt a risk? It doesn't seem so to us. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Les Hôtels Baverez's earnings per share history for free.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.