These 4 Measures Indicate That Supply Network (ASX:SNL) Is Using Debt Reasonably Well

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk. It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Supply Network Limited (ASX:SNL) makes use of debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Supply Network

What Is Supply Network's Net Debt?

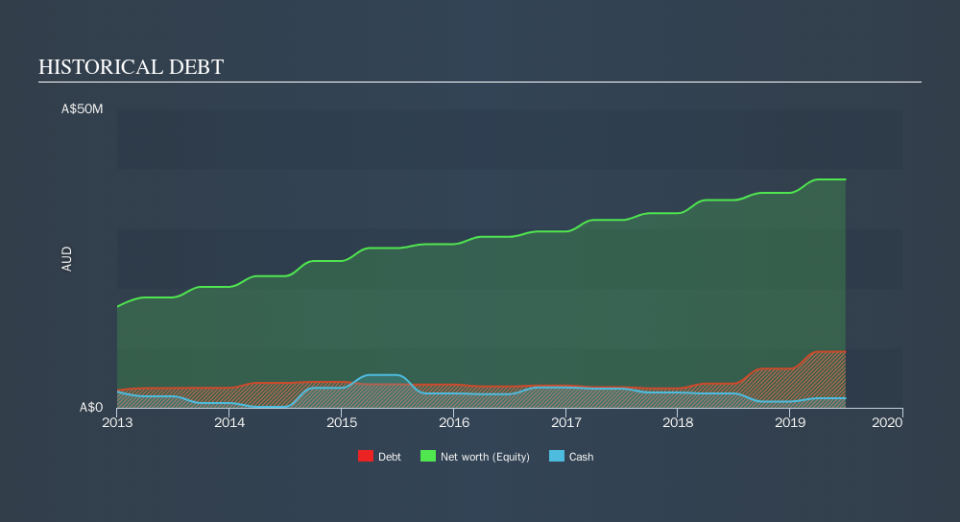

As you can see below, at the end of June 2019, Supply Network had AU$9.40m of debt, up from AU$4.05m a year ago. Click the image for more detail. However, it also had AU$1.61m in cash, and so its net debt is AU$7.79m.

How Strong Is Supply Network's Balance Sheet?

According to the last reported balance sheet, Supply Network had liabilities of AU$22.3m due within 12 months, and liabilities of AU$9.13m due beyond 12 months. Offsetting these obligations, it had cash of AU$1.61m as well as receivables valued at AU$13.8m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by AU$16.1m.

Since publicly traded Supply Network shares are worth a total of AU$168.3m, it seems unlikely that this level of liabilities would be a major threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Supply Network's net debt is only 0.55 times its EBITDA. And its EBIT easily covers its interest expense, being 38.7 times the size. So we're pretty relaxed about its super-conservative use of debt. Fortunately, Supply Network grew its EBIT by 6.6% in the last year, making that debt load look even more manageable. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Supply Network's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. In the last three years, Supply Network's free cash flow amounted to 22% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

Happily, Supply Network's impressive interest cover implies it has the upper hand on its debt. But, on a more sombre note, we are a little concerned by its conversion of EBIT to free cash flow. Looking at all the aforementioned factors together, it strikes us that Supply Network can handle its debt fairly comfortably. On the plus side, this leverage can boost shareholder returns, but the potential downside is more risk of loss, so it's worth monitoring the balance sheet. Given Supply Network has a strong balance sheet is profitable and pays a dividend, it would be good to know how fast its dividends are growing, if at all. You can find out instantly by clicking this link.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.