These 4 Measures Indicate That Ter Beke (EBR:TERB) Is Using Debt Reasonably Well

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Ter Beke NV (EBR:TERB) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Ter Beke

How Much Debt Does Ter Beke Carry?

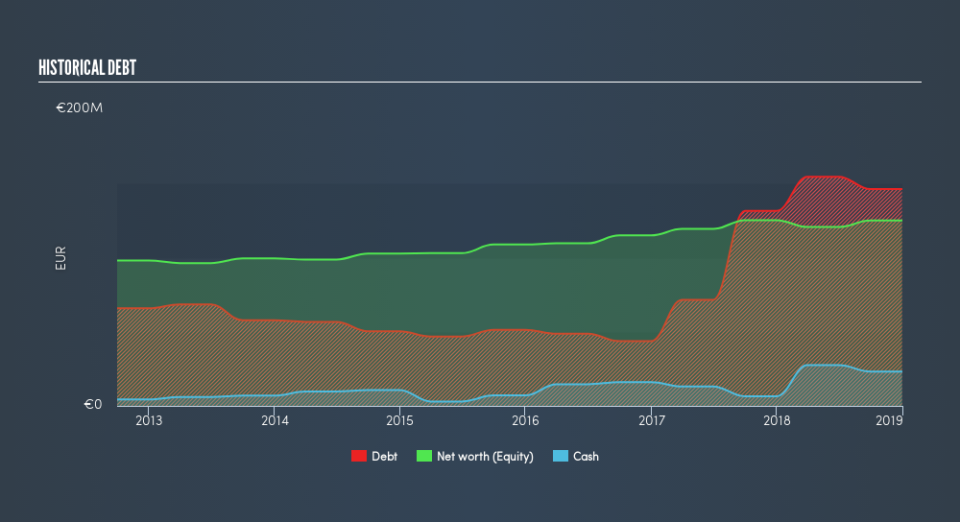

The image below, which you can click on for greater detail, shows that at December 2018 Ter Beke had debt of €146.2m, up from €137.0m in one year. On the flip side, it has €23.2m in cash leading to net debt of about €123.0m.

How Healthy Is Ter Beke's Balance Sheet?

According to the last reported balance sheet, Ter Beke had liabilities of €150.9m due within 12 months, and liabilities of €149.0m due beyond 12 months. Offsetting this, it had €23.2m in cash and €121.9m in receivables that were due within 12 months. So it has liabilities totalling €154.9m more than its cash and near-term receivables, combined.

This is a mountain of leverage relative to its market capitalization of €183.7m. This suggests shareholders would heavily diluted if the company needed to shore up its balance sheet in a hurry.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Ter Beke has net debt to EBITDA of 2.9 suggesting it uses a fair bit of leverage to boost returns. On the plus side, its EBIT was 8.7 times its interest expense, and its net debt to EBITDA, was quite high, at 2.9. One way Ter Beke could vanquish its debt would be if it stops borrowing more but conitinues to grow EBIT at around 17%, as it did over the last year. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Ter Beke's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, Ter Beke recorded free cash flow worth a fulsome 87% of its EBIT, which is stronger than we'd usually expect. That positions it well to pay down debt if desirable to do so.

Our View

When it comes to the balance sheet, the standout positive for Ter Beke was the fact that it seems able to convert EBIT to free cash flow confidently. But the other factors we noted above weren't so encouraging. For instance it seems like it has to struggle a bit to handle its total liabilities. Considering this range of data points, we think Ter Beke is in a good position to manage its debt levels. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. Another positive for shareholders is that it pays dividends. So if you like receiving those dividend payments, check Ter Beke's dividend history, without delay!

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.