These 4 Measures Indicate That Tian An China Investments (HKG:28) Is Using Debt In A Risky Way

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Tian An China Investments Company Limited (HKG:28) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Tian An China Investments

How Much Debt Does Tian An China Investments Carry?

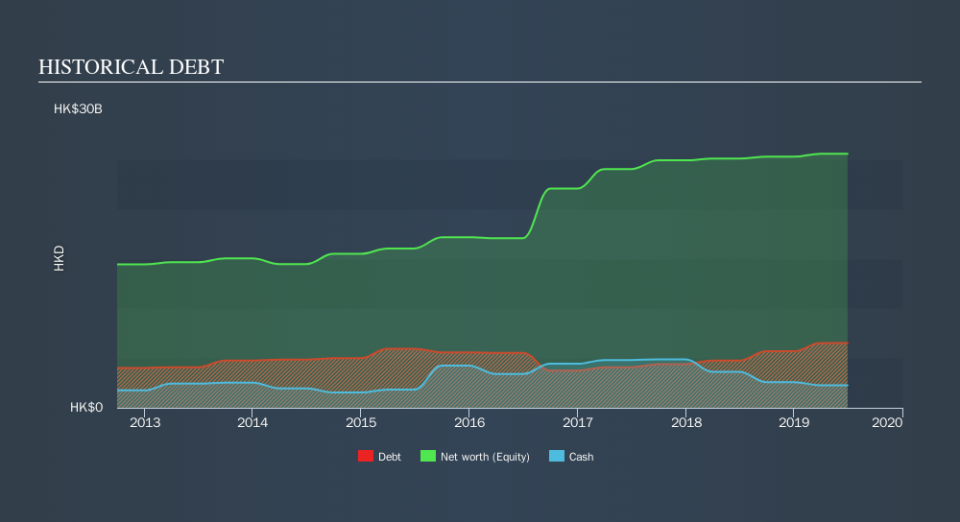

As you can see below, at the end of June 2019, Tian An China Investments had HK$6.50b of debt, up from HK$4.75b a year ago. Click the image for more detail. However, it does have HK$2.28b in cash offsetting this, leading to net debt of about HK$4.23b.

A Look At Tian An China Investments's Liabilities

Zooming in on the latest balance sheet data, we can see that Tian An China Investments had liabilities of HK$7.64b due within 12 months and liabilities of HK$6.55b due beyond that. On the other hand, it had cash of HK$2.28b and HK$2.85b worth of receivables due within a year. So it has liabilities totalling HK$9.06b more than its cash and near-term receivables, combined.

This deficit casts a shadow over the HK$5.65b company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, Tian An China Investments would likely require a major re-capitalisation if it had to pay its creditors today.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

As it happens Tian An China Investments has a fairly concerning net debt to EBITDA ratio of 10.2 but very strong interest coverage of 1k. This means that unless the company has access to very cheap debt, that interest expense will likely grow in the future. Shareholders should be aware that Tian An China Investments's EBIT was down 57% last year. If that earnings trend continues then paying off its debt will be about as easy as herding cats on to a roller coaster. When analysing debt levels, the balance sheet is the obvious place to start. But it is Tian An China Investments's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, Tian An China Investments recorded negative free cash flow, in total. Debt is far more risky for companies with unreliable free cash flow, so shareholders should be hoping that the past expenditure will produce free cash flow in the future.

Our View

To be frank both Tian An China Investments's EBIT growth rate and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But at least it's pretty decent at covering its interest expense with its EBIT; that's encouraging. Taking into account all the aforementioned factors, it looks like Tian An China Investments has too much debt. That sort of riskiness is ok for some, but it certainly doesn't float our boat. Given the risks around Tian An China Investments's use of debt, the sensible thing to do is to check if insiders have been unloading the stock.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.