4 Transportation Companies to Consider as Coronavirus Outbreak Intensifies

Market indexes headed into the last week of January lower as fears regarding the coronavirus outbreak in China intensified. CNBC reported on Monday that airline stocks tumbled as a result of the outbreak, which has 2,862 confirmed cases so far in China. In the U.S., the fifth case was confirmed over the weekend. United Airlines Holdings Inc. (NASDAQ:UAL) and Delta Air Lines Inc. (NYSE:DAL) were both down more than 4% on Monday, while American Airlines (NASDAQ:AAL) slid 5.7%.

As a result, investors may be interested in finding investment opportunities among transportation and logistics stocks that are trading below the Peter Lynch value.

A legendary investor who managed Fidelity's Magellan Fund between 1977 and 1990, Lynch developed this strategy in order to simplify his stock-picking process. With the belief good, stable companies eventually trade at 15 times their annual earnings, he set the standard at a price-earnings ratio of 15. Stocks trading below this level are often considered good investments since their share prices are likely to appreciate over time, creating value for shareholders. The GuruFocus All-in-One Screener, a Premium feature, also looked for companies with a business predictability rank of at least two out of five stars and a 10-year revenue per share growth rate of at least 6%.

As of Jan. 27, companies that met these criteria were P.A.M. Transportation Services Inc. (NASDAQ:PTSI), JetBlue Airways Corp. (NASDAQ:JBLU), Hawaiian Holdings Inc. (NASDAQ:HA) and Allegiant Travel Co. (NASDAQ:ALGT).

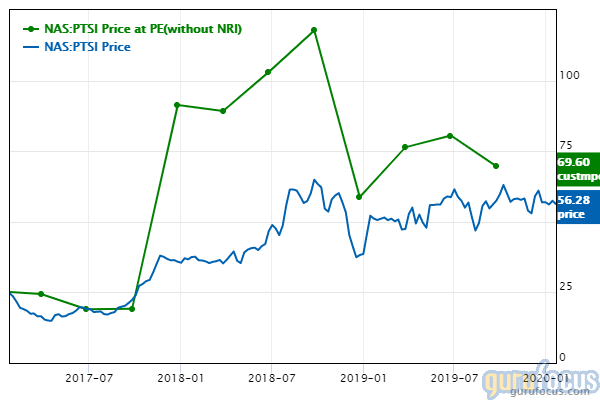

P.A.M. Transportation Services

The Tontitown, Arkansas-based trucking company has a $322.8 million market cap; its shares were trading around $56.10 on Monday with a price-earnings ratio of 12.09, a price-book ratio of 2.17 and a price-sales ratio of 0.63.

The Peter Lynch chart shows the stock is trading below its fair value, which suggests it is undervalued.

Guru Focus rated P.A.M. Transportation's financial strength 4 out of 10. Although the company's interest coverage meets Benjamin Graham's threshold of 5, the Altman Z-Score of 2.51 indicates it is under some financial pressure.

The company's profitability fared better, scoring a 6 out of 10 rating on the back of operating margin expansion, strong returns that outperform a majority of competitors and consistent earnings and revenue growth. It also has a moderate Piotroski F-Score of 5, which suggests operations are stable, and a three-star business predictability rank. According to GuruFocus, companies with this rank typically see their stocks gain an average of 8.2% per annum over a 10-year period

Jim Simons (Trades, Portfolio)' Renaissance Technologies is the only guru invested in the stock, holding 6.82% of its outstanding shares.

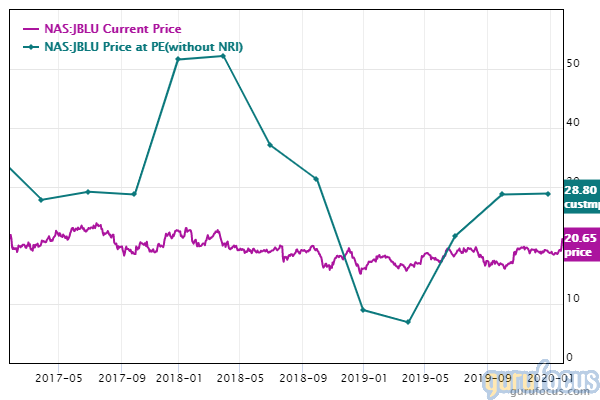

JetBlue Airways

The discount airline company, which is headquartered in New York, has a market cap of $5.62 billion; its shares were trading around $20.01 on Monday with a price-earnings ratio of 10.4, a price-book ratio of 1.2 and a price-sales ratio of 0.75.

According to the Peter Lynch chart, the stock is undervalued.

Boosted by no long-term debt and adequate interest coverage, JetBlue's financial strength was rated 7 out of 10 by GuruFocus. The Altman Z-Score of 1.86, however, suggests the company is under some financial pressure.

The company's profitability scored an 8 out of 10 rating, driven by operating margin expansion as well as strong returns that outperform over half of its industry peers. It also has a moderate Piotroski F-Score of 6 and, as a result of steady revenue and earnings growth, a 3.5-star business predictability rank. GuruFocus says companies with this rank typically see their stocks gain an average of 9.3% per year.

Of the gurus invested in JetBlue, PRIMECAP Management (Trades, Portfolio) has the largest stake with 7.80% of outstanding shares. Donald Smith (Trades, Portfolio), Simons' firm, Richard Snow (Trades, Portfolio), Pioneer Investments (Trades, Portfolio), Hotchkis & Wiley, Robert Olstein (Trades, Portfolio), Lee Ainslie (Trades, Portfolio) and Paul Tudor Jones (Trades, Portfolio) are also shareholders.

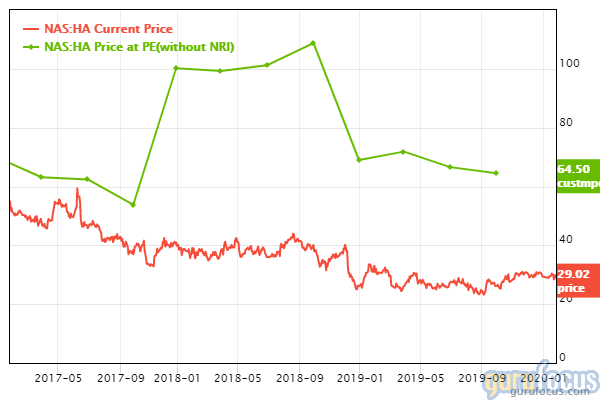

Hawaiian Holdings

The Honolulu-based airline has a $1.29 billion market cap; its shares were trading around $27.85 on Monday with a price-earnings ratio of 6.42, a price-book ratio of 1.21 and a price-sales ratio of 0.47.

Based on the Peter Lynch chart, the stock appears to be undervalued.

Boosted by sufficient interest coverage, Hawaiian Holdings' financial strength was rated 5 out of 10 by GuruFocus. The low Altman Z-Score of 1.52, however, warns the company is in financial distress and could be at risk of going bankrupt.

The airline's profitability fared much better, scoring a 9 out of 10 rating on the back of expanding margins and strong returns that outperform a majority of competitors. Hawaiian Holdings also has a moderate Piotroski F-Score of 5. Despite recording consistent earnings and revenue growth, its three-star business predictability rank is on watch.

With a 3.04% stake, Third Avenue Management (Trades, Portfolio) is the company's largest guru shareholder. Other top guru investors are Chuck Royce (Trades, Portfolio), PRIMECAP, the Third Avenue Value Fund (Trades, Portfolio), Hotchkis & Wiley and Simons' firm.

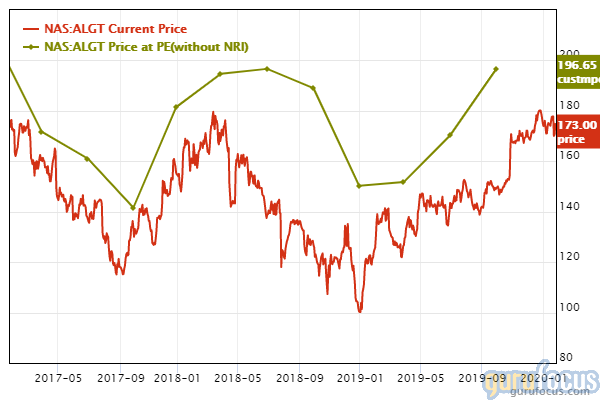

Allegiant Travel

The low-cost airline, which is headquartered in Las Vegas, has a market cap of $2.74 billion; its shares were trading around $168.99 on Monday with a price-earnings ratio of 12.81, a price-book ratio of 3.29 and a price-sales ratio of 1.51.

The Peter Lynch chart suggests the stock is undervalued.

GuruFocus rated Allegiant's financial strength 4 out of 10. As a result of issuing approximately $548.11 million in new long-term debt over the past three years, it has poor interest coverage. The Altman Z-Score of 2.44 also indicates it is under some financial pressure.

The company's profitability scored a perfect 10 out of 10 rating despite having declining operating margins. Allegiant is supported by strong returns, a moderate Piotroski F-Score of 5 and consistent earnings and revenue growth. It also has a perfect five-star business predictability rank. According to GuruFocus, companies with this rank typically see their stocks gain an average of 12.1% per year.

Diamond Hill Capital (Trades, Portfolio) is the company's largest guru shareholder, holding 3.24% of its outstanding shares. First Pacific Advisors (Trades, Portfolio), Royce, Simons' firm, the FPA Capital Fund (Trades, Portfolio), Steven Cohen (Trades, Portfolio), PRIMECAP, John Hussman (Trades, Portfolio), Francis Chou (Trades, Portfolio) and Pioneer also have positions in the stock.

Disclosure: No positions.

Read more here:

Boyar Value Group's 'Forgotten 40' for 2020

Southwest Posts 4th-Quarter Earnings Miss as Boeing Issues Continue

David Nierenberg Slashes Position in Geospace Technologies

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.