4 US and European Consumer Cyclical Companies With High Business Quality

In light of several sporting events occurring over the next two weeks, four U.S. and European consumer cyclical companies with high financial strength and profitability include Adidas AG (XTER:ADS), Industria De Diseno Textil SA (XMAD:ITX), Nike Inc. (NYSE:NKE) and Ross Stores Inc. (NASDAQ:ROST) according to the All-in-One Screener, one of our major GuruFocus Premium features.

American football and tennis set to host major events

The consumer cyclical sector includes industries like apparel retail, apparel manufacturing, footwear and accessories. Such companies are sensitive to changes in the business cycle: During economic downturns, consumers are likely to cut back on name-brand expenses. On the other hand, demand for such goods increase during market expansions. Further, demand for sporting goods might be high during major sporting events yet low during time periods that lack high-prestige events like the Super Bowl.

On Sunday, the NFL hosted two conference championship games: The Kansas City Chiefs won the AFC Championship Game while the San Francisco 49ers won the NFC Championship Game. The two teams will meet in the 2020 Super Bowl on Feb. 2.

Additionally, the Australian Open, the first of four Grand Slam tennis events, started its two-week event on Sunday. As such, companies that produce sporting goods might offer good investing opportunities as people get ready for the big game.

GuruFocus introduced a quality rank, which measures the business quality of a company relative to competitors within the industry. The quality rank combines the financial strength and profitability ranks, i.e., a company that has high financial strength and high profitability is likely to have high business quality.

Adidas

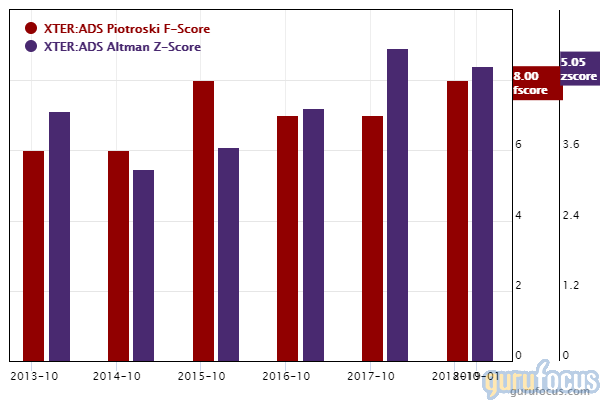

Adidas, a major German sports apparel company, manufactures athletic footwear through brands like Adidas and Reebok. GuruFocus ranks the company's profitability 9 out of 10 on several positive investing signs, which include a strong Piotroski F-score of 7, a 3.5-star business predictability rank and operating margins that have increased approximately 7.9% per year over the past five years and are outperforming over 80% of global competitors.

Adidas' financial strength ranks 7 out of 10 on the heels of strong Altman Z-scores and debt ratios that outperform over 67% of global competitors.

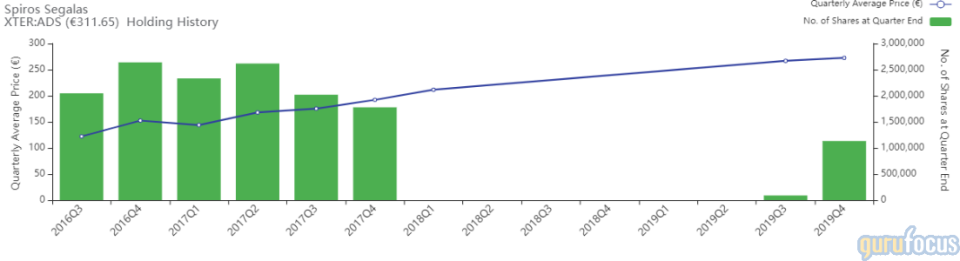

Spiros Segalas (Trades, Portfolio) added 1,043,376 shares of Adidas during fourth-quarter 2019, increasing the stake 1,174.19% and his equity portfolio 1.10%. Shares averaged 272.43 euros ($302.17) during the quarter.

Industria

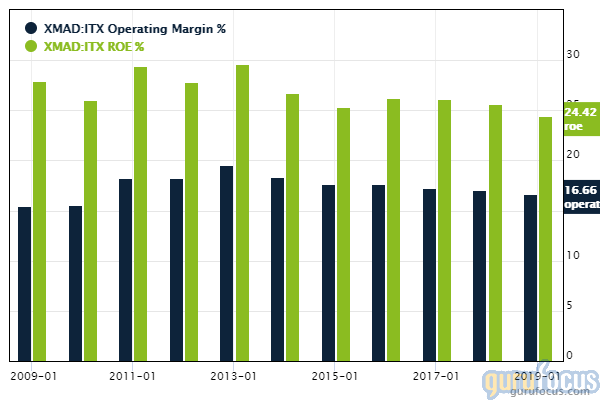

Industria De Diseno Textil designs and manufactures apparel items through brands like Zara and Massimo Dutti. GuruFocus ranks the Spanish company's profitability 9 out of 10 on several positive investing signs, which include a five-star business predictability rank and a return on equity that outperforms 92% of global competitors. Additionally, operating margins are outperforming over 93% of global cyclical retail companies despite contracting approximately 1.7% per year over the past five years.

The Signature Select Canadian Fund (Trades, Portfolio) owns 129,600 shares as of September 2019.

Nike

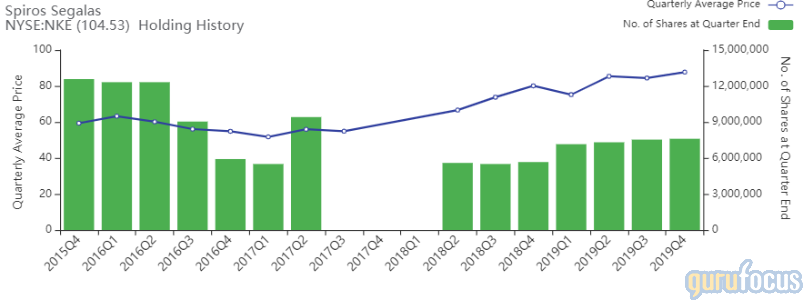

Nike designs and wholesales athletic footwear and apparel through a network of over 1,100 stores across approximately 170 countries around the world. GuruFocus ranks the Beaverton, Oregon-based sport giant's profitability 9 out of 10 on several positive investing signs, which include a 4.5-star business predictability rank and a return on equity that outperforms over 98% of global competitors. Additionally, operating margins are outperforming over 85% of global footwear companies despite contracting approximately 2.1% per year over the past five years.

Segalas added 68,673 shares of Nike during fourth-quarter 2019, with shares averaging $87.72.

Ross Stores

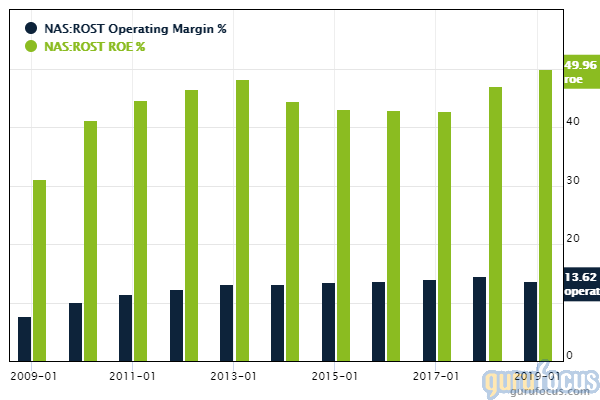

Ross sells name-brand and designer apparel goods to middle-income consumers at between 20% to 60% lower than regular prices. GuruFocus ranks the Dublin, California-based retailer's profitability 9 out of 10 on several positive investing signs, which include a 4.5-star business predictability rank, expanding profit margins and a return on equity that outperforms 97% of global competitors.

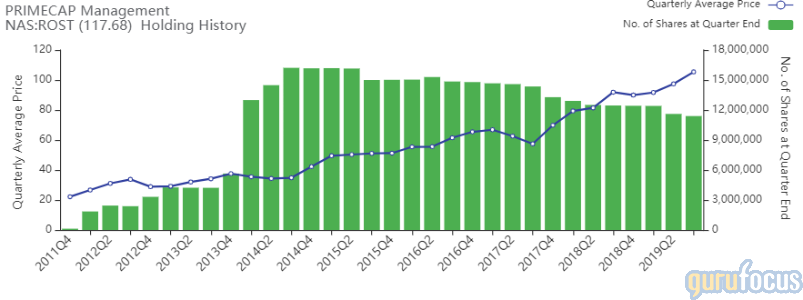

Gurus with large holdings in Ross include PRIMECAP Management (Trades, Portfolio), Pioneer Investments (Trades, Portfolio) and Jim Simons (Trades, Portfolio)' Renaissance Technologies.

Disclosure: Long Ross Stores.

Read more here:

Yacktman Focused Fund's Top 5 Sells in the 4th Quarter

Tweedy Browne's Top 4 Sells of the 4th Quarter

FPA Capital Fund Buys 4 Stocks in 4th Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.