$400M of taxpayer money in NY COVID aid was stolen. That is just the tip of the iceberg.

- Oops!Something went wrong.Please try again later.

An army of petty thieves, sophisticated fraudsters and international crime syndicates ripped off about $400 million of COVID-19 pandemic aid and unemployment benefits intended for New Yorkers, a USA TODAY Network investigation found.

And that is just the tip of the coronavirus fraud iceberg. New Yorkers struggling to feed their families and keep businesses open lost out on billions in taxpayer-funded relief. Instead, that money financed the luxurious lives of those who defrauded the system, in some cases, according to records and interviews with experts and officials.

“It is safe to say that the creation of these pandemic programs was one of the biggest slush funds of all time,” said Jessica Tillipman, The George Washington University Law School assistant dean. “It is unimaginable how many billions of dollars were wasted."

Earlier this year, USA TODAY reporters investigated allegations against the Illinois-based Center for COVID Control and Nomi in Utah went on to reveal each company's role in the government's haphazard and chaotic response to the pandemic that enriched businesses and deprived the public of critical information.

Despite lacking experience in the complex and meticulous world of public health, the principles behind Center for COVID Control and Nomi were able to make millions during the pandemic.

Similarly in New York, while authorities raced to track down and recoup the stolen tax dollars, the USA TODAY Network investigated the complex web of public efforts targeting the historic fraud and government waste that unfolded since COVID-19 hit in March 2020.

In many ways, this fleecing of taxpayers will have financial implications for generations, potentially hindering future aid programs and deepening suffering during the looming recession, the investigation shows.

$8 billion: The amount of tax dollars lost to fraud if just 5% of New York’s $162 billion pot of pandemic aid was stolen, a percentage based on prior fraud trends following emergency aid programs nationally.

Experts asserted pandemic fraud exceeded previous emergency aid — such as post-9/11 and natural disaster recoveries — due to the sheer scale of funding, as well as flawed oversight and transparency.

$350 million: The amount of pandemic-related fraud activity in New York — from loan schemes to medical supply scams — uncovered by federal law enforcement, including some crimes caught before coming to fruition.

$36.7 billion: The amount the state Labor Department said it prevented from being misspent by rejecting 1.5 million fraudulent unemployment benefit claims in New York. But auditors said the agency failed to provide documents supporting the statement.

State labor officials caught another $180 million in fraudulent unemployment payments, but they couldn’t say how much has been recouped, citing ongoing collections and criminal investigations.

New York also sued companies for allegedly violating state contracts seeking thousands of ventilators and medical gowns in 2020. The ongoing effort is trying to recoup at least $56.4 million.

'This is all taxpayers' money'

The probe delved into hundreds of pages of court records, revealing how some fraudsters used coronavirus funds to buy everything from Bentley and Mercedes luxury cars to a motel on a trout-fishing lake in Missouri and a New Jersey bed-and-breakfast styled like a European castle.

Interviews with two U.S. Attorneys in upstate New York districts further revealed the brazenness of fraudsters who targeted the dire government effort to prop up the nation’s economy amid a global crisis.

The top federal prosecutors offered key insights into relief programs that favored speedy distribution of funds over well-established government accountability rules.

“There was such a rush to expand eligibility and get the money out quickly because people were hurting so badly,” said Northern District U.S. Attorney Carla Freedman in Syracuse, New York.

“It provided an opportunity for criminals who otherwise might not have been able to get away with it, or quite frankly never thought about doing it in the first place,” she added, noting authorities will be chasing down the fraud for years to come.

But another troubling repercussion will be the role such widespread fraud plays in shaping public perceptions of government.

“When you see your money wasted and the government being ineffective, you lose trust in government and elected representatives and democracy,” said Shruti Shah, president and CEO of Coalition for Integrity, a government watchdog.

“This is all taxpayers’ money, and the money really should have gone to help those in need,” she added.

A scathing audit released this month also slammed state Labor Department officials for failing to replace the long-troubled unemployment insurance system, which contributed to an estimated $11 billion in unemployment payments lost to fraud amid the pandemic's first year.

"The agency resorted to stop-gap measures to paper over problems, and this proved to be costly to the state, businesses, and New Yorkers,” state Comptroller Thomas DiNapoli said in a statement on the unemployment fraud.

State officials involved in the oversight effort declined interview requests for this report and refused to answer some written questions, citing ongoing investigations.

How much COVID aid flowed to New York?

To fully understand the story of coronavirus fraud in New York, consider the massive amounts of emergency funding flowing through the aid programs.

For example, nearly 5 million New Yorkers received about $105 billion in unemployment benefits, which included added pandemic funds. That is equivalent to about 50 years of benefits in two years, state officials said.

Meanwhile, a total of 1.1 million New Yorkers and entities in the state received other pandemic loans and aid, with the average amount of about $102,000, federal data show.

How did COVID fraud happen and how are prosecutors cracking down?

Still, the striking amount of pandemic fraud in New York, in some ways, is just beginning to come into focus through the lens of criminal cases unearthed so far.

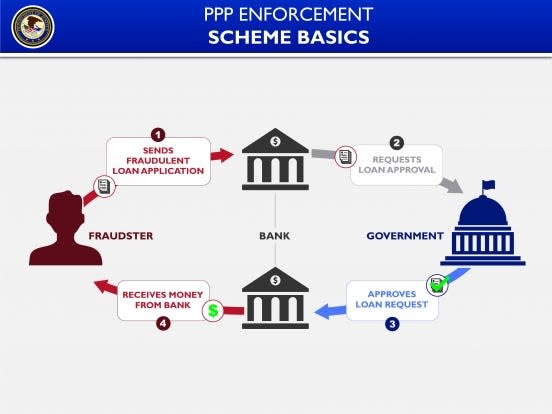

Many schemes were hatched from those familiar with crime who seemingly took news of the $2.2 trillion Coronavirus, Aid, Relief and Economic Security Act in late March 2020 as a glaring neon sign declaring, “Free Money.”

The online loan application process, which was shrouded in secrecy initially because the then-Trump administration refused to publicly disclose basic applicant details, only added chum for fraud sharks.

“Part of it is opportunity, and this seemed fairly easy because you could do it from home and from your computer,” U.S. Attorney Trini Ross said in Buffalo.

“There are just people looking to see the weaknesses in the systems that are set up to help people,” she added.

While digital fraud had been rising in recent decades, the mix of lockdowns, coronavirus concerns and massive amount of relief funding during the pandemic supercharged the problem. In-person vetting of applicant claims and other fraud oversight all but broke down during the early COVID-19 surges.

To crackdown on the tsunami of fraud, the federal Justice Department committed scores of prosecutors and investigators to catching coronavirus-related crimes.

Among the results of the crackdown nationally as of earlier this year:

Criminal charges against more than 1,000 defendants with alleged losses exceeding $1.1 billion.

The seizure of $1 billion in Economic Injury Disaster Loan proceeds.

More than 240 civil investigations into alleged misconduct in connection with pandemic relief loans totaling more than $6 billion.

What types of coronavirus fraud hit New York?

As the government checks flowed, some small business owners filed bogus documents inflating their workforces to illegally gain eligibility for millions of dollars in pandemic loans.

Other people launched a cottage industry, churning out phony loan and unemployment benefit applications. Social media and text messages pinged between accomplices, sharing jokes about their newfound wealth at taxpayers’ expense.

Street gangs and crime syndicates based overseas simply added coronavirus fraud to their long list of criminal enterprises. Some of them posted videos and rap songs online boasting of their COVID-19 relief schemes. Several unemployment scams involved prison inmates convincing those on the outside to file bogus claims in their names.

Several of the biggest cases involved price gouging and fake supply deals connected to personal protective gear and medical supply shortages, as well as COVID-19 test kits.

Banking officials and state employees also face charges of stealing pandemic funds, including a state Labor Department worker who pleaded guilty to a nearly $900,000 unemployment fraud scheme.

“Those are the kinds of cases that, of course, we want to prioritize because these are people in the same way that police officers are given a level of trust and certain access,” said Freedman. Spotlighting prosecutions of wayward officials, she added, helps restore public trust in government.

'All you can do is keep chipping away'

While authorities have seized piles of cash, a yacht, firearms, and other ill-gotten gains so far, prosecutors this year warned untold fraud would go unpunished due to statutes of limitation.

In other words, so much pandemic aid was stolen that many individuals could wait out the clock and avoid prosecution. As a result, federal lawmakers and President Joe Biden in August extended the statute of limitations to 10 years.

“My message to those cheats out there is this: You can’t hide. We’re going to find you. We’re going to make you pay back what you stole and hold you accountable under the law,” Biden said.

Yet despite the added time for seeking justice, authorities face challenges in overcoming early gaps in reporting and tracking pandemic aid. And recouping stolen funds becomes more difficult as time passes and thieves burn through their spoils.

“A lot of people will probably get away with this, and all you can do is keep chipping away,” Tillipman said.

Can the fraudsters still be held accountable?

Meanwhile, it seems coronavirus aid programs ignored lessons learned from countless government watchdog reports on fraud during past emergencies, such as requiring the immediate release of application details and politically independent oversight committees.

While authorities eventually implemented many of those best practices to curb fraud, the initial missteps may ultimately influence the total amount of fraud, which experts suggested will remain unclear for months, if not years.

But a recent policy change to effectively forgive many Paycheck Protection Program loans of $100,000 or less could undermine efforts to curb fraud and waste, according to an Office of Inspector General memo last month.

Regulators decided to stop collections on loans of $100,000 or less. These loans totaled nearly $229 billion, or about 29% of the entire program. Officials noted prior collection efforts only recouped a fraction of delinquent loans, asserting further efforts are “not cost effective.”

Government watchdogs, however, raised concerns the decision would hinder future aid programs attempts to collect on loans and limit accountability.

Amid the debate, Freedman noted people who submitted bogus loan applications of all sizes broke federal law, regardless of forgiveness measures.

“They shouldn’t think they’re not going to get caught; we’re still investigating people,” Freedman said.

Freedman's district, for example, has about 50 coronavirus fraud investigations active across large swaths of upstate. It previously filed charges in 21 cases, spanning more than $17 million in actual government losses, of which about $12 million is being recouped through seized assets and court orders.

“Most criminals commit the crime because they think they’re going to get away, but fortunately … much of the time they don’t,” Freedman said.

New York investigating potential COVID fraud in state contracts

At the state level, officials are still investigating many aspects of the pandemic response, including billions of dollars in state contracts awarded since 2020.

Central to the effort is the fact emergency orders issued by Gov. Kathy Hochul and her predecessor, Andrew Cuomo, waived pre-approval reviews of many contracts by the state comptroller’s office.

As a result, high-profile examples abound of scammers and companies that failed to deliver on state contracts for everything from ventilators and personal protective equipment to various public services.

So far, the state Office of General Services, which oversees many state contracts, has identified 12 COVID-19 related state contracts that involved potential fraudulent activity and referred them to the state Attorney General's Office for review and potential legal action, the agency said in a statement.

The Attorney General’s Office declined to provide details on the state contract referrals, noting in a statement that some of the deals prompted ongoing litigation and others remain under investigation.

A review of court records revealed the Attorney General’s Office has filed lawsuits related to at least five state contracts linked to the COVID-19 response. The lawsuits seek repayment of $56.4 million from companies that allegedly failed to deliver thousands of ventilators and medical gowns during the initial pandemic surge in spring 2020.

Overall, the Office of General Services handled 29 COVID-related contracts totaling about $644 million, and the agency has spent about $99 million so far in connection to those contracts, the statement noted.

Before Hochul ended New York's COVID-19 emergency order in September, many Republican lawmakers had criticized the Democratic governor for previously extending the emergency order as she eased many pandemic restrictions earlier this year.

The pushback mounted amid bipartisan questions about New York paying $637 million for COVID-19 test kits as omicron raged last winter. The tests came through a New Jersey-based company, Digital Gadgets, owned by a family that has donated nearly $300,000 to Hochul’s campaign, as first reported by the Times Union.

Further, some state spending on emergency gear such as ventilators and X-ray machines also proved wasteful in hindsight, as medical needs evolved drastically over the pandemic. In the end, New York paid about $250 million for thousands of those devices that now sit unused in stockpile facilities, as first reported by Politico.

The state Comptroller’s Office declined an interview request for this article, noting it is currently auditing how state agencies handled unemployment benefits and ventilator purchases during the pandemic.

Addressing the fraud and waste in New York, Tillipman asserted “no organization or government is ever immune from waste and fraud” despite even the most stringent oversight and enforcement. But pandemic response failures in New York and nationally, she asserted, will have especially painful ripple effects.

“Ultimately it harms systems for people who need it the most,” she added.

Follow David Robinson on Twitter: @DrobinsonLoHud.

This article originally appeared on New York State Team: $400M in COVID aid intended for NY stolen by fraudsters