5 Companies With High Dividend Yields

According to the GuruFocus All-in-One Screener as of Thursday, the following companies have high dividend yields but performed poorly over the past 12 months.

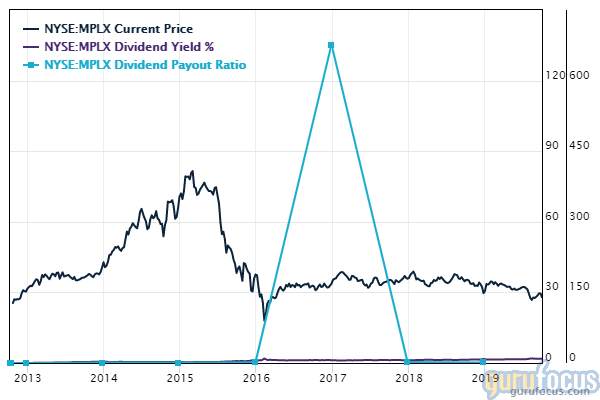

MPLX LP's (NYSE:MPLX) dividend yield is 9.36% with a payout ratio of 1.12. Over the last 52 weeks, the stock has fallen 21.03%. Shares are trading with a price-book ratio of 2.87 and a price-earnings ratio of 12.15.

The midstream oil and gas company has a market cap of $29.51 billion and a profitability and growth rating of 8 out of 10. The return on equity of 23.94% and return on assets of 8.47% are outperforming 80% of competitors. Its financial strength is rated 3 out of 10. The equity-asset ratio of 0.32 is underperforming 55% of competitors.

The company's largest guru shareholder is Pioneer Investments (Trades, Portfolio) with 0.04% of outstanding shares, followed by T Boone Pickens (Trades, Portfolio)' BP Capital with 0.02%.

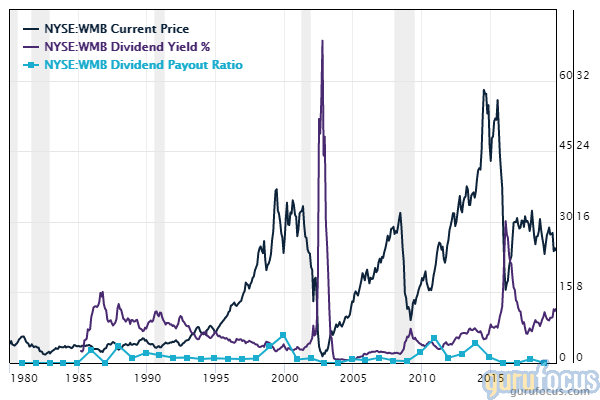

Williams Companies Inc.'s (NYSE:WMB) dividend yield is 6.34%. Over the last 52 weeks, the share price has fallen 15%. The stock is trading with a price-earnings ratio of 292.13 and a price-book ratio of 2.05.

With a $28.32 billion market cap, the pipeline company has a profitability and growth rating of 6 out of 10. The return on equity of 0.45% and return on assets of 0.14% are underperforming 77% of competitors. Its financial strength is rated 3 out of 10. The cash-debt ratio of 0.04 is underperforming 53% of competitors. The equity-asset ratio of 0.30 is above the industry median of 0.06.

Larry Robbins (Trades, Portfolio) is the company's largest guru shareholder with 0.61% of outstanding shares, followed by Pioneer Investments with 0.07% and Pickens' firm with 0.03%.

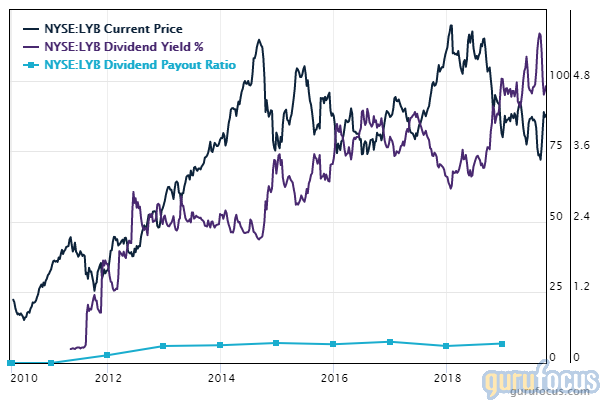

LyondellBasell Industries NV's (LYB) dividend yield is 4.85% and the payout ratio is 0.42. Over the last 52 weeks, the stock has declined 18%. Shares are trading with a price-book ratio of 2.91 and a price-earnings ratio of 8.80.

With a $28.39 billion market cap, the petrochemical producer has a profitability and growth rating of 7 out of 10. The return on equity of 34.24% and return on assets of 12.5% are outperforming 57% of competitors. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.11 is underperforming 85% of competitors. The equity-asset ratio of 0.34 is below the industry median of 0.56.

Robbins is the company's largest guru shareholder with 1.23% of outstanding shares, followed by Pioneer Investments with 0.78% and Barrow, Hanley, Mewhinney & Strauss with 0.32%.

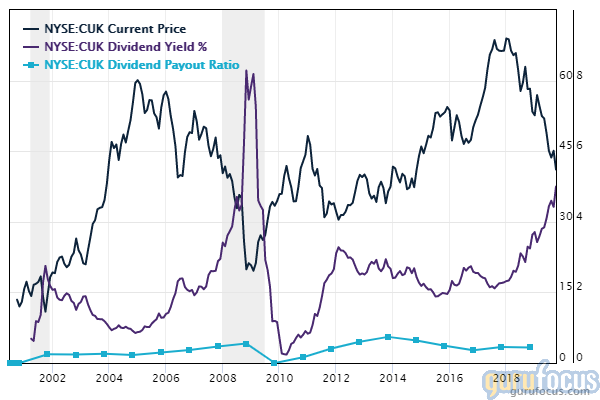

Carnival PLC's (NYSE:CUK) dividend yield is 5.03% with a payout ratio of 0.45. Over the last 52 weeks, the stock has climbed 34%. Shares are trading with a price-book ratio of 1.06 and a price-earnings ratio of 8.97.

The cruise company has a market cap of $28.28 billion. The company has a profitability and growth rating of 7 out of 10. The return on equity of 15.91% and return on assets of 8.93% are outperforming 80% of competitors. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.11 is underperforming 77% of competitors. The equity-asset ratio of 0.58 is above the industry median of 0.49.

With 0.11% of outstanding shares, Jim Simons (Trades, Portfolio)' Renaissance Technologies is the company's largest guru shareholder, followed by Sarah Ketterer (Trades, Portfolio) with 0.02%.

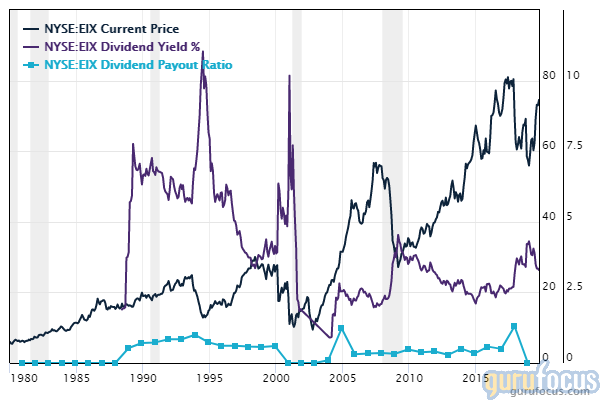

Edison International's (NYSE:EIX) dividend yield is 3.28%. Over the last 52 weeks, the share price has risen 8.43%. The stock is trading with a price-book ratio of 2.26 and a forward price-earnings ratio of 16.39.

The utility company has a market cap of $26.67 billion. GuruFocus rated its profitability and growth 6 out of 10. The return on equity of -2.22% and return on assets of -0.44% are underperforming 88% of competitors. Its financial strength is rated 3 out of 10. The cash-debt ratio of 0.01 is underperforming 93% of competitors. The equity-asset ratio of 0.18 is below the industry median of 0.35.

Richard Pzena (Trades, Portfolio) is the company's largest guru shareholder with 2.27% of outstanding shares, followed by Simons' firm with 1.22%, the T Rowe Price Equity Income Fund (Trades, Portfolio) with 0.73% and Jeff Ubben (Trades, Portfolio)'s ValueAct Holdings with 0.21%.

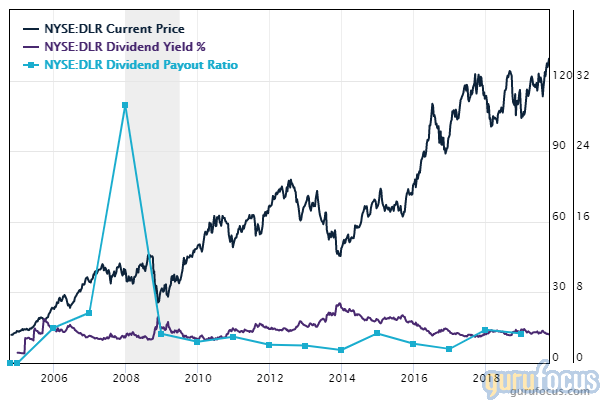

Digital Realty Trust Inc.'s (DLR) dividend yield is 3.34% with a payout ratio of 3.87. Over the last 52 weeks, the share price has risen 16.56%. The stock is trading with a price-book ratio of 3.11 and a price-earnings ratio of 117.12.

The real estate investment trust has a market cap of $26.82 billion. The company has a profitability and growth rating of 8 out of 10. The return on equity of 2.28% and return on assets of 1.39% are underperforming 77% of competitors. Its financial strength is rated 3 out of 10. The equity-asset ratio of 0.41 is underperforming 73% of competitors.

With 0.21% of outstanding shares, the Pioneer Investments is the company's largest guru shareholder, followed by Chris Davis (Trades, Portfolio) with 0.07%.

Disclosure: I do not own any stocks mentioned.

Read more here:

5 Companies Growing Book Value

6 Cheap Stocks With Low Price-Earnings Ratios

6 Stocks Outperforming the S&P 500 Index

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.