5 Dividend Stocks With Good Price-Earnings Ratios

According to the GuruFocus All-in-One Screener as of April 3, the following guru-held companies have high dividend yields and are trading with reasonable price-earnings ratios.

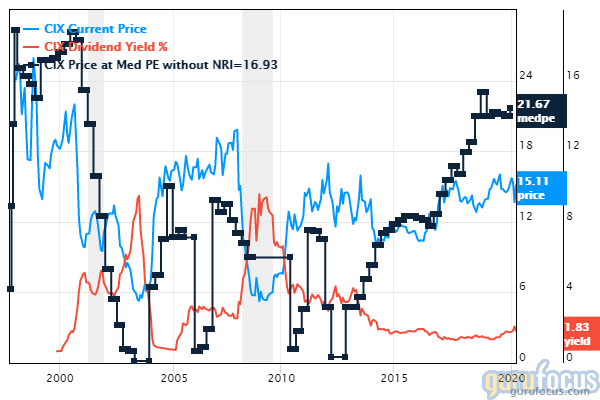

Compx International

Compx International Inc.'s (CIX) dividend yield is 1.98% and the payout ratio is 0.59. Over the past 52 weeks, the stock has increased 4.12% and shares are trading with a price-book ratio of 1.20 and a price-earnings ratio of 12.20.

Warning! GuruFocus has detected 3 Warning Sign with CIX. Click here to check it out.

87586d4b9fd405eef1de4045a27ff9b7.png

The manufacturer of security products has a market cap of $194 million. The return on equity of 10.24% and return on assets of 9.31% are outperforming 57% of companies in the business services industry. The company has no debt.

Chuck Royce (Trades, Portfolio) is the company's largest guru shareholder with 1.70% of outstanding shares, followed by Jim Simons (Trades, Portfolio)' Renaissance Technologies with 1.51%.

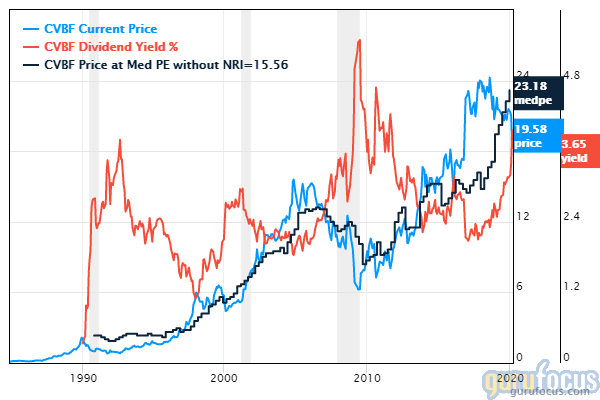

CVB Financial

CVB Financial Corp.'s (NASDAQ:CVBF) dividend yield is 3.62%. Over the past 52 weeks, the stock has declined 3.77% and the shares are trading with a price-earnings ratio of 13.34 and a price-book ratio of 1.40.

The bank holding company has a $2.78 billion market cap. The return on equity of 10.75% and return on assets of 1.84% are outperforming 64% of competitors. The cash-debt ratio of 7.31 is outperforming 81% of competitors. The equity-asset ratio of 0.18 is above the industry median of 0.11.

Simons' firm is the company's largest guru shareholder with 0.9% of outstanding shares, followed by Ken Fisher (Trades, Portfolio) with 0.06%.

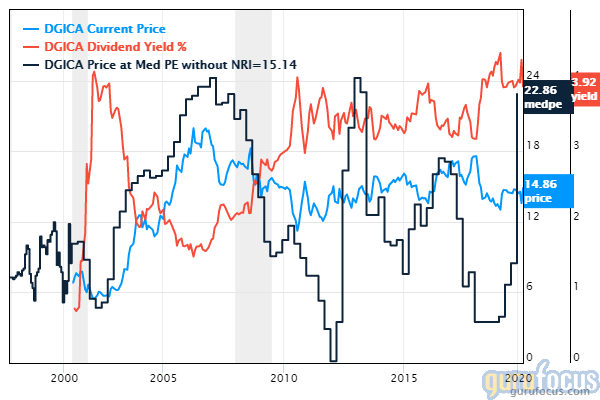

Donegal Group

Donegal Group Inc.'s (NASDAQ:DGICA) dividend yield is 3.9% with a payout ratio of 0.38. Over the past 52 weeks, the stock has increased 16.33%. Shares are trading with a price-book ratio of 0.96 and a price-earnings ratio of 9.85.

The insurance holding company has a market cap of $418 million. GuruFocus rated its profitability 5 out of 10. The return on equity of 10.92% and return on assets of 2.5% are outperforming 58% of competitors. Its financial strength is rated 5 out of 10. The cash-debt ratio of 1.23 is below the industry median of 2.47.

Simons' firm is the company's largest guru shareholder with 2.11% of outstanding shares, followed by Jeremy Grantham (Trades, Portfolio)'s GMO with 0.04%.

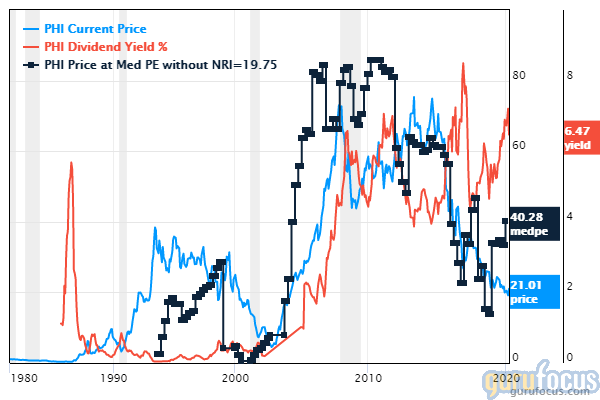

PLDT

PLDT Inc.'s (NYSE:PHI) dividend yield is 6.81% with a payout ratio of 0.69. Over the past 52 weeks, the stock has increased 6.71% and the shares are trading with a price-book ratio of 2.11 and a price-earnings ratio of 10.48.

The telecommunications company has a market cap of $4.6 billion and a GuruFocus profitability rating of 7 out of 10. The return on equity of 20.14% and return on assets of 4.47% are outperforming 65% of competitors. Its financial strength is rated 4 out of 10 with a cash-debt ratio of 0.17 and an equity-asset ratio of 0.21.

With 1.52% of outstanding shares, Simons' firm is the company's largest guru shareholder.

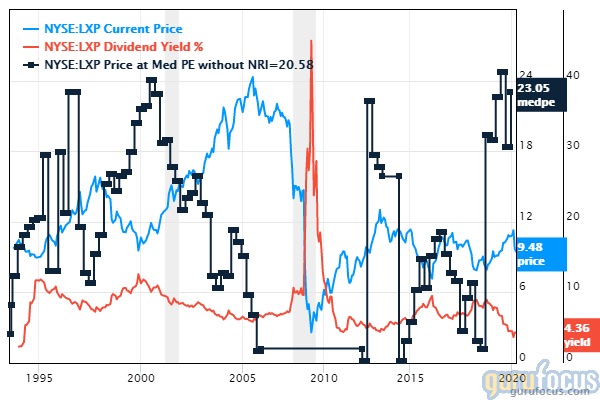

Lexington Realty Trust

The Lexington Realty Trust's (NYSE:LXP) dividend yield is 4.30% and the payout ratio is 0.36. Over the past 52 weeks, the stock has gained 7.99%. The shares are trading with a price-earnings ratio of 8.62.

The real estate investment trust has a market cap of $2.46 billion. GuruFocus rated its profitability 6 out of 10. The return on equity of 18.81% and return on assets of 9.25% are outperforming 94% of competitors. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.09 is above the industry median of 0.06.

With 0.28% of outstanding shares, Simons' firm is the company's largest guru shareholder, followed by Royce with 0.12% and Pioneer Investments (Trades, Portfolio) with 0.05%.

Disclosure: I do not own any stocks mentioned.

Read more here:

Insiders Roundup: NGM, Legg Mason

6 Retailers Trading With Low Price-Earnings Ratios

6 Healthcare Companies Boosting Book Value

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 3 Warning Sign with CIX. Click here to check it out.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?