5 Energy Companies With the Strength to Weather the Coronavirus Storm

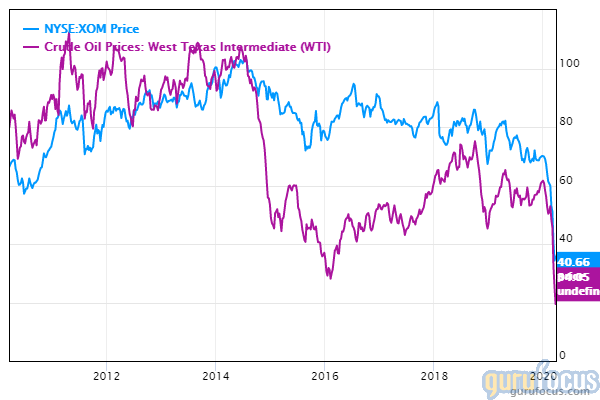

As crude oil prices continue tanking on geopolitical issues, five energy companies with high financial strength and are trading at single-digit Shiller price-earnings ratios are Exxon Mobil Corp. (NYSE:XOM), ConocoPhillips (NYSE:COP), Valero Energy Corp. (NYSE:VLO), HollyFrontier Corp. (NYSE:HFC) and Helmerich & Payne Inc. (NYSE:HP) according to the All-in-One Screener, a GuruFocus Premium feature.

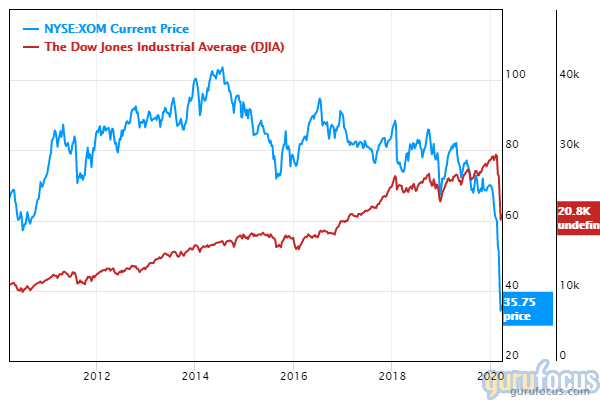

Dow ends week down, but higher than last week's close

On Friday, the Dow Jones Industrial Average closed at 21,636.78, down 915.39 points or approximately 4% from Thursday's close of 22,552.17, yet up 2,462.8 points or 12.85% from last Friday's close of 19,173.98.

Stocks tumbled despite the House approving the $2 trillion stimulus bill unanimously agreed by the Senate earlier this week. Barclays PLC (NYSE:BCS) chief U.S. equity strategist Maneesh Deshpande said in a note that medium-term risks are "skewed to the downside" following the Dow's three-day rally, citing two uncertainties that "remain unresolved": the length of the economic quarantine required to contain the virus and the ultimate damage caused.

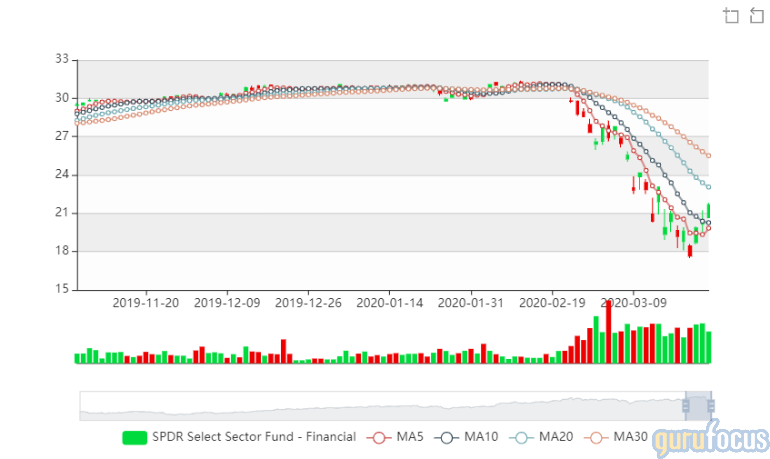

Energy sector tanks during first quarter of 2020, billionaire investor Cooperman makes "contrarian" call

West Texas Intermediate crude oil prices sank near a five-year low of $19.48 per barrel, down nearly 50% from prices near the beginning of March, as the virus outbreak severed demand. A price war between several OPEC nations further pressured oil prices, sending the S&P 500 energy sector down over 40% year to date.

The deep decline in energy stock prices sent the energy sector Shiller price-earnings ratio to 8.40, the lowest among the market sectors and about half that of the Shiller price-earnings ratio of the financial services sector, which is second-lowest at 15.30.

Omega Advisors Chairman Leon Cooperman (Trades, Portfolio) made a "contrarian" call on the energy sector: Following his statement that he is "optimistic" that the markets have reached a bottom, the renowned investor added that "the best cure for low oil prices is low oil prices" and that the supply demand for energy could "tighten up."

As such, investors might seek opportunities in energy stocks that are trading near single-digit Shiller price-earnings ratios and have strong balance sheets according to GuruFocus' financial strength rank.

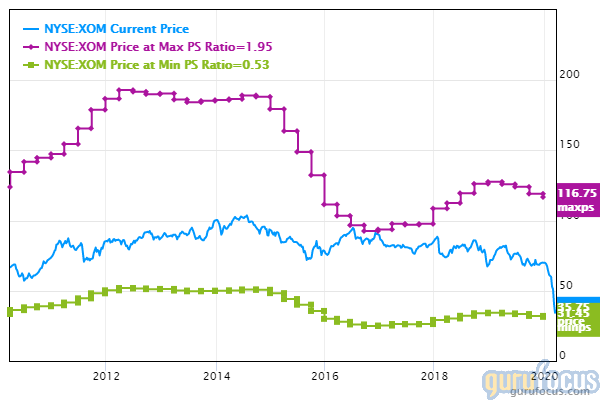

Exxon Mobil

Shares of Exxon Mobil closed at $36.95, down 4.65% from the previous close.

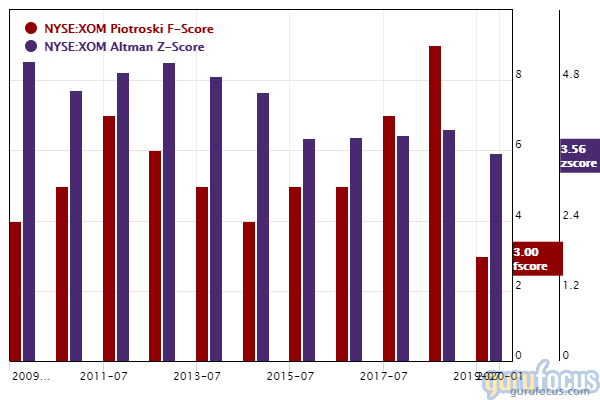

GuruFocus ranks the Irving, Texas-based company's financial strength 6 out of 10: Even though it has a low Piotroski F-score of 3, Exxon Mobil has a strong Altman Z-score of 3.08 and debt ratios that are outperforming over 65% of global competitors.

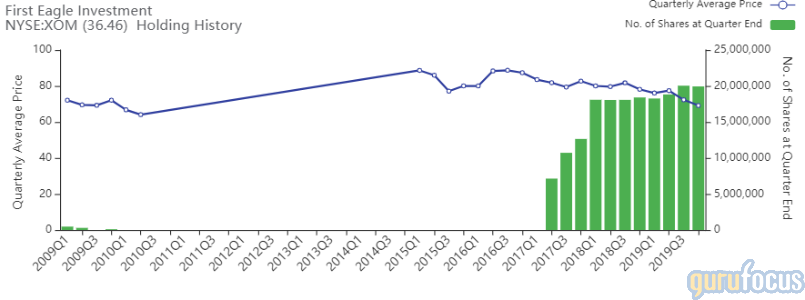

Gurus with large holdings in Exxon Mobil include First Eagle Investment (Trades, Portfolio) and Ken Fisher (Trades, Portfolio).

ConocoPhillips

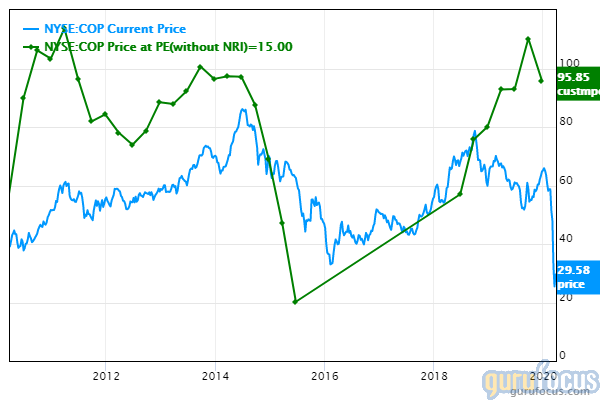

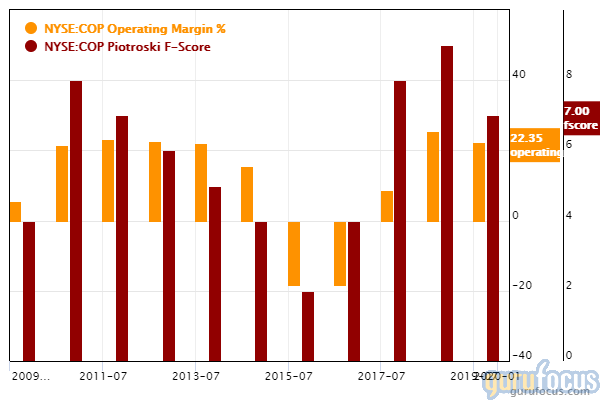

Shares of ConocoPhillips closed at $29.25, down 8.79% from the previous close.

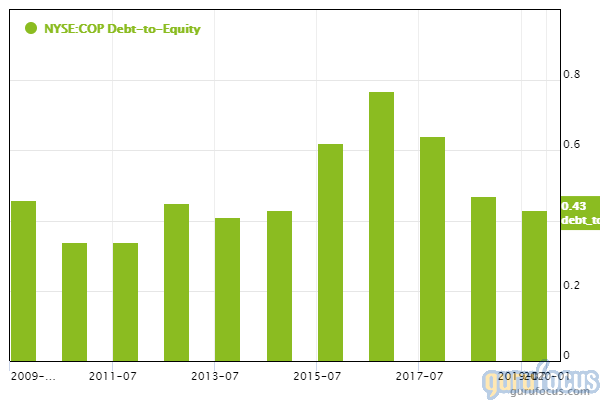

GuruFocus ranks the Houston-based company's financial strength 6 out of 10: While the company has a debt-to-Ebitda ratio that outperforms 80% of global competitors, ConocoPhillips has a moderately-weak Altman Z-score of 2.49 and a debt-to-equity ratio that outperforms just 52% of global energy exploration and production companies.

ConocoPhillips' profitability ranks 7 out of 10 on the heels of a high Piotroski F-score of 7 and operating margins outperforming 79% of global competitors.

Valero

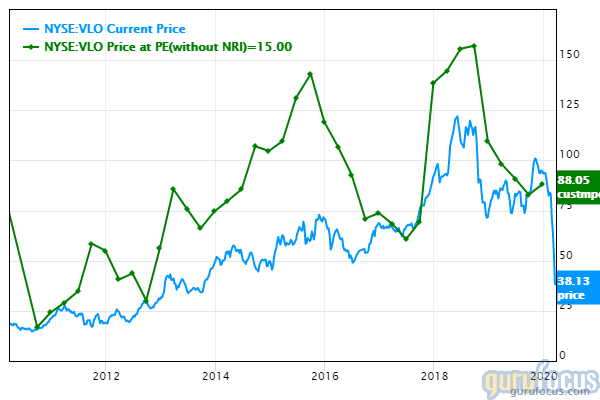

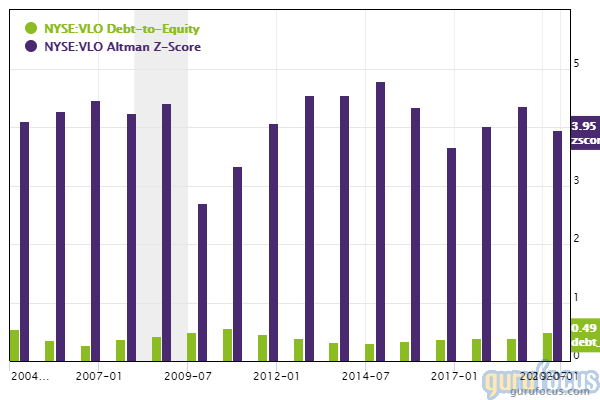

Shares of Valero closed at $45.04, down 1.44% from the previous close.

GuruFocus ranks the San Antonio, Texas-based company's financial strength 6 out of 10: Even though the company's debt-to-equity ratio underperforms 51.69% of global competitors, Valero has a strong Altman Z-score of 3.57 and interest coverage that is above Benjamin Graham's safe threshold of 5 and outperforms 61.52% of global oil and gas companies.

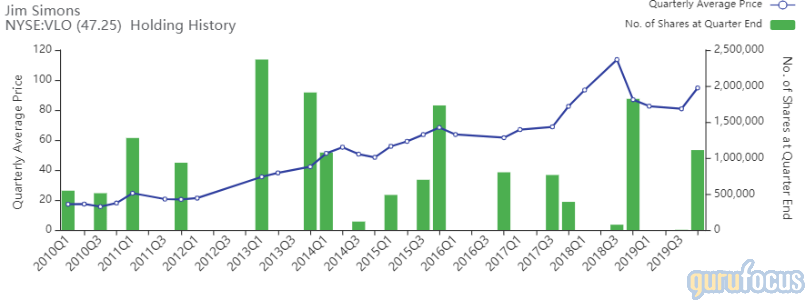

Gurus with large holdings in Valero include Pioneer Investments (Trades, Portfolio) and Jim Simons (Trades, Portfolio)' Renaissance Technologies.

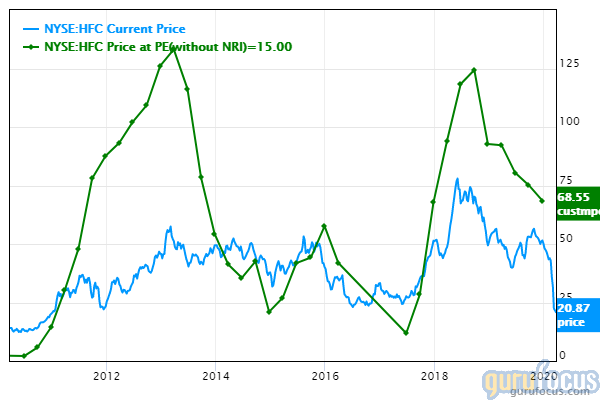

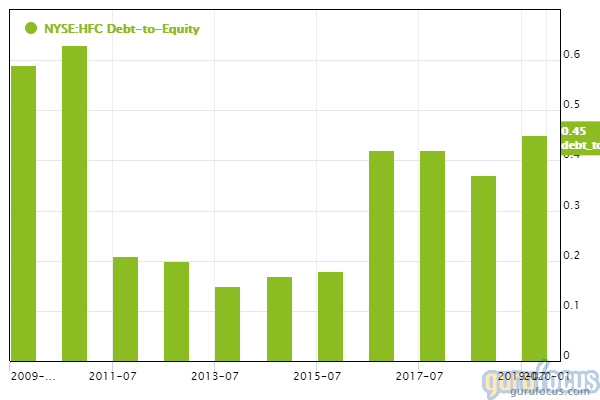

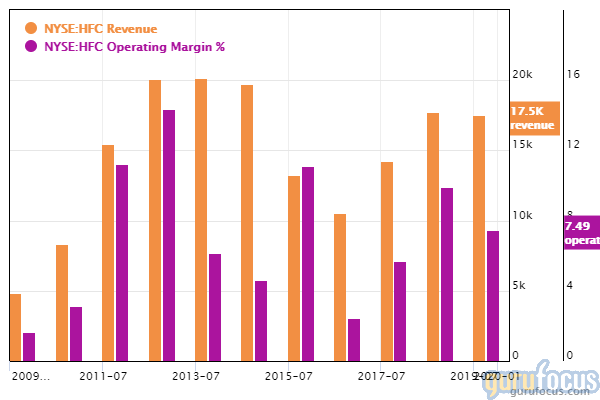

HollyFrontier

Shares of HollyFrontier closed at $24.25, up 1.25% from the previous close.

The Dallas-based company owns and operates refineries serving the Rockies, the midcontinent and the Southwest regions. GuruFocus ranks HollyFrontier's financial strength 6 out of 10: Although the company's interest coverage and debt-to-Ebitda ratio outperform over 63% of global competitors, HollyFrontier has a modest Piotroski F-score of 4 and an Altman Z-score of 2.87.

GuruFocus ranks HollyFrontier's profitability 7 out of 10 and valuation 9 out of 10 on positive investing signs that include expanding operating margins and price valuations near five-year lows.

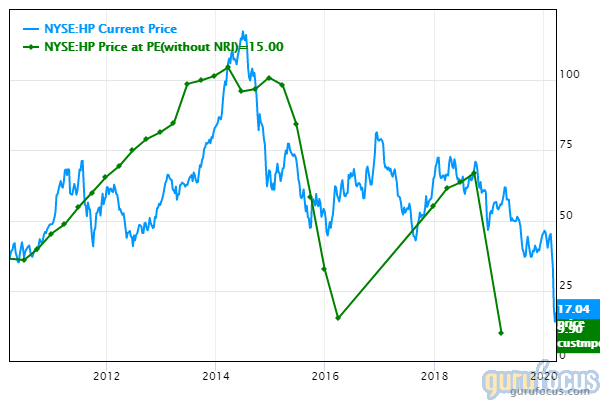

Helmerich & Payne

Shares of Helmerich & Payne closed at $16.84, down 11.13% from the previous close.

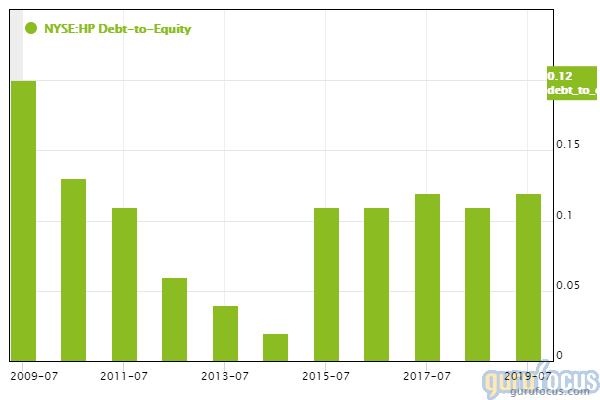

GuruFocus ranks the Tulsa, Oklahoma-based company's financial strength 7 out of 10 on several positive investing signs, which include a solid Piotroski F-score of 6 and debt ratios that outperform over 73% of global competitors.

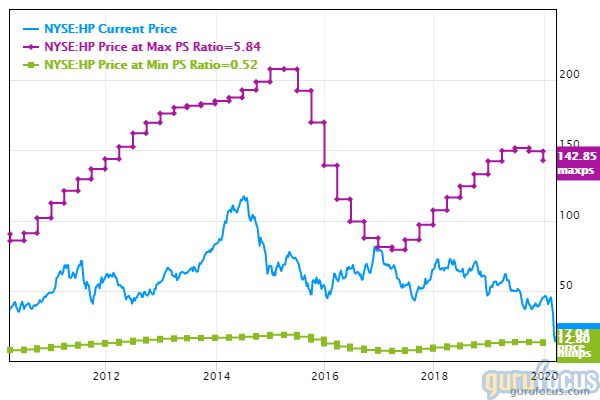

Helmerich & Payne's valuation ranks 9 out of 10 on the heels of price-book and price-sales ratios close to 10-year lows.

Disclosure: No positions.

Read more here:

Leon Cooperman 'Optimistic' About Stock Market Reaching a Bottom

5 Buffett-Munger Stocks to Spring Toward in 2nd Quarter

4 Profitable and Predictable Stocks to Combat Market Volatility

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.