5 Energy Stocks Trading With Low Price-Sales Ratios

- By Tiziano Frateschi

According to the GuruFocus All-In-One Screener, a Premium feature, the following energy companies were trading with low price-sales ratios as of March 8.

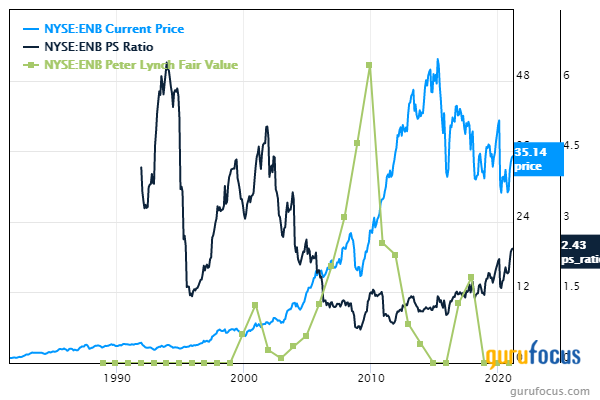

Enbridge

Shares of Enbridge Inc. (ENB) were trading around $35.14 with a price-sales ratio of 2.30 and a price-earnings ratio of 30.04.

The U.S. energy generation, distribution and transportation company has a $71.25 billion market cap. The share price has risen at an annualized rate of 5.59% over the past decade.

The discounted cash flow calculator gives the stock a fair value of $12.35, suggesting it is overpriced by 184%.

The aerospace and defense company's largest guru shareholder is Pioneer Investments (Trades, Portfolio) with 0.29% of outstanding shares, followed by the T Rowe Price Equity Income Fund (Trades, Portfolio) with 0.13%, Barrow, Hanley, Mewhinney & Strauss with 0.05% and Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.03%.

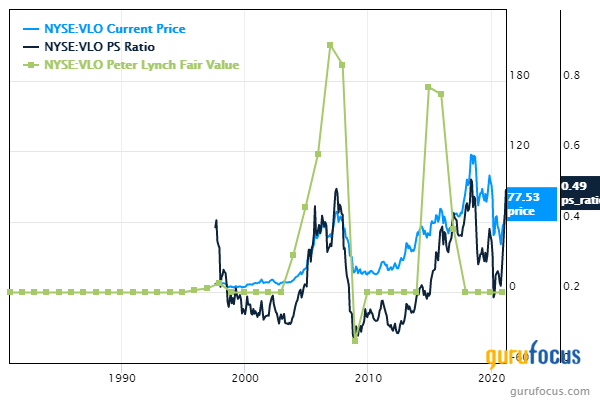

Valero Energy

On Monday, Valero Energy Corp. (VLO) was trading around $77.53 per share with a price-sales ratio of 0.49 and a price-book ratio of 1.68.

The U.S. independent refiner has a market cap of $31.67 billion. The stock has risen at an annualized rate of 14.09% over the past 10 years.

With a 0.76% stake, Pioneer Investments (Trades, Portfolio) is the company's largest guru shareholder, followed by Barrow, Hanley, Mewhinney & Strauss with 0.53% and Simons' firm with 0.11%.

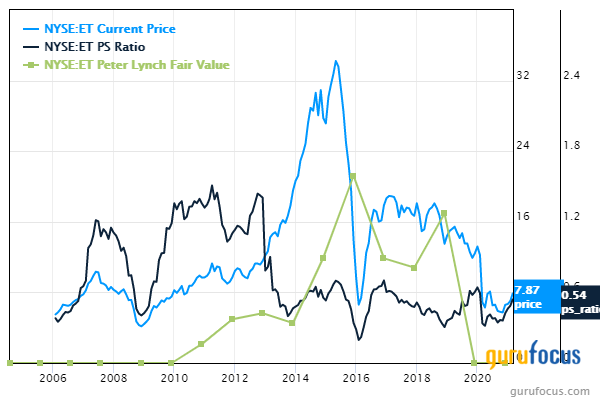

Energy Transfer

Energy Transfer LP (ET) was trading around $7.87 on Monday with a price-sales ratio of 0.54 and a price-book ratio of 1.15.

The company has a market cap of $21.26 billion. The stock has risen at an annualized rate of 5.70% over the past decade.

The company's largest guru shareholder is David Tepper (Trades, Portfolio) with 0.89% of outstanding shares, followed by David Abrams (Trades, Portfolio) with 0.82% and Leon Cooperman (Trades, Portfolio) with 0.24%.

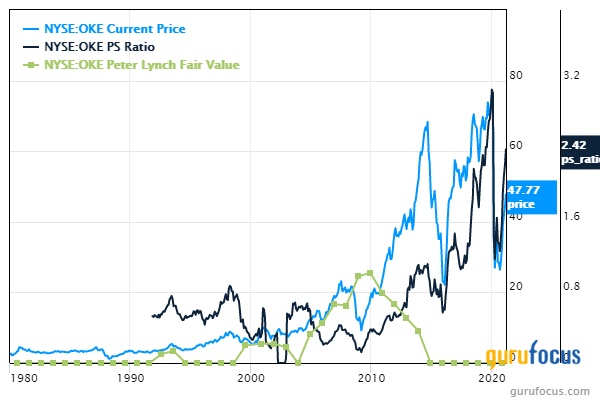

ONEOK

ONEOK Inc. (OKE) was trading around $47.77 with a price-sales ratio of 2.42 and a price-earnings ratio of 34.37.

The company, which is a provider of natural gas gathering, processing, storage and transportation, has a market cap of $21.25 billion. The stock has risen at an annualized rate of 9.84% over the past decade.

The discounted cash flow calculator gives the stock a fair value of $14.88, suggesting it is overpriced by 221%.

With a 0.46% stake, the Pioneer Investments (Trades, Portfolio) is the company's largest guru shareholder, followed by Mario Gabelli (Trades, Portfolio) with 0.04% and Simons' firm with 0.03%.

Cheniere Energy

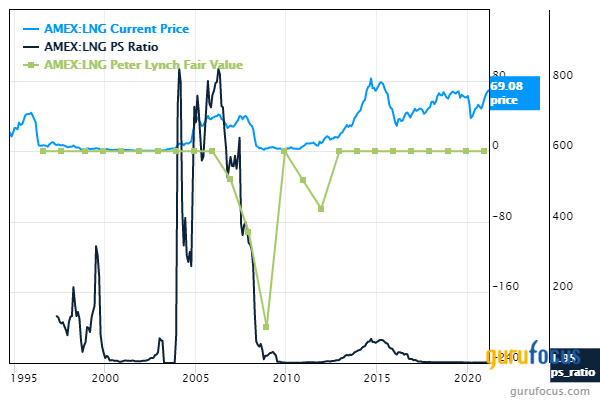

Cheniere Energy Inc. (LNG) shares were trading around $69.08 with a price-sales ratio of 1.95.

The company has a $17.51 billion market cap. The share price has risen at an annualized rate of 21.86% over the past decade.

The company's largest guru shareholder is Carl Icahn (Trades, Portfolio) with 6.41% of outstanding shares, followed by Pioneer Investments (Trades, Portfolio) with 0.32%, Murray Stahl (Trades, Portfolio) with 0.20%, NWQ Managers (Trades, Portfolio) with 0.11% and Steven Cohen (Trades, Portfolio) with 0.09%.

Disclosure: I do not own any stocks mentioned.

Read more here:

5 Guru Stocks With Predictable Business

5 Industrial Stocks Outperforming the Market

5 Retailers Popular Among Gurus

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.