5 fights to watch as tax deal goes to Senate

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

A tax deal that includes business tax breaks and an expansion of the child tax credit (CTC) was cleared in the House on Wednesday night in a vote of 357 to 70. But the bill’s fate in the Senate is up in the air.

The deal proposed by top tax writers Sen. Ron Wyden (D-Ore.) and Rep. Jason Smith (R-Mo.) was a rare bipartisan initiative in a divided Congress, but it could face its toughest hurdles yet in the Senate amid Republican resistance.

Asked Thursday whether there would be enough Republicans on board to back the bill, Sen. Kevin Cramer (R-N.D.) told reporters that “that would be the trick.”

Here are five points of contention to watch on the tax proposal as it gets considered in the upper chamber.

How — if at all — is the cost of the bill covered?

Sen. John Cornyn (R-Texas) asks questions during a Senate Judiciary Committee hearing with social media executives to discuss protecting children from sexual exploitation on Wednesday, January 31, 2024. (Greg Nash)

To pay for a $33 billion expansion in the child tax credit along with $33 billion in business deductions and other provisions, the bill cancels the employee retention tax credit, a pandemic-era tax break that supports businesses for not firing workers.

But Republicans say shifting spending from one tax credit to another doesn’t actually balance the cost of the bill in the long run.

“It’s kind of a phony pay-for,” said Sen. John Cornyn (R-Texas). “Because the original tax credit done during the pandemic wasn’t paid for. So saying now we can use the unpaid-for tax credit to pay for this seems like smoke and mirrors.”

“I certainly would support the Finance Committee doing a hearing and markup, but I would not be willing to just rubber stamp it,” Cornyn added.

Cramer expressed the same hesitation Thursday.

“I wish it was paid for better. I know that it’s got pay-fors, but they’re paying for it with money that’s not paid for,” he said.

While the business deductions and child tax credit are extended for two years under the legislation, budget experts warn that lawmakers are intending to extend them well beyond that time frame before the tax code resets in 2025.

While the top-line cost of the tax credits in the bill is about $79 billion, Smith has already boasted that just the business deductions will end up saving businesses $600 billion that they would have paid to the government. Experts say that number is accurate, assuming the provisions are extended.

This could contribute meaningfully to the national deficit, which ballooned after the pandemic and stands now at about $34 trillion.

“I won’t be supporting it,” Sen. Ron Johnson (R-Wis.) said. “We are $34 trillion in debt. We just can’t keep affording to do these things.”

Asked whether the business credits and child credit expansion were a good trade-off, Johnson said they weren’t.

“It’s not worth laying the foundation for a trillion-dollar-over-10-years child tax credit system,” he said.

GOP issues with the child tax credit

Sen. John Thune (R-S.D.) addresses reporters during a press conference on Wednesday, January 17, 2024 to discuss immigration parole as a deal to broaden funding for border security is being worked on in the Senate. (Greg Nash)

Republicans also want the expanded CTC to be linked to more stringent work requirements.

Sen. John Thune (R-S.D.) told reporters Thursday that the bill would need to be amended or it wouldn’t get 60 votes.

“There are some things that shouldn’t be in there, some of the things on the CTC, for example. It’s always been connected to work. You can get it for one year, but then you can get the thing for two successive years without working,” Thune told The Hill soon after the bill’s release.

“They increased the refundability amount and indexed the overall credit [to inflation]. There are some things in there that I’ve got to take a look at,” he said.

Democrats are unlikely to accept more-stringent work requirements, however, after several experts have raised doubts about the efficacy of such measures.

“Reams of evidence suggest that they do not encourage work,” economist Kathryn A. Edwards wrote in a 2023 opinion piece. “On the contrary, they are more likely to impose hardship and possibly increase poverty. When combined with a lack of adequate labor protections, they can even border on exploitation.”

Democrats fear the bill is too business-friendly

Sen. Tim Kaine (D-Va.) speaks to reporters before a closed-door Senate Foreign Relations Committee hearing with Secretary of State Antony Blinken at the Capitol on Thursday, January 18, 2024. (Greg Nash)

Democrats argue that the tax bill is weighted too much toward businesses because it extends business tax credits that were taken away to pay for a sizable reduction in the corporate tax rate in 2018.

“It’s a compromise, and some on our side think that the mixture of the tax benefit to the companies versus to the [child tax credit] isn’t to their liking,” Sen. Tim Kaine (D-Va.) said Thursday.

Kaine still described himself as “strongly inclined to support” the bill, but some of his progressive colleagues are not sold yet.

Top Stories from The Hill

Trump doles out millions to lawyers: Here’s who’s getting the most

GOP moderates adopt hard-line tactics amid Republican infighting

Sen. Bernie Sanders (I-Vt.) said he was as yet undecided on the package and needed to look at it in greater detail.

“The child tax credit is an important step in helping lower-income families. That’s the good news. The bad news — and disagreement — is that we give away enormous amounts of tax rates to large profitable corporations at a time when they’re already not paying their fair share of taxes. That’s the balance that we have to look at,” he said.

State and local tax gripes could limit support

Sen. Robert Menendez (D-N.J.) speaks to reporters as he arrives to the Capitol for a series of votes, including a continuing resolution to fund the federal government, on Thursday, January 18, 2024. (Greg Nash)

Resistance to the deal in the House was pronounced among blue-state Republicans, who want to see the cap on state and local tax (SALT) deductions raised as part of any larger tax deal.

Sources told The Hill that New York Republican lawmakers and House leadership struck an agreement to bring a SALT-related bill to the floor by the end of next week, though an aide for House Speaker Mike Johnson (R-La.) later pushed back on the time frame.

If that bill materializes, it could add another dimension to the debate in the Senate as something to be potentially folded in or cast aside.

Sen. Bob Menendez (D-N.J.) said Thursday he needed some more time with the bill but that he thought he’d be in favor of it.

“I think I’ll be for it, I’ve just got to see it,” he said.

Election implications of passing a big tax bill

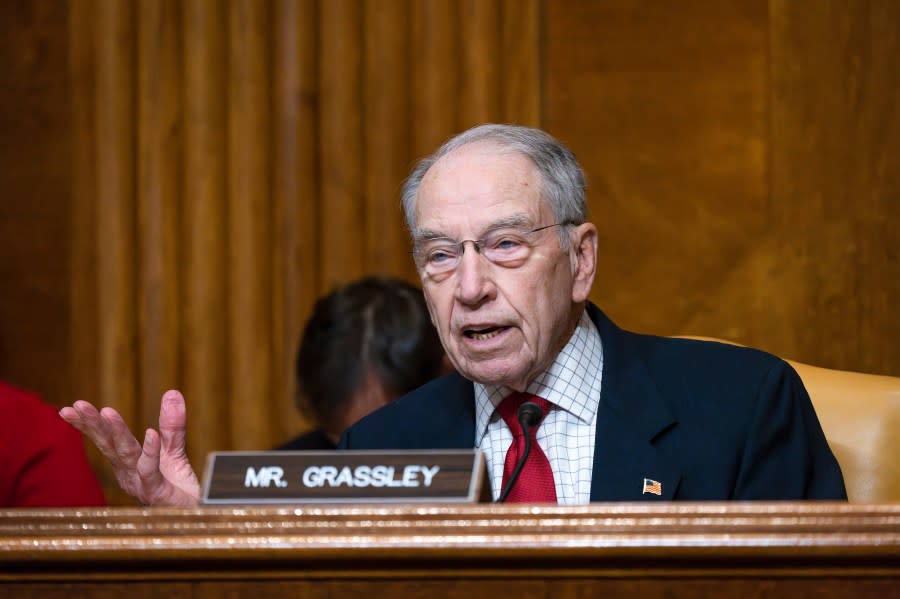

FILE – Senate Budget Committee Ranking Member Sen. Chuck Grassley, R-Iowa, speaks at a hearing at the Capitol in Washington, May 4, 2023. Grassley has been hospitalized in the Washington area with an infection and is receiving antibiotic infusions. v(AP Photo/J. Scott Applewhite, File)

The optics of the tax package — and the question of which party could benefit more from its passage — is also on the minds of senators.

Sen. Chuck Grassley (R-Iowa) told Semafor on Wednesday that “passing a tax bill that makes the president look good — mailing out checks before the election — means he could be reelected.”

“Then we won’t extend the 2017 tax cuts,” he said.

Wyden pushed back Thursday on Grassley’s argument.

“I heard about … Biden, you know, cutting checks. That’s just preposterous,” he said, adding that IRS Commissioner Danny Werfel confirmed “that he can get this done in a matter of a few weeks.”

“We got a lot of small businesses that are talking to my colleagues to do everything I can to get this done quickly and get a presidential signature on it,” he told reporters.

For the latest news, weather, sports, and streaming video, head to The Hill.