5 High-Quality Utility Stocks on Coronavirus Pandemic Uncertainty

- By James Li

In light of markets juggling between news of potential coronavirus vaccines and news of accelerating virus cases, five stocks with high financial strength and profitability in the utilities sector include Consolidated Water Co. (NASDAQ:CWCO), Enel Generacion Chile SA (XSGO:ENELGXCH), Enel Generacion Peru SAA (LIM:ENGEPEC1), Jersey Electricity PLC (LSE:JEL) and Telecom Plus PLC (LSE:TEP) according to the All-in-One Screener, a Premium feature of GuruFocus.

Stocks closed mixed as surging coronavirus cases offset vaccine rally

On Wednesday, the Dow Jones Industrial Average closed at 29,397.63, down 23.29 points from Tuesday's close of 29,420.92, thus putting on hold Monday's rally on the heels of positive Covid-19 vaccine progress.

Stocks were pressured as U.S. virus cases set a new seven-day average high of 121,153 according to a CNBC analysis of John Hopkins University data. Global coronavirus cases have topped 51.62 million, with over 10.62 million cases in the U.S.

On the heels of accelerating cases in the U.S., New York Governor Andrew Cuomo announced that restaurants and bars must close at 10 p.m. starting on Friday except for curbside pickup. Additionally, the state prohibited gatherings of more than 10 people in a private residence.

New York's latest coronavirus restrictions follow lockdown orders in the U.K. and several European countries like France and Italy.

As such, investors may seek opportunities in the utilities sector, which contains stocks that provide basic amenities like water, electricity and sewage services. Additionally, Investopedia describes as a sector with "less price volatility relative to the overall equity markets."

The Screener listed five utilities from the U.S., U.K. and Latin American stock markets that have a financial strength rank of at least 6, a profitability rank of at least 7 and have grown gross margins between 1% and 5% per year on average over the past five years.

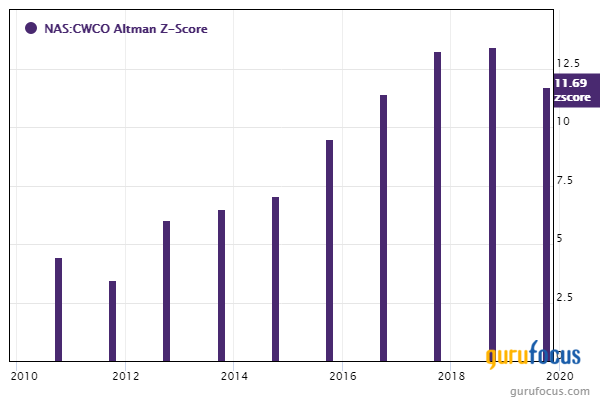

Consolidated Water

Consolidated Water develops and operates seawater desalination plants and water distribution systems in areas with scarce potable water resources. GuruFocus ranks the company's financial strength 9 out of 10 on several positive investing signs, which include a strong Altman Z-score of 10 and interest coverage and debt ratios that outperform over 93% of global competitors.

Gurus with holdings in Consolidated Water include Jim Simons (Trades, Portfolio)' Renaissance Technologies and Pioneer Investments (Trades, Portfolio).

Enel Generacion Chile

Enel Generacion Chile generates electricity for Chilean residents through hydroelectric plants and thermal units. GuruFocus ranks the company's financial strength 6 out of 10: Interest coverage ratios are outperforming over 84.55% of global competitors despite a weak Altman Z-score of 0.95.

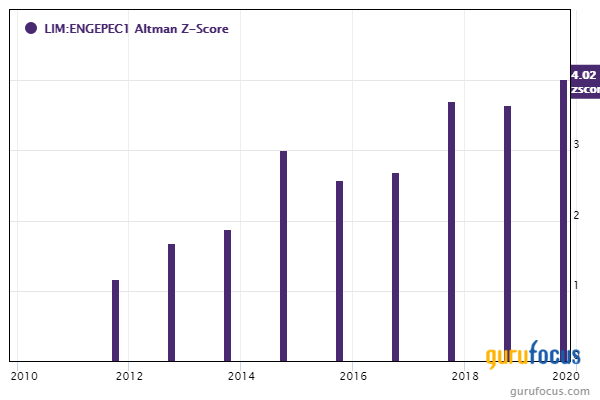

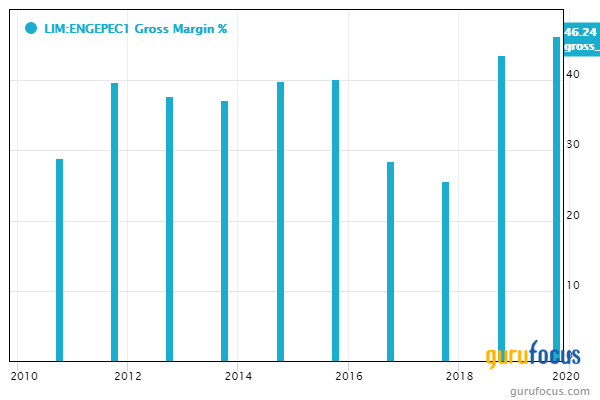

Enel Generacion Peru

Enel Generacion Peru distributes electrical energy in over 50 districts in the Lima region, as well as other Peruvian provinces like El Callao and Huaura. GuruFocus ranks the company's financial strength 8 out of 10 on several positive investing signs, which include a strong Altman Z-score of 3.68 and interest coverage and debt ratios that outperform over 88% of global competitors.

Enel Generacion Peru's profitability ranks 7 out of 10, driven by a high Piotroski F-score of 8 and expanding profit margins. Despite this, revenues have declined approximately 6.3% per year over the past three years, a rate that underperforms over 88% of global competitors.

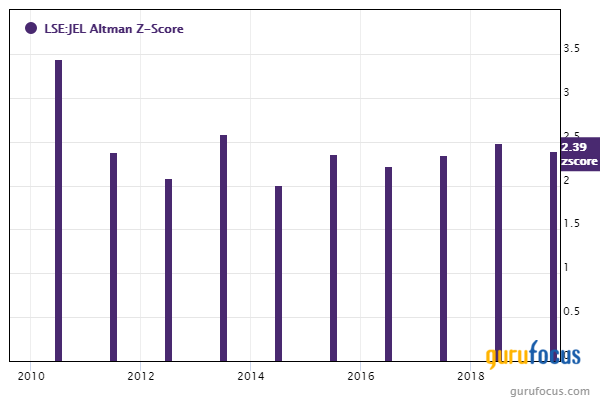

Jersey Electricity

Jersey Electricity provides electricity through operations in the Channel Islands Electricity Grid System with Guernsey Electricity. GuruFocus ranks the company's financial strength 7 out of 10: Even though the company has a modestly weak Altman Z-score of 2.52, Jersey Electricity's debt ratios are outperforming over 82% of global competitors.

Telecom Plus

Telecom Plus provides telecommunication and electricity services around the U.K. GuruFocus ranks the company's financial strength and profitability 7 out of 10 on several positive investing signs, which include a high Piotroski F-score of 7, a strong Altman Z-score of 4.96 and profit margins that are expanding albeit underperforming over 70% of global competitors.

Disclosure: No positions.

Read more here:

Ken Fisher's Top 3rd-Quarter Trades

3 Undervalued Canadian Stocks With Strong Margin Growth

4 Airport and Airline Stocks to Consider on Coronavirus Vaccine Hopes

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.