Here are 5 new investment tips you can steal from Warren Buffett

Even after a lifetime of investing experience and a net worth of more than $100 billion, Warren Buffett still has lots of fresh wisdom to impart.

The famed investor and chairman and CEO of Berkshire Hathaway took some time during his company’s annual shareholder meeting on May 1 to answer questions and provide guidance to budding investors based on his own hard-earned experiences over the past year.

From the event, investors of all levels of experience can take away five key lessons to build a better portfolio in this coming year.

1. Investing isn’t a game

Buffett has been pretty open about what he thinks about the popularity of investing apps in the wake of the GameStop/Robinhood fiasco. His issue isn’t exactly with the apps themselves, but rather how they encourage newbie investors to treat trading like a game.

“I think the degree to which a very rich society can reward people who know how to take advantage, essentially, of the gambling instincts of the American public, the worldwide public — it's not the most admirable part of the accomplishment.”

With the right approach, low or no-commission trading apps can be very useful — and profitable — as long you don’t treat it like a game.

2.You can't beat an S&P 500 index fund

Buffett says he advises most investors to simply purchase an S&P index fund over buying individual stocks — even including his own company.

"I recommend the S&P 500 index fund. I've never recommended Berkshire to anybody because I don't want people to buy it because they think I'm tipping them into something. On my death there's a fund for my then-widow and 90% will go into an S&P 500 index fund," he said.

Buying into an index fund like the S&P 500, either directly or via an ETF, is about as easy, low-risk and reliably profitable as investing gets. You don't need a lot of money to make the strategy work, either — you can start by automatically investing your spare change into the S&P 500 and, just like that, own a portion of some of the most profitable companies in the U.S.

3. Trust your instincts

Buffett has long distrusted tech, but he finally began investing in Apple in 2016. It’s now one of his top most valuable investments.

But last year, he offloaded some of Berkshire Hathaway’s Apple shares.

"That was probably a mistake,” he says of the move.

However, one sale Buffett doesn’t regret is dumping all of his airline shares. While he “doesn’t consider it a great moment in Berkshire’s history,” the company can boast it has more net worth than any other business in the U.S. — and the airlines were the better for it too.

“I think the airline business has done better because we sold and I wish them well but I still wouldn’t want to buy the airline business,” Buffett said.

Whatever your instincts are, if you don’t have enough cash to buy shares in a company (Apple is currently $132 per share), you can sign up for a free app that allows you to buy fractions of shares — meaning you can get a hold of the best companies the market has to offer, regardless of your budget.

4. The present doesn’t always dictate the future

There’s no telling for sure if what’s popular today will still matter tomorrow. And Buffett says that shouldn’t be your overall goal when it comes to investing anyway.

“There’s a lot more to picking stocks than figuring out what’s going to be a wonderful industry in the future,” said Buffett.

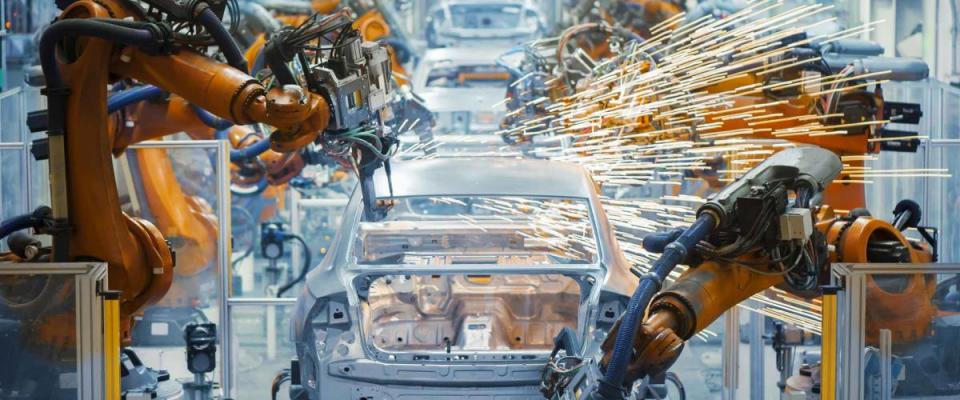

To illustrate his point, he put up a slide of all the auto companies from decades ago that started with the letter “M.” The list was so long it didn’t fit on a single slide.

That’s because when cars started to become commonplace in the 1900s, Buffett says about 2,000 businesses flooded the industry, expecting it would have “an amazing future.”

But by 2009, he notes there were three automakers left and two went into bankruptcy proceedings.

With that in mind, you don’t need to fixate on chasing the next big thing. You're just as likely to find success with more tried-and-true approaches, like investing in U.S. farmland, which for decades has delivered returns as good or better than the stock market's.

5. Don’t lose a certain amount of caution

With the rise of special purpose acquisition companies (SPACs) or “blank check companies”, designed to raise the funds to buy an existing company, Buffett is wary of rampant speculation taking place in the marketplace.

“The SPACs generally have to spend their money in two years, as I understand it. If you have to buy a business in two years, you put a gun to my head and said, ‘You’ve got to buy a business in two years,’ I’d buy one but it wouldn't be much of one,” he said.

He has a similar level of disdain for bitcoin, which he opted to dodge having to comment on during the meeting — despite the fact that he acknowledged how much he hates it when politicians do the same.

Buffett has also become more concerned about inflation, which has begun to accelerate lately, with increasing demand in certain areas of the supply chain.

His concern here likely stems from the fact that higher prices can cut into the value of future company profits: “We’re not going to have much luck on acquisitions while this sort of a period continues,” Buffett said.

In the meantime, don’t stop investing, just make sure you’re careful and strategic with your money, especially when all you can afford is to invest your spare change.