5 Money Experts for Gen Z To Follow Now

Like every other generation before it, Gen Z has a unique set of circumstances that continue to shape their response to the world. They grew up in the fast-paced age of the internet, with instant results and loads of information to sort from. When it comes to vital knowledge like how to handle personal finances, information flows endlessly.

See: GOBankingRates' Best Credit Cards for 2023

Find Out: Protect Your Financial Future With Gold and Silver

Find: States Whose Economies Are Failing vs. States Whose Economies Are Thriving

1. Taylor Price

After switching from pre-med to finance in college due to health complications, Taylor Price embarked on a journey of self discovery that would eventually impact more than just her own future. The 'get rich quick' schemes that litter the internet helped give her ideas on what she wanted to do with her major: become a reliable source of financial advice online for others her age.

Price began on TikTok with quick tips on topics ranging from investing with small amounts of money to getting a good credit score as early as 18 years old. Price's content blew up fast and she expanded to YouTube, where she has nearly 25,000 subscribers.

Price is currently working on building a class on her website Pricelesstay.com, aimed at giving ease of access to financial info that she feels everyone -- especially young people -- should know.

Take Our Poll: How Big of a Sign-Up Bonus Would It Take for You To Change Banks?

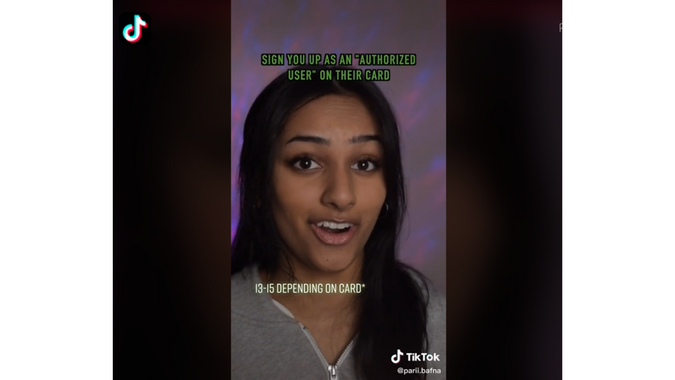

2. Parii Bafna

Parii Bafna's passion for personal finance started from a hunger for vital knowledge that she felt wasn't accessible to her and her peers. She got on TikTok to become a source of that knowledge. Eventually, she created a YouTube channel where she expanded her advice to longer segments. Bafna now also has her own blog where followers can get in contact with her directly via text message or email and ask her any burning financial questions they may have.

Bafna believes that awareness of where our money goes is the best way to wealth and health. In other words, we feel more at peace when our budget reflects the needs of our personal life. And she wants her audiences to create and maintain budgets that meet their needs and helps them grow to be the best versions of themselves.

Bafna's content is full of tips on how to achieve this, delivered with an entertaining twist!

3. John Liang

Despite the fact that he isn't part of Gen Z, John Liang has still made a name for himself among Gen Z audiences. His way of reaching out to the world is through his various accounts on platforms including TikTok, YouTube and Instagram.

Liang is all about exposing "life's personal financial cheat codes" to make personal finance feel like a cinch at a glance. An example of this are his segments on understanding the benefits of certain credit cards and using them in outside-of-the-box ways to save on things like travel.

His resources also include clever advice on and explanations of contemporary financial occurrences such as shrinkflation, making complicated issues much more easy to digest for people who are unfamiliar with the financial world.

4. Tori Dunlap

Dunlap was first moved to take control of her finances at the age of 9, when she bought and operated her own candy vending machine -- she had multiple of by the time she was 16. By then she was also already saving up money to attend college. Dunlap saw the financial inequality between men and women in the workplace and the world at large and let that motivate her to empower and educate women and men alike.

Dunlap is now a financial coach who does motivational/educational speaking about her journey to making $100,000 by 25 years old. She has her own podcast and has also made appearances on CNN and BBC (among other networks) all due to her expertise on financial success and what it takes to achieve it.

5. Queenie Tan

Queenie Tan's angle on personal finance and investing is to simplify it for the sake of a more stress-free life for the younger generations. Her content is full of advice on how to invest wisely and save money through certain apps and resources while not taking the joy out of life.

On top of having a well-established presence on TikTok and Instagram, Tan also runs a podcast with her partner Pablo. They break down important topics like how to buy your first home or manage money with your romantic partner successfully, or even tips on how to negotiate for a higher salary at your current job.

The key to their content is not only making money management and investing more digestible, but also a more stress-free activity for everyone.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: 5 Money Experts for Gen Z To Follow Now