These 5 Profitable Companies Are Largely Undervalued

- By Tiziano Frateschi

According to the GuruFocus discounted cash flow calculator as of Jan. 15, the following companies have a high margin of safety and have grown their margins over a 10-year period.

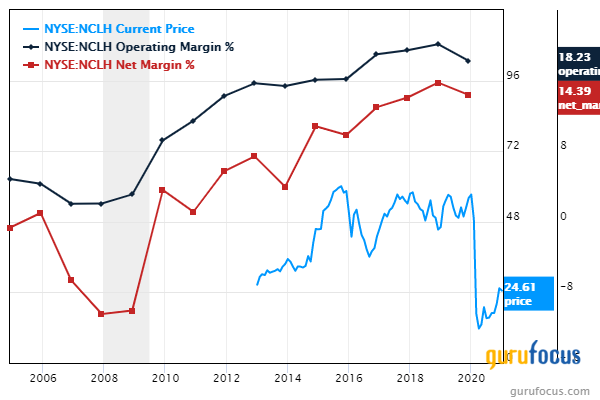

Norwegian Cruise Line

Norwegian Cruise Line Holdings Ltd.'s (NCLH) net margin and operating margin have grown by 10.33% and 16.13%, respectively, per annum over the past 10 years.

According to the DCF calculator, the stock is undervalued with a 106.30% margin of safety at $24.61 per share. The price-book ratio is 1.63. The share price has been as high as $59.78 and as low as $7.03 in the last 52 weeks; it is currently 58.83% below its 52-week high and 240.07% above its 52-week low.

The cruise company has a market cap of $7.77 billion and an enterprise value of $16.35 billion.

The company's largest guru shareholder is PRIMECAP Management (Trades, Portfolio) with 1.35% of outstanding shares, followed by John Rogers (Trades, Portfolio) with 0.35% and Steven Cohen (Trades, Portfolio)'s Point72 Asset Management with 0.21%.

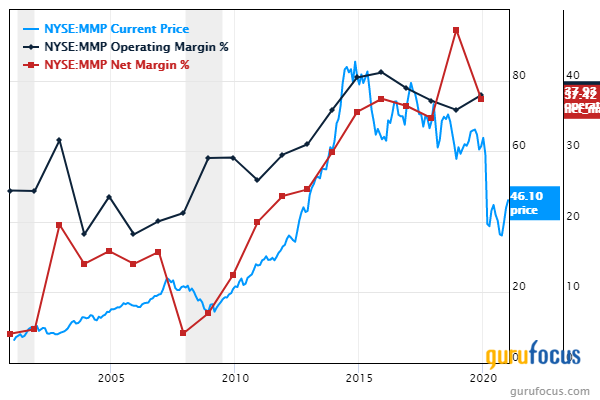

Magellan Midstream

The net margin of Magellan Midstream Partners LP (MMP) has grown 35.12% per annum over the past decade. The operating margin has grown 36.52% per annum over the past decade.

According to the DCF calculator, the stock is undervalued with a 47.79% margin of safety at $46.10 per share. The price-earnings ratio is 11.41. The share price has been as high as $65.34 and as low as $22.02 in the last 52 weeks; it is currently 29.45% below its 52-week high and 109.36% above its 52-week low.

The company, which operates oil pipelines and storage terminals in the Central and Eastern United States, has a market cap of $10.30 billion and an enterprise value of $15.34 billion.

With 0.09% of outstanding shares, Louis Moore Bacon (Trades, Portfolio) is the company's largest guru shareholder, followed by Pioneer Investments (Trades, Portfolio) with 0.06% and George Soros (Trades, Portfolio) with 0.04%.

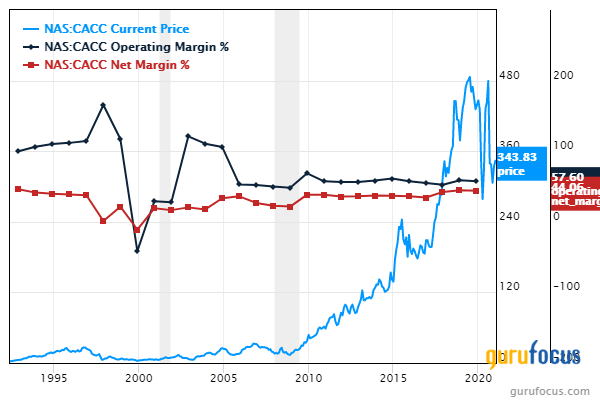

Credit Acceptance

Credit Acceptance Corp. (CACC) has grown its net margin and operating margin by 36.95% and 57.42%, respectively, per year over the past decade.

According to the DCF calculator, the stock is undervalued with a 47.37% margin of safety at $343.83 per share. The price-earnings ratio is 14.98. The share price has been as high as $539 and as low as $199 in the last 52 weeks; it is currently 36.21% below its 52-week high and 72.78% above its 52-week low.

The consumer finance company has a market cap of $6.07 billion and an enterprise value of $10.68 billion.

The company's largest guru shareholder is Ruane Cunniff (Trades, Portfolio) with 7.32% of outstanding shares, followed by Glenn Greenberg (Trades, Portfolio) with 0.80% and Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.46%.

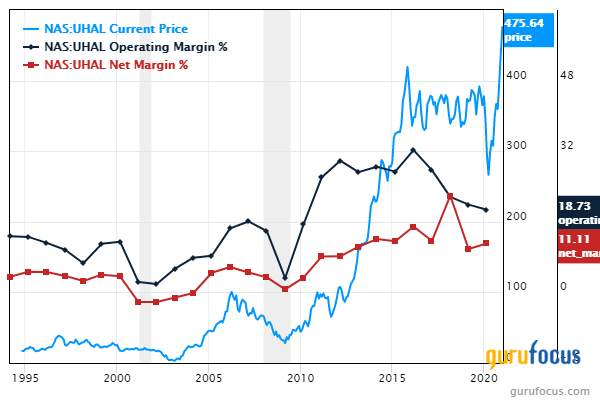

Amerco

The net margin of Amerco Inc. (UHAL) has grown 11.36% per annum over the past decade. The operating margin has grown 27.31% annually over the same period.

According to the DCF calculator, the stock is undervalued with a 30.08% margin of safety at $475 per share. The price-earnings ratio is 18.39. The share price has been as high as $487 and as low as $222 in the last 52 weeks; it is currently 2.40% below its 52-week high and 113.92% above its 52-week low.

The U.S. company, which provides rental trucks to household movers, has a market cap of $9.33 billion and an enterprise value of $12.91 billion.

The company's largest guru shareholder is David Abrams (Trades, Portfolio) with 2.86% of outstanding shares, followed by Yacktman Asset Management (Trades, Portfolio) with 1.30% and Barrow, Hanley, Mewhinney & Strauss with 1.18%.

China Mobile

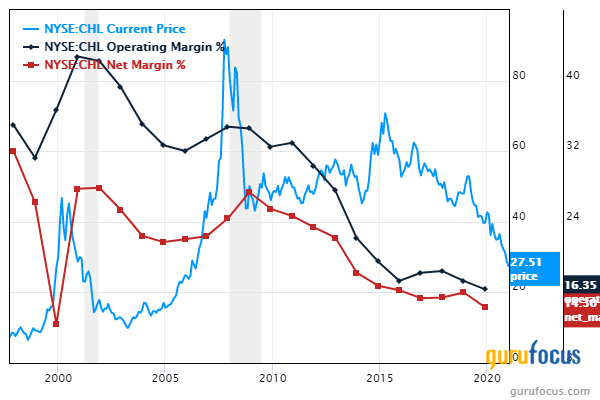

China Mobile Ltd.'s (CHL) net margin and operating margin have grown 16.50% and 18.97%, respectively, per year over the past 10 years.

The price-earnings ratio is 8.43. The share price has been as high as $44.93 and as low as $25.35 in the last 52 weeks; it is currently 38.77% below its 52-week high and 8.52% above its 52-week low.

The Chinese telecom operator has a market cap of $112.66 billion and an enterprise value of $55.98 billion.

With 0.25% of outstanding shares, Renaissance Technologies is the company's largest guru shareholder, followed by Sarah Ketterer (Trades, Portfolio) with 0.22% and Charles Brandes (Trades, Portfolio) with 0.01%.

Disclosure: I do not own any stocks mentioned.

Read more here:

5 Health Care Stocks Gurus Are Buying

5 Banks Trading With Low Price-Earnings Ratios

5 Tech Companies Trading With Low Price-Sales Ratios

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.