5 Profitable Stocks With a Margin of Safety

- By Tiziano Frateschi

According to the GuruFocus discounted cash flow calculator as of April 21, the following companies have a high margin of safety and have grown their margins over a 10-year period.

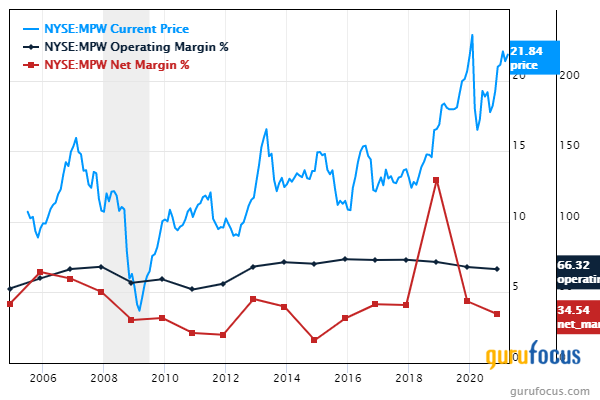

Medical Properties Trust

Medical Properties Trust Inc.'s (MPW) net margin and operating margin have grown by 40.56% and 70.79% per annum, respectively, over the past 10 years.

According to the DCF calculator, the stock is undervalued with a 35.99% margin of safety at $21.83 per share. The price-earnings ratio is 26.96. The share price has been as high as $22.75 and as low as $15.25 in the last 52 weeks; it is currently 4% below its 52-week high and 43.21% above its 52-week low.

The healthcare facility REIT has a market cap of $12.64 billion and an enterprise value of $21.13 billion.

The company's largest guru shareholder is Pioneer Investments (Trades, Portfolio) with 0.11% of outstanding shares.

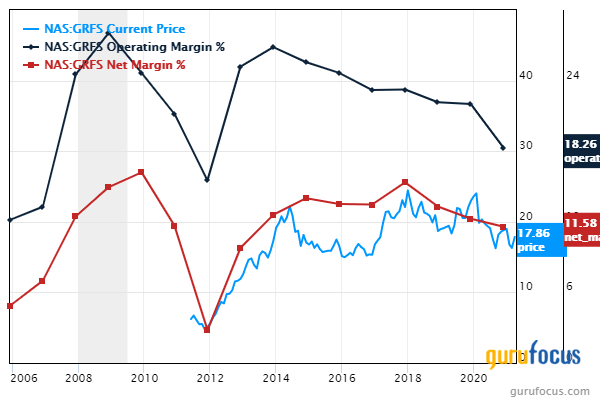

Getty Realty

The net margin of Grifols SA (GRFS) has grown 12.95% per annum over the past decade. The operating margin has grown 23.22% per annum over the same period.

According to the DCF calculator, the stock is undervalued with a 28.22% margin of safety at $17.86 per share. The price-earnings ratio is 26.18. The share price has been as high as $21.88 and as low as $14.81 in the last 52 weeks; it is currently 18.37% below its 52-week high and 20.59% above its 52-week low.

The integrated plasma derivative producer has a market cap of $12.19 billion and an enterprise value of $21.68 billion.

With 0.49% of outstanding shares, BAILLIE GIFFORD & CO is the company's largest guru shareholder, followed by Charles Brandes (Trades, Portfolio) with 0.10% and Mario Gabelli (Trades, Portfolio) with 0.01%.

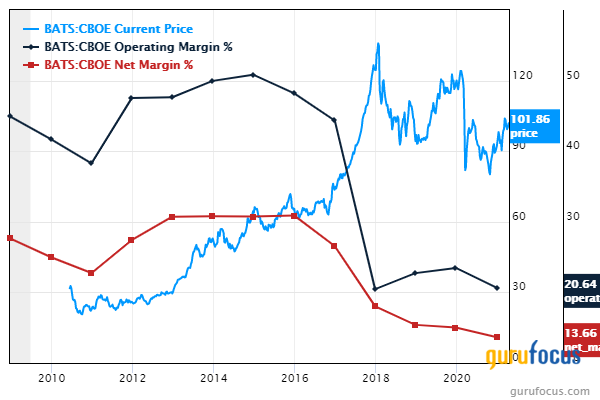

Cboe Global Markets

Cboe Global Markets Inc. (CBOE) has grown its net margin and operating margin by 27% and 45.95%, respectively, per year over the past decade.

According to the DCF calculator, the stock is undervalued with a 9.42% margin of safety at $101.86 per share. The price-earnings ratio is 23.84. The share price has been as high as $107.11 and as low as $77.63 in the last 52 weeks; it is currently 4.91% below its 52-week high and 31.21% above its 52-week low.

The company, which operates in the Capital Markets industry, has a market cap of $10.91 billion and an enterprise value of $11.91 billion.

The company's largest guru shareholder is Jim Simons (Trades, Portfolio)' Renaissance Technologies firm with 2.86%% of outstanding shares, followed by Stahl with 0.41% and Pioneer Investments (Trades, Portfolio) with 0.17%.

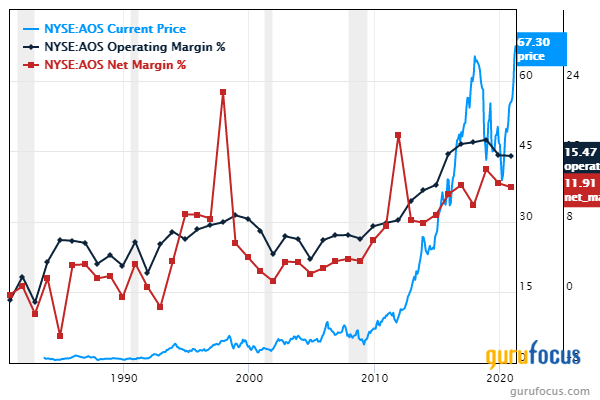

A.O. Smith

The net margin of A.O. Smith Corp. (AOS) has grown 11.53% per annum over the past decade. The operating margin has grown 15.51% annually over the same period.

According to the DCF calculator, the stock is undervalued with a 12.07% margin of safety at $74.37 per share. The price-earnings ratio is 14.50. The share price has been as high as $82.38 and as low as $54.68 in the last 52 weeks; it is currently 9.72% below its 52-week high and 36.01% above its 52-week low.

The company, which manufactures residential and commercial gas, gas tankless and electric water heaters, has a market cap of $10.87 billion and an enterprise value of $10.33 billion.

The company's largest guru shareholder is Pioneer Investments (Trades, Portfolio) with 0.11% of outstanding shares, followed by Gabelli with 0.05%, Joel Greenblatt (Trades, Portfolio) with 0.02% and Lee Ainslie (Trades, Portfolio)'s Maverick Capital with 0.01%.

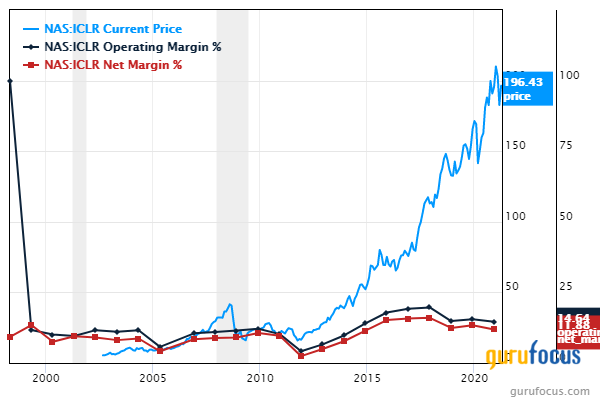

Icon PLC

Icon PLC's (ICLR) net margin and operating margin have grown 12.16% and 14.75%, respectively, per year over the past 10 years.

According to the DCF calculator, the stock is undervalued with a 24.05% margin of safety at $196.43 per share. The price-earnings ratio is 31.99. The share price has been as high as $223.62 and as low as $135 in the last 52 weeks; it is currently 12.16% below its 52-week high and 45.50% above its 52-week low.

The company, which provides drug development and clinical trial services, has a market cap of $10.37 billion and an enterprise value of $2.96

With 4.43% of outstanding shares, Simons' firm the company's largest guru shareholder, followed by Ron Baron (Trades, Portfolio) with 1.19% and the Invesco European Growth Fund (Trades, Portfolio) with 0.19%.

Disclosure: I do not own any stocks mentioned.

Read more here:

5 Stocks Trading Below Peter Lynch Value

5 Banks Trading With Low Price-Sales Ratios

5 Utilities Beating the Market

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.