5 Reasons Why Warren Buffett Is Investing in Banks

Warren Buffett (Trades, Portfolio), arguably the most successful investor the world has ever seen, has many investors and analysts following him in an attempt to gauge future market directions.

According to GuruFocus data, the guru's current portfolio has a weighting of 47.18% for the financial services sector, which is a clear indication of his bullishness on this business segment. His exposure to this sector has grown from 32% in 2017 to 47.18% in 2019, signaling that Buffett has continued to invest in banks over the last couple of years.

What is more interesting is that Buffett is still willing to purchase banking stocks even after the Federal Reserve decided to cut the interest rates twice in the last three months. Bloomberg reported on Tuesday that Berkshire Hathaway (NYSE:BRK.A)(NYSE:BRK.B) is seeking approval from the U.S. central bank to boost its stake in Bank of America (NYSE:BAC) beyond the threshold of 10%.

This is a noteworthy development, especially considering the common belief that net interest margins compress when policy rates decline. Here are five possible reasons as to why Buffett is loading up on bank stocks.

Financial services sector stocks are the cheapest in the market

Value investors search for undervalued opportunities, and there is no difference when it comes to Buffett as well. As of Wednesday, the financial services sector is the cheapest in the S&P 500 from an earnings multiple perspective.

Source: GuruFocus

The relatively low earnings multiple suggests many investors are not optimistic about the prospects for this sector. This is precisely the type of scenario in which Buffett thrives; after all, he has a reputation for investing in unpopular companies and industries. This strategy has helped him generate better returns than the market for decades.

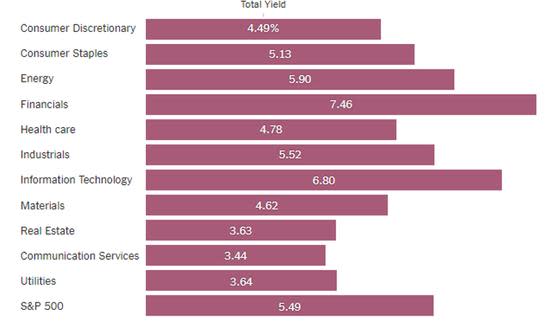

The total yield of over 7%

Buffett has historically taken a liking to companies that distribute wealth to its shareholders by way of dividends or share repurchases. Even though Berkshire Hathaway has never paid a dividend, according to company filings, billions of dollars have been spent on share buybacks.

As of last September, the financial services sector had the highest total yield (combined yield of dividends and buybacks) among all U.S. sectors.

Source: The New York Times

This high yield might be one of the reasons why Buffett is bullish on the prospects of banks, a theory that is supported by his comments in the 2016 annual letter to Berkshire Hathaway shareholders.

"Many of our investees, including Bank of America, have been repurchasing shares, some quite aggressively. We very much like this behavior because we believe the repurchased shares have in most cases been underpriced (undervaluation, after all, is why we own these positions). When a company grows and outstanding shares shrink, good things happen for shareholders."

Buffett is not concerned about the imminent U.S. recession

Banks perform poorly during recessionary periods for many reasons. First, interest rates decline when a recession occurs, which inevitably results in a decline in profits as net interest margins compress. Second, consumers become reluctant to take loans and other forms of credit due to the uncertainty of their income levels. This results in low credit growth, which is an obstacle for banks to grow their earnings. Finally, business investments decline significantly during recessionary periods due to a lack of attractive prospects for companies. Banks suffer from low growth of capital expenditures and investments of corporations as the demand for credit facilities decline. All these factors were behind the underperformance of the banking sector (as measured by the KBW Bank Index, which consists of 24 leading national and regional banks) in the last 12 months, in comparison to the S&P 500 Index.

However, while the general investing public and Wall Street analysts have been wary of investing in banks, Buffett's view has been a complete contrast, one of the reasons for this being that the guru is not worried about a U.S. recession. His focus is entirely fixed on the long term, which is apparent from the comments made in the 2018 annual letter to shareholders.

"Our country's almost unbelievable prosperity has been gained in a bipartisan manner. Today, the Federal Reserve estimates our household wealth at $108 trillion, an amount almost impossible to comprehend. Americans will be both more prosperous and safer if all nations thrive. Over the next 77 years, however, the major source of our gains will almost certainly be provided by The American Tailwind. We are lucky - gloriously lucky - to have that force in our back."

The resilience of U.S. banks

On Tuesday, a few major banks reported financial results for the third quarter of this year. While the expectations were bleak because of the recent rate cuts, the results were promising and showed no signs of a significant slowdown in earnings.

Company | Comments |

JPMorgan Chase | The bank reported net earnings of $9.08 billion for the third quarter, in comparison to $8.38 billion in the corresponding quarter last year. The reported earnings per share of $2.68 was higher than the consensus estimate of $2.45. |

Citigroup | Citigroup reported net income of $4.9 billion for the third quarter, a 6% gain from the $4.6 billion of earnings for the same quarter last year. The earnings per share of $2.07 beat the analyst estimates of $1.95. |

Wells Fargo | Net interest income fell 7.5%, but loans and deposits grew 1.3% and 1.9%, respectively, which is a sign of increased business activities. The allocation of $1.6 billion for legal expenses was a drag on earnings. |

Source: Company filings

The return on average assets for U.S. banks reached one of their worst points during the financial crisis. However, the recovery has been remarkable, supported by both strict regulations on lending and quantitative easing.

Source: Federal Reserve Bank of St. Louis

Even though the interest rate environment is not supportive of margin expansion in the short term, U.S. banks are in an excellent position to deliver attractive long-term returns. The third-quarter results of major banks are proof of this.

The resilience of large banks to severe economic conditions might be one of the reasons why Buffett is bullish on this sector.

Banks are in much better shape than they were before the financial crisis

Since the financial crisis, cash and reserve holdings of banks have grown at a much higher rate than loans, which has resulted in a decrease in the liquidity stress ratio. Policymakers have also been keen to push banks to hold more liquid assets in a bid to safeguard the banking system from the next recession.

Source: Liberty Street Economics

Investors' fears of another collapse of banks in the next downturn are likely overblown, which is something Buffett might have already figured out. This has led to billion-dollar investments in banks over the last decade.

Takeaway for investors

Financial services sector stocks, including the big banks, are considerably cheaper than many other companies in the market today. However, the pessimism toward the banking sector arising from historical performance during recessions is keeping investors on the sidelines, with the exception of Buffett. There are reasons to believe this sector will provide stable returns over the long term. Investors can take a cue from the investment wizard and seek opportunities in bank stocks.

Disclosure: I do not own any stocks mentioned in this article.

Read more here:

Synchrony Financial: A Warren Buffett Holding Trading at a Discount

STORE Capital: The Fastest-Growing Company in Warren Buffett's Portfolio

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.