5 Residential Construction Companies Gurus Agree on

In light of homebuilding sentiment reaching a year-to-date high, five residential construction companies most broadly held by gurus according to the Aggregated Portfolio are Lennar Corp. (NYSE:LEN), D.R. Horton Inc. (NYSE:DHI), PulteGroup Inc. (NYSE:PHM), NVR Inc. (NYSE:NVR) and Meritage Homes Corp. (NYSE:MTH).

Housing Market Index reaches year-to-date high, but concerns remain

The National Association of Home Builders / Wells Fargo Inc. (NYSE:WFC) Housing Market Index reached 68 for September, up 1 point from the September 2018 reading of 67 and the highest reading for the year so far. The Housing Market Index considers three components: current sales conditions, traffic of prospective buyers and sales expectations. The NAHB calculates a seasonally-adjusted index using scores for each of the three components. Scores above 50 suggest overall good sentiment, while scores below 50 suggest overall poor sentiment.

NAHB Chairman Greg Ugalde, a homebuilder and developer from Torrington, Connecticut, said low interest rates and solid demand continue fueling builder sentiment despite headwinds stemming from "ongoing supply-side challenges." However, NAHB Chief Economist Robert Dietz added that the ongoing trade dispute between the U.S. and China increased concern among builders: The NAHB Home Building Geography Index indicates that a slowdown in the manufacturing sector contributed to a deceleration in home construction in certain areas despite growth in rural and exurban areas.

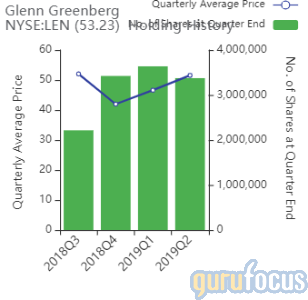

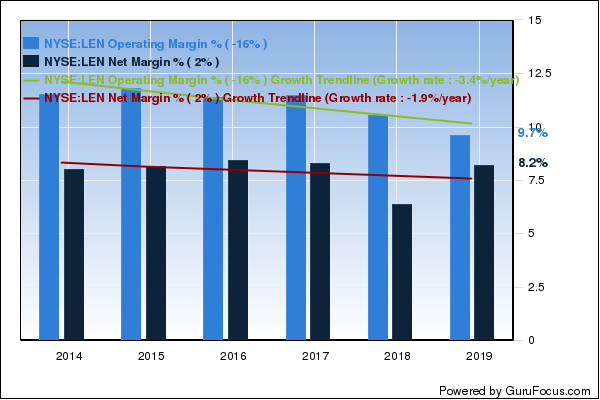

Lennar

Fourteen gurus own shares of Lennar with a combined weight of 20.50%. Gurus with large holdings of the company include Glenn Greenberg (Trades, Portfolio) and Ken Fisher (Trades, Portfolio).

The Miami-based homebuilder targets first-time, move-up and active adult homebuyers under the Lennar brand name. According to GuruFocus, Lennar's operating margins are outperforming 67.44% of global competitors despite contracting approximately 3.4% per year on average over the past five years.

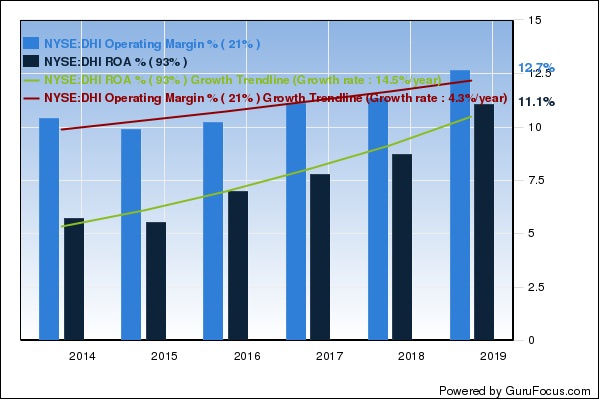

D.R. Horton

Twelve gurus own shares of D.R. Horton with a combined weight of 9.71%. Gurus with large holdings of the stock include Steve Mandel (Trades, Portfolio)'s Lone Pine Capital and George Soros (Trades, Portfolio)' Soros Fund Management.

The Arlington, Texas-based company offers single-family detached homes in 78 markets across 26 states. GuruFocus ranks D.R. Horton's financial strength 6.2 out of 10 and profitability 8 out of 10 on several positive indicators, which include a strong Altman Z-score of 5.13, expanding operating margins and a return on assets that outperforms 85.97% of global competitors.

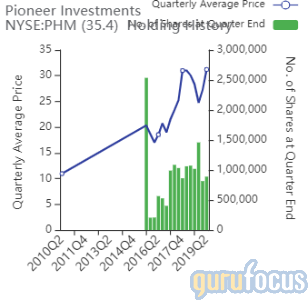

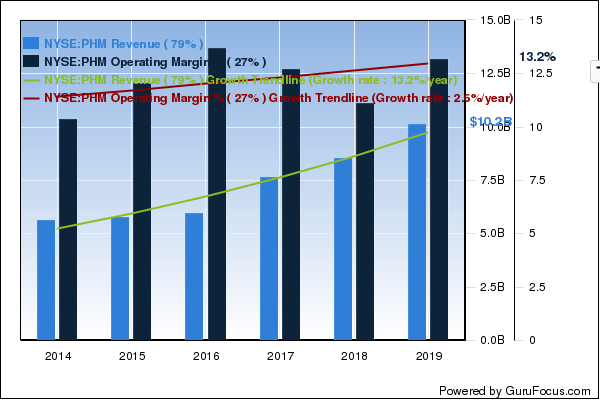

PulteGroup

Ten gurus own shares of PulteGroup with a combined weight of 2.39%.

The Atlanta-based homebuilder operates in 47 markets across 25 states. GuruFocus ranks PulteGroup's profitability 9 out of 10 on several positive investing signs, which include expanding profit margins, a strong Piotroski F-score of 8 and a three-year revenue growth rate that outperforms 86.70% of global competitors.

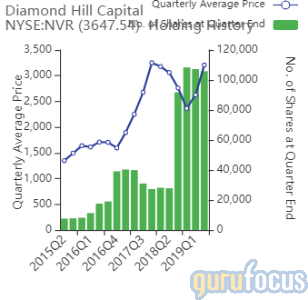

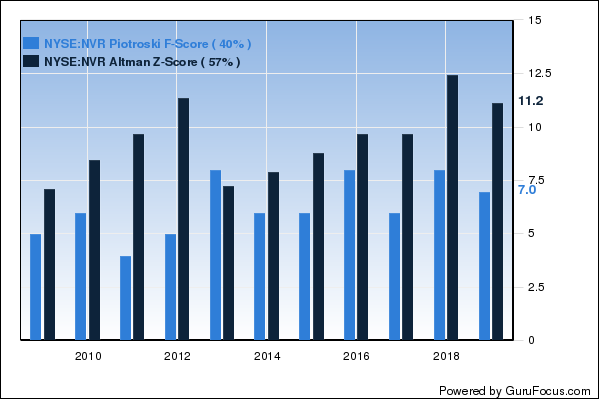

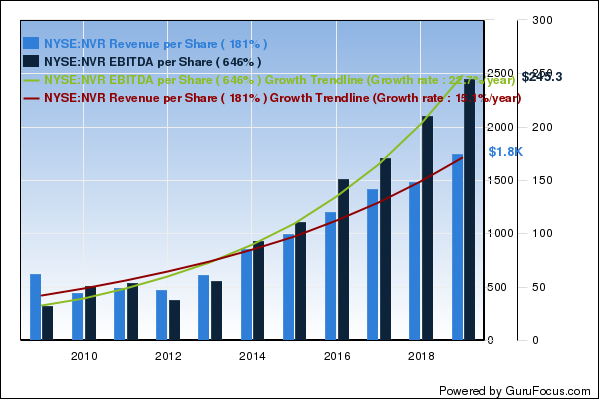

NVR

Nine gurus own shares of NVR with a combined weight of 13.33%.

The Reston, Virginia-based homebuilder operates in 28 metro areas in 14 states east of the Mississippi River. GuruFocus ranks NVR's financial strength and profitability 8 out of 10 on several positive signs, which include a strong Piotroski F-score of 7, a robust Altman Z-score of 12.05 and returns that are outperforming over 96% of global competitors.

NVR's business predictability ranks four stars on consistent revenue and earnings growth over the past 10 years.

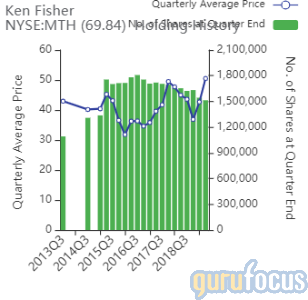

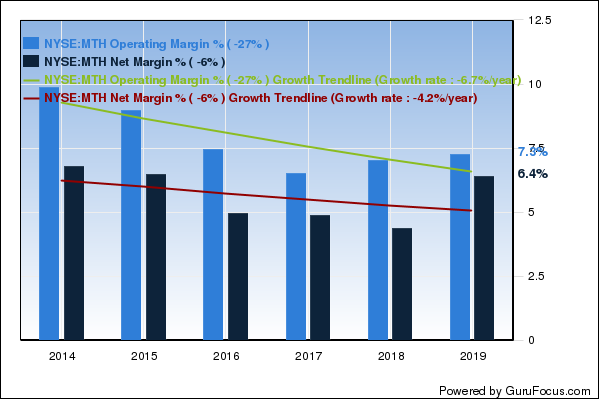

Meritage

Seven gurus own shares of Meritage with a combined weight of 3.24%.

The Scottsdale, Arizona-based homebuilder operates primarily in the western, southern and southeastern parts of the U.S. GuruFocus ranks the company's profitability 8 out of 10: Operating margins are near a 10-year high of 9.94% despite underperforming 50.67% of global competitors. Additionally, Meritage has a strong Piotroski F-score of 8.

Disclosure: No positions.

Read more here:

5 Good Stocks to Consider Ahead of Fall 2019

4 Airline Stocks to Consider as Oil Prices Spike 15%

5 Greenblatt Magic Formula Stocks in Basic Materials

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.