5 Stocks With High Business Predictability Ratings

- By Tiziano Frateschi

According to the GuruFocus All-in-One Screener, the following companies have high business predictability ratings and a wide margin of safety.

Novo Nordisk A/S (NVO)

The company has a 4.5 out of five-star business predictability rank and, according to the discounted cash flow calculator, a 33% margin of safety at $48 per share.

The pharmaceutical company has a market cap of $113.45 billion. Over the last five years, its revenue has grown 10.8% and earnings per share have grown 15.80%.

The stock has fallen 17% over the last 12 months and is currently trading with a price-earnings ratio of 19.71. The share price has been as high as $58.37 and as low as $41.23 in the last 52 weeks. As of Monday, it was 17.68% below its 52-week high and 16.54% above its 52-week low.

The company's largest guru shareholder is Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.82% of outstanding shares, followed by Ken Fisher (Trades, Portfolio) with 0.57% and Tom Gayner (Trades, Portfolio) with 0.04%.

BlackRock Inc. (BLK)

The company has a 4.5-star business predictability rank and, according to the DCF calculator, a 31% margin of safety at $415 per share.

The investment management company has a market cap of $66.56 billion. Over the last five years, its revenue has grown 6.80% and its earnings per share have grown 13.10%.

The stock has tumbled 29% over the last 12 months and is currently trading with a price-earnings ratio of 15.76 and a price-book ratio of 2.07. The share price has been as high as $594.52 and as low as $360.79 in the last 52 weeks. As of Monday, it was 29.45% below its 52-week high and 16.26% above its 52-week low.

With 0.15% of outstanding shares, Pioneer Investments (Trades, Portfolio) is the company's largest guru shareholder, followed by the Simons' firm with 0.14% and Gayner with 0.12%.

Churchill Downs Inc. (CHDN)

The company has a 4.5-star business predictability rank and, according to the DCF calculator, a 26% margin of safety at $262 per share.

The gambling company has a $3.63 billion market cap. Over the last five years, its revenue has grown 10.60% and its earnings per share have grown 20.20%.

The stock has risen 5% over the last 12 months; it is currently trading with a price-earnings ratio of 10.02 and a price-book ratio of 7.06. The share price has been as high as $314.60 and as low as $223.73 in the last 52 weeks. It is currently 15.09% below its 52-week high and 19.40% above its 52-week low.

With 0.86% of outstanding shares, Mario Gabelli (Trades, Portfolio) is the company's largest guru shareholder, followed by the Simons' firm with 0.52%, Lee Ainslie (Trades, Portfolio) with 0.11% and Joel Greenblatt (Trades, Portfolio) with 0.06%.

Grand Canyon Education Inc. (LOPE)

The company has a three-star business predictability rank and, according to the DCF calculator, a 28% margin of safety at $92.5 per share.

The American for-profit education company has a $4.5 billion market cap. Over the last five years, its revenue has grown 12.40% and its earnings per share have risen 21.20%.

The stock price was stable over the last 12 months; it is currently trading with a price-earnings ratio of 20.34. The share price has been as high as $130.10 and as low as $85.14 in the last 52 weeks. It is currently 28.13% below its 52-week high and 9.82% above its 52-week low.

The company's largest guru shareholder is Simons' firm with 2.18% of outstanding shares, followed by Pioneer Investments with 0.31%, Paul Tudor Jones (Trades, Portfolio) with 0.03% and Jeremy Grantham (Trades, Portfolio) with 0.03%.

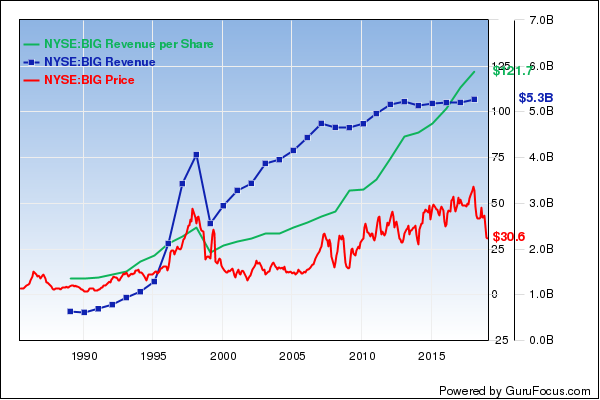

Big Lots Inc. (BIG)

The company has a four-star business predictability rank and, according to the DCF calculator, a 29% margin of safety at $32.5 per share.

The company, which operates discount retail stores, has a market cap of $1.28 billion. Over the last five years, its revenue has grown 7.60% and its earnings per share have increased 8%.

The stock has fallen 49% over the last 12 months; it is currently trading with a price-earnings ratio of 8.86 and a price-book ratio of 2.15. The price has been as high as $64.42 and as low as $26.21 in the last 52 weeks. It is currently 50.51% below its 52-week high and 21.63% above its 52-week low.

With 4.02% of outstanding shares, Richard Snow (Trades, Portfolio) is the company's largest guru shareholder, followed by Ainslie with 1.84%.

Disclosure: I do not own any stocks mentioned.

Read more here:

6 Undervalued Companies Growing Earnings

5 Energy Stocks in Gurus' Portfolios

6 Gurus' Stocks That Are Underperforming Portfolios

This article first appeared on GuruFocus.