5 tax breaks Trump took advantage of that the average American can't

REUTERS/Jonathan Ernst

President Trump has engaged in several tax avoidance strategies popular with the ultrawealthy, including writing off business losses and reclassifying residences, last weekend's New York Times investigation into his tax returns revealed.

The President filed a $70,000 tax deduction for his hairstyling during his time on 'The Apprentice,' listing it as a business expense.

Trump also lists his Mar-a-Lago club as his official residence, allowing him to write off its luxuries as business expenses.

Some of these write-offs, such as business losses, can be filed by the average person but likely not to the same extent as President Trump's.

Donald Trump, America's first billionaire president, paid little to nothing in federal taxes over the past decade by employing a variety of creative accounting methods, according to an explosive account of his tax returns by The New York Times.

Trump denied The Times' report in tweets Monday without specifically addressing its claims. He tweeted that he "paid many millions of dollars in taxes but was entitled, like everyone else, to depreciation & tax credits." While many such strategies around tax credits and depreciation are technically available to the average American, the ones the president took advantage of to lower his federal income tax bill $750 in two separate years require vast resources.

The president used his multimillion-dollar losses from his businesses to cancel out taxes on his actual income, and used his luxury properties' status as businesses to deduct his everyday luxuries. In other words, if you ran a business that could double as a "winter White House" in southern Florida, you could deduct a lot from your taxes, too.

The president has paid less in taxes than the average ultrawealthy person. At the effective tax rate of the top 1% of Americans, Trump would have paid $100 million, per the Times. Over time, there's been evidence of increasing divergence in tax payments between the ultrawealthy and most Americans — in 2018, billionaires paid a smaller portion of their income in taxes than average Americans for the first time in history.

Keep reading to learn more about the techniques President Trump and his organization used to avoid paying taxes that most average Americans basically can't.

Trump's businesses lost millions, and he used the losses like a "tax avoidance coupon," The New York Times reported.

Associated Press

Filing such losses was the main way Trump avoids paying his federal income taxes, according to The New York Times. For each of the millions of dollars Trump listed as losses from his various business, he was entitled to another dollar off a different section of his tax bill.

Using the tax breaks from his losses, Trump was able to avoid paying income tax on $600 million he made from his television show "The Apprentice" and from other investments, per the Times. That income was then used to keep Trump's businesses afloat despite their losses.

Some years, Trump even recorded such large losses at his various properties that they surpassed the legal max of what can be filed in a single year and rolled them over to future years, or to get a refund on taxes previously paid, per the Times.

Trump also got tax credits for making new business investments.

Reuters

Trump also took advantage of further tax credits designed to boost local communities. For instance, while renovating Washington DC's Old Post Office Hotel into Trump International Hotel in 2016, Trump claimed a historic preservation tax break, the Times reported.

Trump filed more than $9.7 million in various business investment credits, per the Times.

Trump also paid relatives robust consulting fees to help reduce his taxable profits.

Photo by Sarah Silbiger/Getty Images

Trump deducted $28 million in "consulting fees" from his tax bill between 2010 and 2018, the Times reported.

The Times reported that many of these consultants were Trump family members classified as consultants so their fees could be deducted as business expenses, even if they were already employees of The Trump Organization. Though the tax returns did not list the names of the consultants, at least one of the amounts matches a payment Ivanka Trump reported on her financial disclosures.

Trump's official residence is one of his businesses, The Mar-a-Lago Club, and its luxuries are therefore tax-deductible.

Reuters

Trump filed a business expense tax deduction for several Mar-a-Lago extravagances, including $109,433 for linens and silverware, $197,829 for landscaping in 2017 alone, and $210,000 for an event photographer, per the Times.

Separate from Mar-a-Lago, Trump also wrote off all the expenses tied to his private plane and $70,000 for hairstyling during his time on "The Apprentice" as business expenses, too, the Times reported.

Trump also creatively designated some of his other properties to get even more benefits.

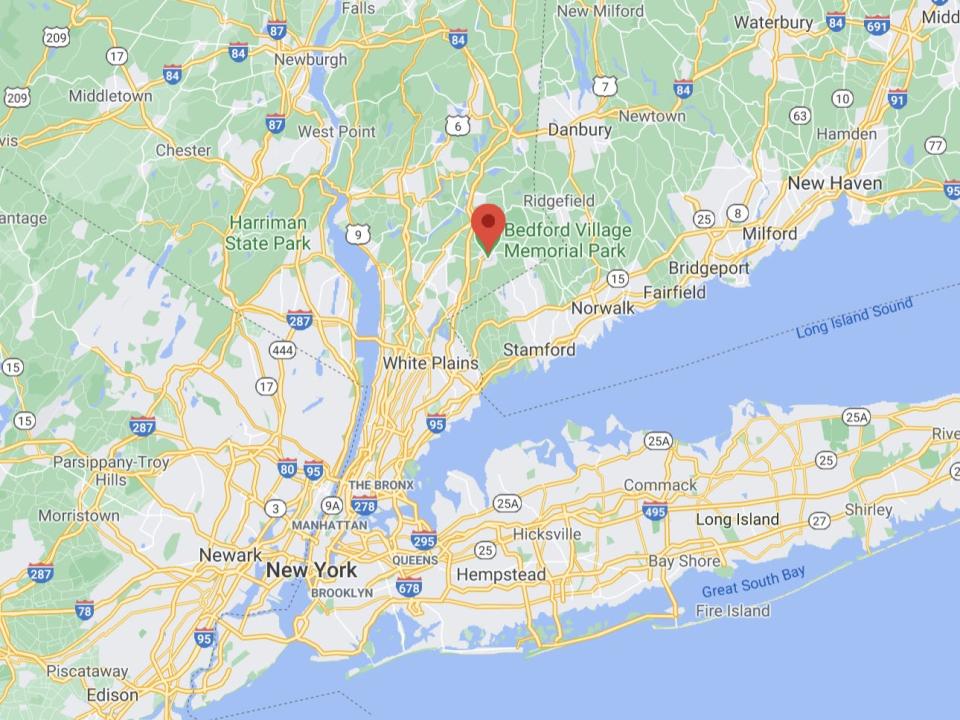

Google Maps

For the president's 230-acre Seven Springs estate in Westchester County, New York, he claimed two different types of tax benefits, The Times reported.

Firstly, it is classified as an investment property, allowing its real estate taxes to be written off as business expenses. However, that classification necessitates that Trump works to profit from the estate, a requirement seemingly at odds with its description as "a retreat for the Trump family" on The Trump Organization's website.

Secondly, Trump landed a $21.1 million charitable tax deduction by signing a land conversation deal for the property's nature preserves.

The Trump National Golf Club in Los Angeles also benefits from a conservation easement deduction, per the Times.

Read the original article on Business Insider