5 Tech Stocks Trading With Low Price-Earnings Ratios

- By

As of June 23, the GuruFocus All-in-One Screener, a Premium feature, found that the following guru-owned tech stocks have low price-earnings ratios. While some of them are great value investments, others may need to be researched more carefully, according to the discounted cash flow calculator.

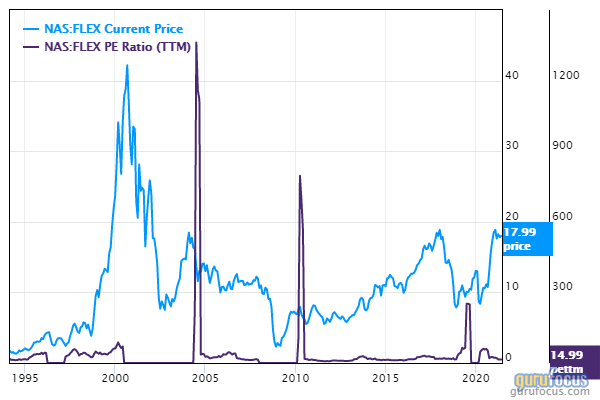

Flex

With a market cap of $8.83 billion, Flex Ltd. (FLEX) has a price-earnings ratio of 14.99 and a price-book ratio of 2.58. According to the DCF calculator, the stock has a fair value of $17.71 while trading at $17.99.

The stock price has risen 73.31% over the past 12 months and is now 10.23% below its 52-week high and 88.77% above its 52-week low.

The company, which provides product management services to global electronics and technology companies, has a GuruFocus profitability rating of 7 out of 10. The return on equity of 19.51% and return on assets of 4.21% are outperforming 57% of companies in the hardware industry. Its financial strength is rated 5 out of 10 with a cash-debt ratio of 0.61.

PRIMECAP Management (Trades, Portfolio) is the company's largest guru shareholder with 12.09% of outstanding shares, followed by Richard Pzena (Trades, Portfolio) with 1.57% and Stanley Druckenmiller (Trades, Portfolio) with 0.56%.

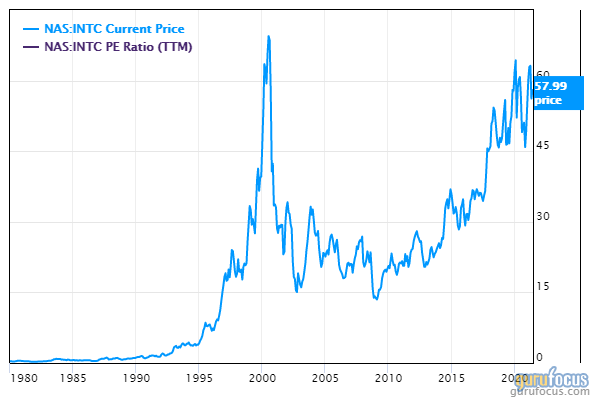

Intel

With a $234.15 billion market cap, Intel Corp. (INTC) is trading with a price-earnings ratio of 13.09 and a price-book ratio of 2.93. According to the DCF calculator, the stock has a fair value of $86.71 while trading at $57.99.

The share price has declined 1.26% over the past 12 months and is now 15.33% below the 52-week high and 32.97% above the 52-week low.

The chipmaker has a GuruFocus profitability rating of 9 out of 10. The return on equity of 23.62% and return on assets of 12.41% are outperforming 82% of companies in the semiconductors industry. Its financial strength is rated 6 out of 10 with a cash-debt ratio of 0.62.

PRIMECAP Management (Trades, Portfolio) is the company's largest guru shareholder with 0.85% of outstanding shares, followed by Ken Fisher (Trades, Portfolio) with 0.75% and Seth Klarman (Trades, Portfolio) with 0.58%.

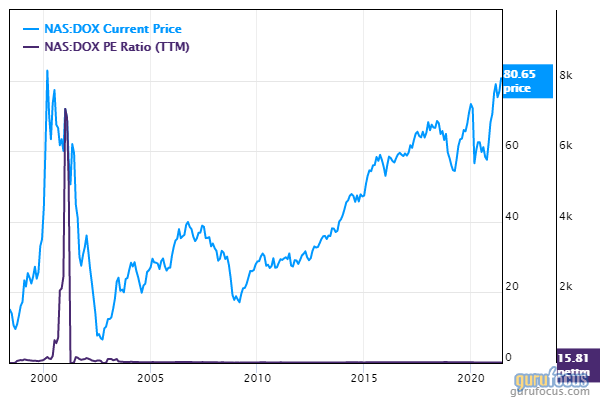

Amdocs

With a market cap of $10.30 billion, Amdocs Ltd. (DOX) is trading with a price-earnings ratio of 15.81 and a price-book ratio of 2.86. According to the DCF calculator, the stock has a fair value of $84.09 while trading at $80.65.

Shares have risen 30.60% over the past 12 months and are now 2.10% below the 52-week high and 47.49% above the 52-week low.

The company, which provides software and services to communications, cable and satellite, entertainment and media industry service providers, has a GuruFocus profitability rank of 8 out of 10. The return on equity of 18.35% and return on assets of 10.49% are outperforming 80% of companies in the software industry. Its financial strength is rated 7 out of 10 with a cash-debt ratio of 1.15.

Pzena is the company's largest guru shareholder with 3.42% of outstanding shares, followed by John Rogers (Trades, Portfolio) with 0.80% and Steven Cohen (Trades, Portfolio) with 0.70%.

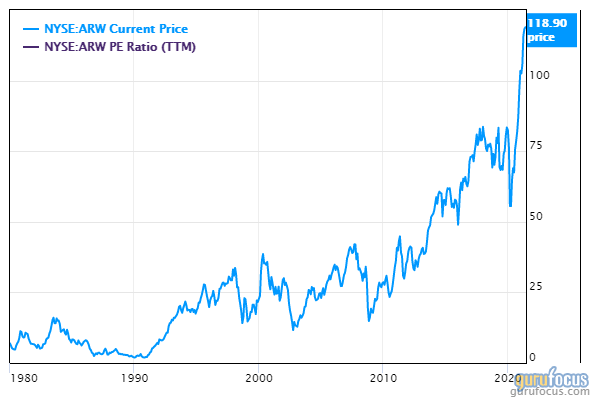

Arrow Electronics

Arrow Electronics Inc. (ARW) has a market cap of $8.77 billion and is trading with a price-earnings ratio of 12.37 and a price-book ratio of 1.71. According to the DCF calculator, the stock has a fair value of $141.84 while trading at $118.90.

Shares have climbed 78.61% over the past 12 months and are now trading 4.70% below the 52-week high and 86.80% above the 52-week low.

The company, which provides semiconductors, electronic components, software and enterprise infrastructure hardware, has a GuruFocus profitability rating of 7 out of 10. The return on equity of 15.24% and return on assets of 4.65% are outperforming 61% of competitors in the hardware industry.

The company's largest guru shareholder is HOTCHKIS & WILEY with 0.78% of outstanding shares, followed by Jeremy Grantham (Trades, Portfolio) with 0.33%.

Vontier

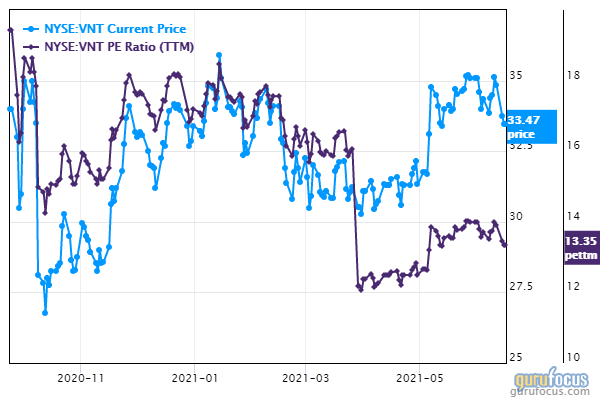

Vontier Corp. (VNT) has a market cap of $5.65 billion. Its shares are trading with a price-earnings ratio of 13.34 and a price-book ratio of 21.38. According to the DCF calculator, the stock has a fair value of $37.02 while trading at $33.47.

The share price was stable over the past 12 months and are currently 14.18% below the 52-week high and 26.96% above the 52-week low.

The industrial technology company has a GuruFocus profitability rating of 4 out of 10. The return on equity of 45.73% and return on assets of 15.17% are outperforming 94% of companies in the hardware industry. Its financial strength is rated 5 out of 10 with a cash-debt ratio of 0.33.

Chuck Royce (Trades, Portfolio) is the company's largest guru shareholder with 0.78% of outstanding shares, followed by Joel Greenblatt (Trades, Portfolio) with 0.05% and Paul Tudor Jones (Trades, Portfolio) with 0.03%.

This article first appeared on GuruFocus.