5 Top Apartment REITs You Can Buy Right Now

Investing in real estate investment trusts, or REITs, can be an excellent way to achieve a combination of growth and income in your portfolio without taking on excessive risk. While there are a variety of commercial real estate types that REITs own, apartment REITs look especially well-positioned to benefit over the coming years as the millennial generation comes of age and home ownership has become increasingly unaffordable for millions.

With that in mind, here's a primer on REITs and five excellent apartment REITs you may want to take a closer look at.

Image source: Getty Images.

What is a REIT?

A REIT (pronounced "reet") is a unique type of investment vehicle that pools investors' money to buy real estate assets, similar to how a mutual fund pools investors' money to buy stocks or bonds.

To qualify as a REIT, a company needs to meet certain requirements. It must invest at least 75% of its assets in real estate investments and must pay out at least 90% of its taxable income to its shareholders, among other criteria. If it does meet all of the requirements, a REIT enjoys a pretty nice tax advantage, which I'll get into in the next section.

REITs come in two main varieties: Equity REITs primarily invest in commercial properties, while mortgage REITs invest in mortgages and related assets. Generally, the term "REIT" refers to equity REITs unless otherwise specified. In fact, mortgage REITs are so different as investments that they aren't even classified in the real estate sector. So, for the rest of this discussion, you can assume that I'm referring to equity REITs.

The idea of a REIT is to allow investors to put their money to work in assets that would otherwise be impractical or impossible to buy. For example, most people reading this wouldn't be able to buy a high-rise Manhattan apartment building, but there are REITs that can allow you to do just that.

Most REITs specialize in a specific type of property. You can find REITs that invest in office buildings, warehouses, shopping malls, data centers, hotels, and, of course, apartment buildings.

Why do REITs make such great investments?

There are several good reasons you might want to add REITs to your investment strategy. First and foremost, because they are required to pay out so much of their taxable income, REITs make excellent income investments. The overwhelming majority of REITs pay above-average dividends to shareholders.

REITs are also excellent for adding diversification to your portfolio, as real estate is a separate asset class from stocks or bonds. And they make investing in real estate easy -- instead of having to do the work of searching for properties, and managing and maintaining properties, you can buy shares of a REIT with a simple click of the mouse.

I also briefly mentioned in the previous section that REITs get a unique tax advantage. Specifically, if they pay out 90% of their taxable income and meet the other REIT requirements, REIT income is not taxed at the corporate level.

Most corporations that pay distributions to shareholders are effectively taxed twice -- at the corporate level when the profits are earned, and then again at the personal level when they're paid out as dividends. Unfortunately, REIT distributions generally don't qualify for the favorable "qualified dividend" tax rates most stock dividends get, but this still generally turns out to be a big advantage for REIT investors. Plus, investors who hold REITs in taxable accounts qualify for the 20% "pass-through" income tax deduction that was part of the Tax Cuts and Jobs Act.

Finally, REITs have the potential for excellent total returns. Not only do they pay great dividends, but REITs have several other ways they create value for investors, such as rising property values, development of new properties, and more. In fact, many REITs have a long history of market-beating returns.

Why invest in apartment REITs?

The obvious reason to invest in an apartment REIT is to profit from people who rent their homes.

From a more scientific standpoint, apartments are a nice combination of cyclicality and safety. The success of apartment properties is dependent on the health of the economy. For example, in prosperous times, it's easier for landlords to raise rent. This is why apartment rents in San Francisco have skyrocketed in recent years -- the economy has been incredibly strong in the area.

On the other hand, housing is a non-discretionary product, meaning that people need it in good times and bad. In other words, if someone is renting a self-storage unit, or a retail space for a storefront, these are expenses that can be cut back during difficult times. However, when times get tough, maintaining one's housing is usually among consumers' top priorities. So, while pricing power may diminish during tough economies, apartment vacancies tend not to shoot up as quickly as some other property types.

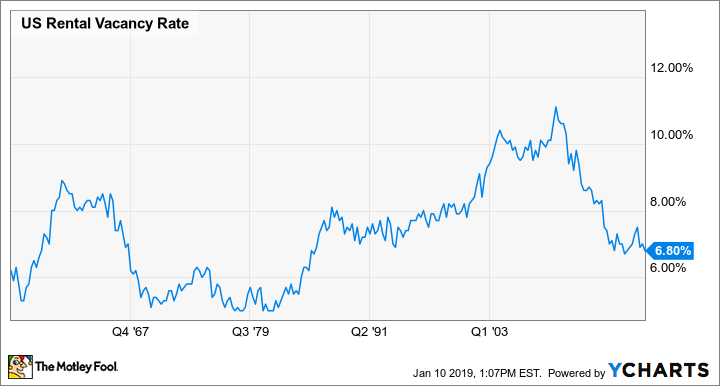

In addition, apartment REITs can be buoyed by home affordability. In recent years, housing has become less affordable, which has been a positive catalyst for apartment owners. Similarly, in recessions, when credit gets tight, it can also be difficult to buy a home, which also works in landlords' favor. In fact, since the 1950s, apartment vacancies have remained in the 5%-11% range.

US Rental Vacancy Rate data by YCharts.

Finally, the current trends are quite favorable for apartment demand. Job growth is strong, especially among the 25-34 age group (the most likely to rent). Wage growth is at a nine-year high, and the massive millennial generation is coming of age, which will make that renter-heavy age group even larger.

What could go wrong?

For starters, it's important to be aware that REITs are highly sensitive to rising interest rates. As rates rise, investors expect higher returns from their income-oriented investments, so rising rates typically put pressure on REIT prices. Most REITs rely on borrowed money to some degree as well, so higher interest rates also translate to higher borrowing costs. In fact, I'd go so far as to say that interest rates are the No. 1 force that moves REIT prices on a short-term basis.

Additionally, I also mentioned that apartments are a somewhat cyclical business. While vacancy rates generally don't spike too high no matter what, they do tend to rise and fall with economic conditions. Higher vacancy rates or falling market rents can put downward pressure on profitability.

5 top apartment REITs you can buy right now

Company (Stock Symbol) | Recent Share Price | Market Capitalization | Dividend Yield |

|---|---|---|---|

Equity Residential (NYSE: EQR) | $75.06 | $27.8 billion | 2.9% |

AvalonBay Communities (NYSE: AVB) | $200.07 | $27.6 billion | 3% |

Mid-America Apartment Communities (NYSE: MAA) | $108.25 | $12.3 billion | 3.6% |

American Campus Communities (NYSE: ACC) | $47.04 | $6.4 billion | 3.9% |

Essex Property Trust (NYSE: ESS) | $290.93 | $19.1 billion | 2.7% |

Data source: CNBC. All figures as of March 14, 2019.

Two big players in big markets

Equity Residential and AvalonBay Communities are quite similar in size. Both companies focus on larger apartment communities located in urban markets where development costs and limited space make it difficult for new competitors to enter the market, and both prefer to develop properties from the ground up. However, there are some differences between the two.

Equity Residential

Equity Residential has a portfolio of 307 properties with over 79,400 apartment units. The company primarily invests in six core markets: Boston, New York, D.C., Seattle, San Francisco, and Southern California. These are markets that are very conducive to rental housing, with high home prices, low supply of rentals, and strong demographics that favor renters.

Equity's average renewal rent increase is 4.9% as of November 2018, and it's simultaneously producing the highest tenant retention in its history -- a great sign of strength in the company's core markets. Plus, as you can see above, the U.S. rental vacancy rate is 6.8%, while Equity's is just 3.8%.

Another reason to love Equity Residential is the company's excellent record of recycling capital, strategically selling lower-growth assets and reinvesting the proceeds to maximize growth. In other words, Equity isn't just a buy-and-hold REIT. Over the past three years, the company sold $8.5 billion worth of apartment properties at an impressive 12% unlevered internal rate of return (IRR) -- a measure of the annualized return the company achieved on its investment -- and returned $4.2 billion of this to shareholders as special dividends while reinvesting the rest.

Thanks to strong capital management, steady rent increases, and great expense controls (its overhead ratio -- the costs of doing business as a percentage of revenue -- is 5.6%, vs. 6.2% for peers), Equity has performed quite well for investors. Over the past decade, Equity has generated an annualized 9.9% total return for investors. And, the company is one of the few REITs with "A" credit ratings (A-/A3) thanks to its strong balance sheet. There's no guarantee that Equity's future performance will be as strong as its past, but I don't see any reason to believe it won't be. Simply put, this is one of the best-run REITs in the sector and has an excellent risk/reward profile.

AvalonBay Communities

As I mentioned above, AvalonBay Communities is similar to Equity Residential in many ways. The company focuses on many of the same markets and is roughly the same size in terms of market capitalization and number of properties -- 291 properties with 85,158 apartments, to be exact.

Just like Equity, AvalonBay's markets are quite strong right now. Same-store rent increases are handily beating the company's own expectations, and core funds from operations (FFO), which is essentially the REIT version of "earnings," are expected to increase by 4.4% year over year when full-year 2018 figures are reported.

One key difference is that AvalonBay has been more active than Equity when it comes to development in the past few years. For comparison, Equity's development starts in 2016 and 2017 totaled just over $200 million, while AvalonBay invested $2.4 billion in development during the same period.

And the company has been doing a great job of creating value. In fact, AvalonBay spent $630 million on completed development through the first three quarters of 2018, and the company estimates the completed properties to have market values that are $275 million higher than this amount. That's impressive value creation. The company has $2.7 billion worth of projects under construction as of the end of 2018's third quarter, so this could be a major value-creation catalyst going forward. Plus, AvalonBay sees lots of future opportunity in the Denver and Southeast Florida markets, both of which are virtually untapped by the company at this point.

Since its 1993 initial public offering, AvalonBay has generated 13.1% annualized total returns -- a remarkable level of performance to sustain for more than 25 years. And, during the same period, the company has more than tripled its dividend rate -- a trend that I think will continue for years to come.

Mid-America Apartments

Mid-America Apartments focuses on higher-growth, non-urban areas of the U.S. -- specifically the Southeast, Southwest, and Mid-Atlantic regions.

Unlike the first two REITs in this discussion, Mid-America Apartments believes its best opportunity is to focus on markets with favorable tax environments, business-friendly infrastructure, and above-average job growth. To name a few examples, the top five markets represented in Mid-America Apartments' portfolio are Atlanta, Dallas, Charlotte, D.C., and Tampa. And, because it avoids the most high-barrier markets, its apartments have much greater price-point diversification than the others.

In fact, well over half of its apartments rent for $1,300 or less per month. While apartments renting for over $2,500 make up 8.2% of the U.S. supply, they make up just 0.1% of Mid-America Apartments' portfolio.

Mid-America Apartments believes this strategy provides more downside protection than higher-end apartment REITs enjoy in tough economies, while also allowing the company to benefit from the growth of its target markets during good times. Currently, Mid-America Apartments is in the process of spending about $430 million on development and improvements in an effort to create shareholder value, which could further add to the company's value creation.

It's tough to argue with the numbers. Mid-America Apartments' renewal rates jumped 6.2% year over year in February 2019, the highest spread of the three REITs discussed so far. The vacancy rate is well below average at 3.9% at the end of 2018. And, perhaps most impressively, the company generated annualized 13.4% total returns for shareholders over the past 20 years.

American Campus Communities

In the interest of full disclosure, American Campus Communities is the REIT from this list that I own in my own portfolio. I think all are excellent long-term investments, but I like the growth potential of American Campus Communities, a leader in a relatively young area of commercial real estate: student housing.

Simply put, there's a huge market for student housing, and U.S. colleges and universities aren't doing a great job of filling the need on their own. Most on-campus housing is extremely outdated -- in fact, the median age of on-campus housing in American Campus Communities' markets is more than 50 years old. And over half of the housing supply in the company's markets consists of general apartment complexes that simply aren't designed for students. Many are far from campus and lack the social and functional elements students want.

Enter American Campus Communities. The company develops student-specific communities, which provides modern housing with the amenities students want at a comparable cost to the outdated on-campus housing options.

The company has put up some impressive statistics so far. American Campus Communities has achieved 58 consecutive quarters of same-store growth. And, while college rentals have a reputation for high vacancy rates, American Campus Communities' average fall occupancy rate of 97.5% is actually better than the overall U.S. apartment average.

In the 14 years since its IPO, American Campus Communities has grown impressively, with $5.7 billion in acquisitions and $4.7 billion in development. The company now has 170 properties with 109,100 rentable beds and has generated a 342% total return ( about 10.5% annualized) for shareholders.

Essex Property Trust

A regional apartment REIT, Essex Property Trust exclusively invests in West Coast apartments, specifically in the Seattle, Northern California, and Southern California markets. These have been extremely strong real estate markets lately. And with gross domestic product (GDP) growth of 33% over the past six years versus a national average of 21% and above-average wage growth, it's no wonder why this is.

These areas have high incomes and even higher costs of home ownership, which has been a favorable catalyst for renting. In fact, the average home price in Essex's market is more than three times the U.S. median, and it is 77% more expensive to own than rent in these areas.

They also have high barriers when it comes to new construction, which gives a large and established player in the region -- like Essex -- a big advantage. Plus, these markets have fantastic job growth and wage growth, which is a great indicator that rental demand growth will remain strong for the foreseeable future. With over $1 billion of development scheduled to be completed during 2019, Essex is certainly taking advantage.

Since its IPO in 1994, Essex Property Trust has delivered exceptional returns for shareholders. The dividend has been increased each year since then, at an annualized rate of 6.4%. And, in that 24-year period, the company has delivered a staggering 17% annualized total return. This means that an investor who got in at the IPO and reinvested all dividends would have more than 43 times their original investment now.

Invest for the long term

As a final point, it's important to point out that all equity REITs are intended to be long-term investments. There are many dynamics -- particularly interest rates -- that can cause volatility in REIT stock prices and have nothing to do with how well the underlying business is doing. In other words, even if a REIT's income and profitability both rise substantially over the next few years, it's entirely possible that its stock price will be lower.

Over the long run, however, any short-term noise should fade away and all five of these should produce excellent income and growth for investors.

More From The Motley Fool

Matthew Frankel, CFP owns shares of American Campus Communities. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.