5 US and Asian Health Care Companies With Good Financial Strength

In light of the coronavirus outbreak in China, five U.S. and Asian health care companies with good financial strength and profitability are Edwards Lifesciences Corp. (NYSE:EW), Novo Nordisk A/S (NYSE:NVO), Guangdong Zhongsheng Pharmaceutical Co. Ltd. (SZSE:002317), DongKook Pharmaceutical Co. Ltd. (XKRX:086450) and Bumrungrad Hospital PCL (BKK:BH) according to the All-in-One Screener, a major GuruFocus Premium feature.

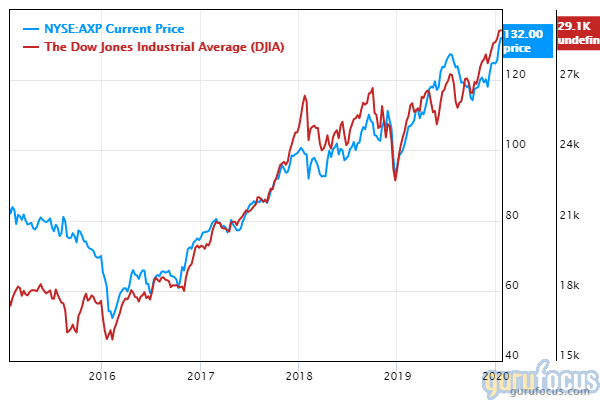

Dow tumbles on increased coronavirus fears, suggesting opportunities in health care

On Monday, the Dow Jones Industrial Average closed at 28,533.90, down 455.83 points from Friday's close of 28,989.73, on increased fears over the coronavirus' impact to the global economy. Dow components Nike Inc. (NYSE:NKE) and American Express Co. (NYSE:AXP) contributed to the broad index's decline, which amounted to approximately 540 points at the intraday low.

Several consumer cyclical industry groups, including travel and leisure and restaurants, pulled back as the coronavirus outbreak lowered demand for travel around the globe. On the other hand, health care stocks might see high demand: According to CNBC, China increased medical supplies and staff in Wuhan, the center of the virus outbreak. Further, Wuhan expects to open a 1,000-bed hospital to treat the infected by the end of this week.

As such, investors might seek opportunities in health care companies with good financial strength and profitability. The Good Companies screen seeks companies with strong business predictability, high average return on capital and increasing revenue and profit margins over the past 10 years.

Edwards Lifesciences

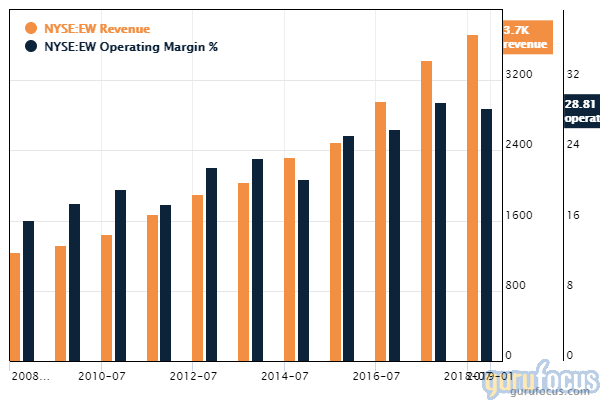

A Baxter International Inc. (NYSE:BAX) spinoff, Edwards Lifesciences designs, manufactures and markets a range of medical devices and equipment for advanced stages of heart disease. GuruFocus ranks the company's profitability 10 out of 10 on several positive investing signs, which include a high Piotroski F-score of 8, a four-star business predictability rank and operating margins that have increased approximately 6.50% per year over the past five years and are outperforming over 95% of global competitors.

Edwards' financial strength ranks 8 out of 10 on the heels of robust interest coverage and a solid Altman Z-score of 15.78.

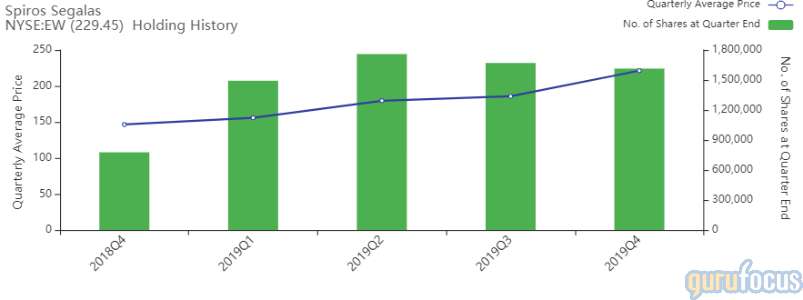

Gurus with large holdings in Edwards include Spiros Segalas (Trades, Portfolio) and the Vanguard Health Care Fund (Trades, Portfolio).

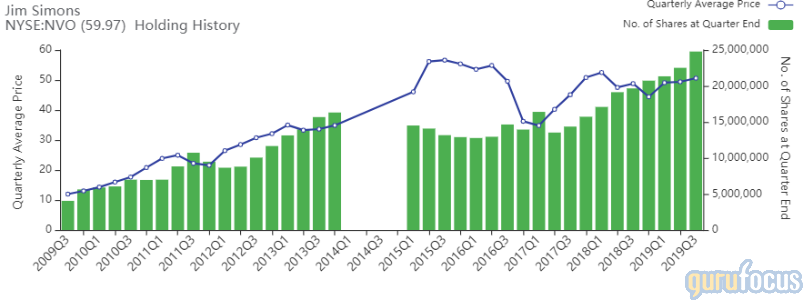

Novo Nordisk

Novo Nordisk manufactures and markets a variety of human and modern insulins, as well as oral antidiabetic agents. GuruFocus ranks the Denmark-based biotech company's profitability 10 out of 10 on several positive investing signs, which include a five-star business predictability rank, expanding profit margins and a return on equity that outperforms 99% of global competitors.

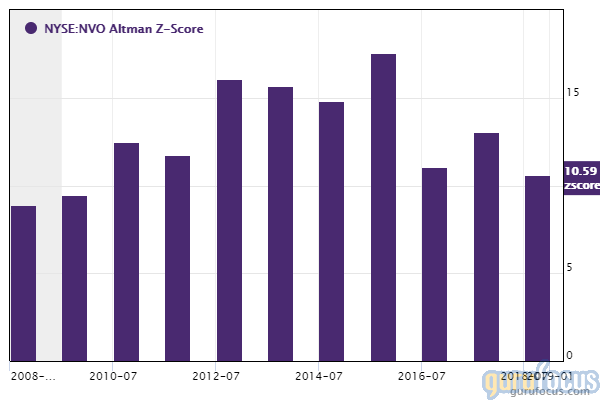

The company's financial strength ranks 8 out of 10 on the heels of strong Altman Z-scores and a debt-to-Ebitda ratio of 0.08, which outperforms approximately 92% of global competitors.

Gurus with large holdings in Novo Nordisk include Jim Simons' Renaissance Technologies and Ken Fisher (Trades, Portfolio).

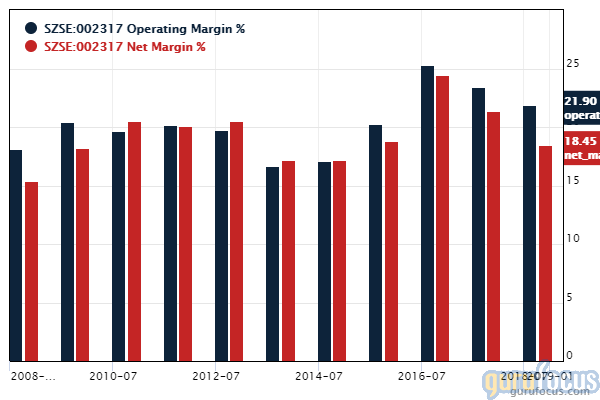

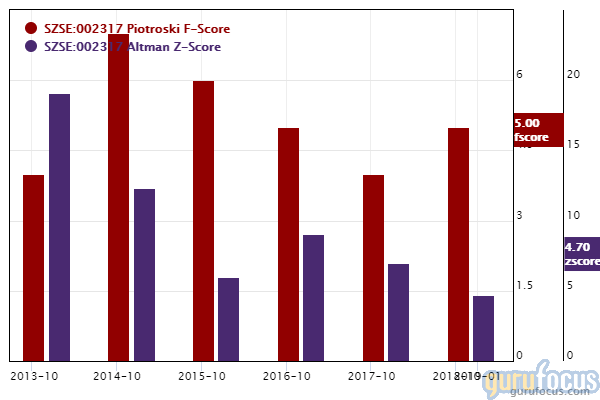

Guangdong Zhongsheng

Guangdong Zhongsheng manufactures and distributes patent medicines and chemical drugs primarily in South China. GuruFocus ranks the company's profitability 9 out of 10 on several positive investing signs, which include a 4.5-star business predictability rank and operating margins that have increased 7.60% per year over the past five years and are outperforming approximately 86.62% of global competitors.

Guangdong Zhongsheng's financial strength ranks 8 out of 10 on the heels of a strong Altman Z-score of 6.48 and debt ratios that outperform over 63% of global competitors.

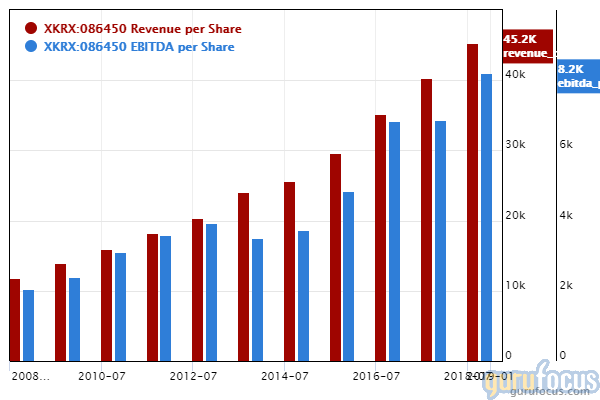

DongKook Pharmaceutical

DongKook Pharmaceutical produces medicines like Madecassol for wounds and Oramedy for stomatitis. GuruFocus ranks the South Korean drug manufacturer's profitability 9 out of 10 on several positive investing signs, which include a five-star business predictability rank and a return on equity that outperforms over 80% of global competitors.

The company's financial strength ranks 8 out of 10 on the heels of strong interest coverage and Altman Z-scores. Despite this, debt ratios are outperforming just over 56% of global drug manufacturers.

Bumrungrad Hospital

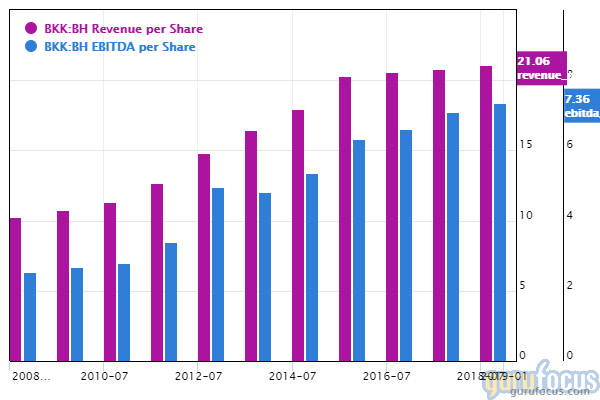

Bumrungrad Hospital operates diagnostic, therapeutic and intensive care facilities, generating revenues primarily from inpatient and outpatient services in Bangkok. GuruFocus ranks the company's profitability 9 out of 10 on several positive investing signs, which include expanding profit margins, a four-star business predictability rank and a return on assets that outperforms over 93% of global competitors.

Disclosure: No positions.

Read more here:

4 US and European Consumer Cyclical Companies With High Business Quality

5 Chinese Peter Lynch Growth Stocks With High Profitability

5 European and Asian Net-Nets for the 1st Quarter of 2020

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.