5 Utilities Trading With Low Price-Sales Ratios

- By Tiziano Frateschi

According to the GuruFocus All-In-One Screener, a Premium feature, the following utilities were trading with low price-sales ratios as of Oct. 20.

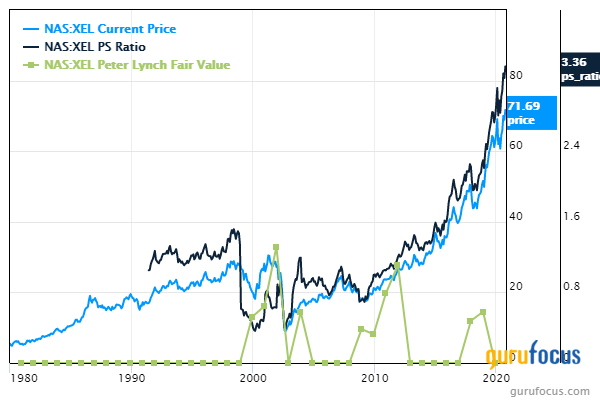

Xcel Energy

Shares of Xcel Energy Inc. (XEL) were trading around $71.69 with a price-sales ratio of 3.36 and a price-earnings ratio of 26.85.

The company has a $37.66 billion market cap. The share price has risen at an annualized rate of 13.61% over the past decade.

The discounted cash flow calculator gives the stock a fair value of $29.31, suggesting it is overpriced by 144%.

The company's largest guru shareholder is Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.25% of outstanding shares, followed by Pioneer Investments (Trades, Portfolio) with 0.11% and Robert Bruce (Trades, Portfolio) with 0.08%.

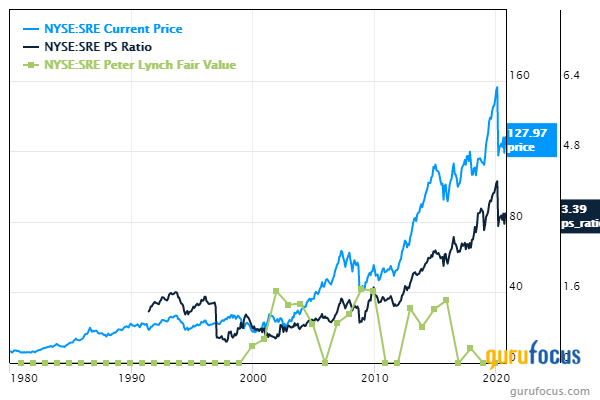

Sempra Energy

On Tuesday, Sempra Energy (SRE) was trading around $127.97 per share with a price-sales ratio of 3.39 and a price-earnings ratio of 1.83.

The company, which distributes natural gas and electricity, has a market cap of $37.02 billion. The stock has risen at an annualized rate of 11.43% over the past 10 years.

The discounted cash flow calculator gives the stock a fair value of $76.86, suggesting it is overpriced by 66%.

With 0.35% of outstanding shares, T Rowe Price Equity Income Fund (Trades, Portfolio) is the company's largest guru shareholder, followed by Simons with 0.27% and Pioneer Investments (Trades, Portfolio) with 0.16%.

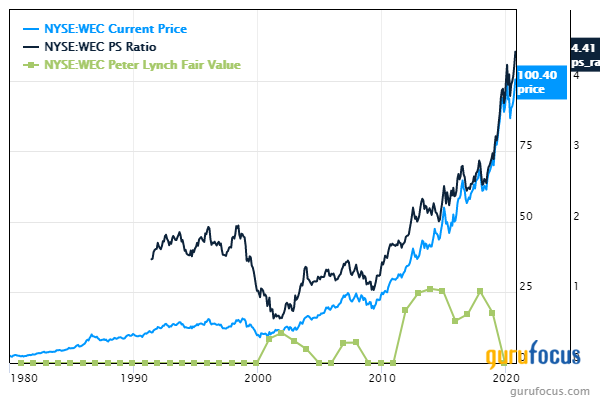

WEC Energy

WEC Energy Group Inc. (WEC) was trading around $100.40 on Tuesday with a price-sales ratio of 4.41 and a price-earnings ratio of 27.14.

The company, which provides electricity and gas, has a market cap of $31.67 billion. The stock has risen at an annualized rate of 14.93% over the past decade.

The discounted cash flow calculator gives the stock a fair value of $47.34, suggesting it is overpriced by 112%.

With 0.27% of outstanding shares, Pioneer Investments (Trades, Portfolio) is the company's largest guru shareholder, followed by Simons' firm with 0.07% and Steven Cohen (Trades, Portfolio)'s Point72 Asset Management with 0.01%.

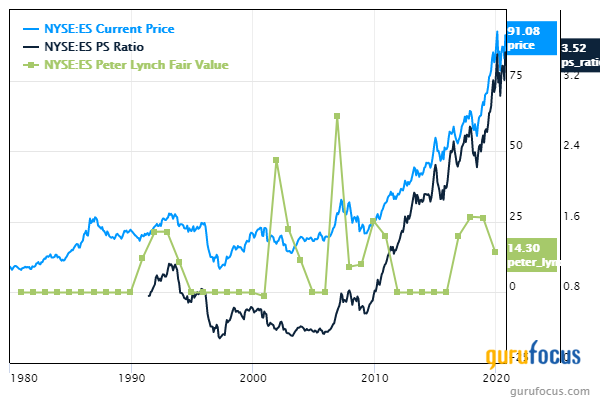

Eversource

Eversource Energy (ES) was trading around $91.08 per share with a price-sales ratio of 3.52 and a price-earnings ratio of 26.02.

The holding company has a market cap of $31.21 billion. The stock has risen at an annualized rate of 13.31% over the past decade.

The discounted cash flow calculator gives the stock a fair value of $37.93, suggesting it is overpriced by 140%.

The company's largest guru shareholder is Pioneer Investments (Trades, Portfolio) with 0.12% of outstanding shares, followed by Mario Gabelli (Trades, Portfolio)'s GAMCO Investors with 0.06% and Cohen with 0.03%.

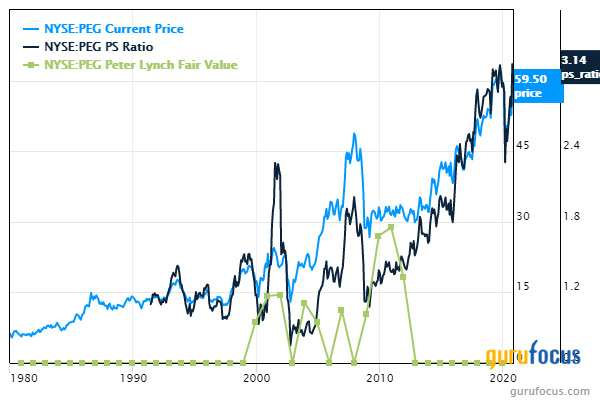

Public Service Enterprise

Shares of Public Service Enterprise Group Inc. (PEG) were trading around $59.50 with a price-sales ratio of 3.14 and a price-earnings ratio of 17.40.

The holding company has a $30.09 billion market cap. The share price has risen at an annualized rate of 8.54% over the past decade.

The discounted cash flow calculator gives the stock a fair value of $36.60, suggesting it is overpriced by 62.57%.

The company's largest guru shareholder is Pioneer Investments (Trades, Portfolio) with 0.47% of outstanding shares, followed by Simons' firm with 0.33% and Joel Greenblatt (Trades, Portfolio) with 0.02%.

Disclosure: I do not own any stocks mentioned.

Read more here:

5 Guru Stocks With Predictable Business

5 Cyclical Stocks Gurus Are Buying

6 Energy Stocks Outperforming the Benchmark

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.