6 Predictable Guru Stocks

According to the GuruFocus All-in-One Screener, the following companies have high business predictability ratings and a wide margin of safety.

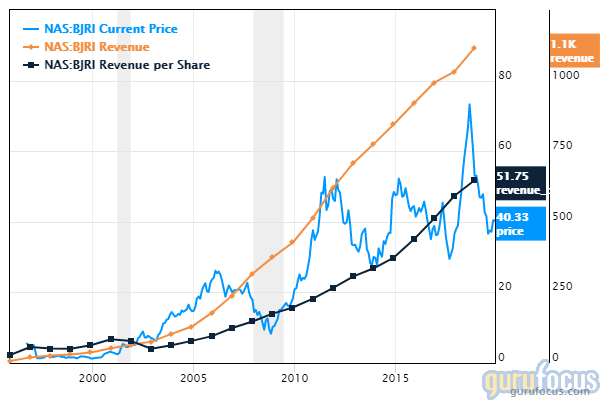

BJ's Restaurants

BJ's Restaurants Inc. (NASDAQ:BJRI) has a business predictability rank of five out of five stars and, according to the discounted cash flow calculator, a 20.82% margin of safety at an average price of $38 per share.

The company, which operates casual dining restaurants in the U.S., has a market cap of $735.66 million and an enterprise value of $1.33 billion. Over the past five years, its revenue has grown 14.80% and its earnings per share have increased 26.40%.

Over the past 12 months, the stock has fallen 30% and is currently trading with a price-earnings ratio of 19.69. The share price has been as high as $56.50 and as low as $32.62 in the last 52 weeks. As of Friday, the stock was trading 31.82% below its 52-week high and 18.09% above its 52-week low.

With 3.13% of outstanding shares, Ron Baron (Trades, Portfolio) is the company's largest guru shareholder, followed by Joel Greenblatt (Trades, Portfolio) with 0.40%

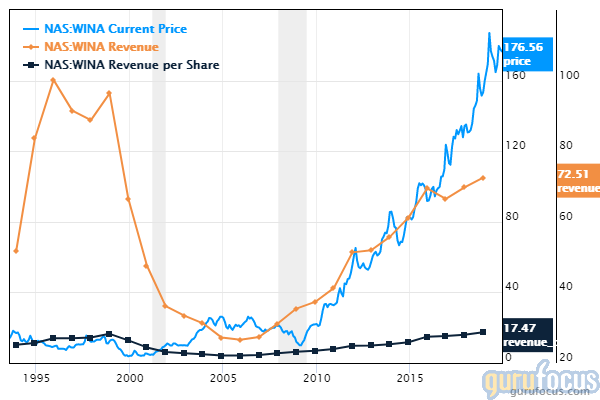

Winmark

Winmark Corp. (NASDAQ:WINA) has a four-star business predictability rank and, according to the DCF calculator, an 18.28% margin of safety at an average price of $176.02 per share.

The company, which operates in retail franchising and leasing business, has a market cap of $674.31 million and an enterprise value of $689.20 million. Over the past five years, its revenue has increased 10.40% and its earnings per share have grown 15.10%.

The stock has risen 14.07% over the last 12 months and shares are trading with a price-earnings ratio of 23.19. The share price has been as high as $194.85 and as low as $144.36 in the last 52 weeks. As of Friday, the stock was trading 9.38% below its 52-week high and 22.32% above its 52-week low.

With 4.91% of outstanding shares, Jim Simons (Trades, Portfolio)' Renaissance Technologies is the company's largest guru shareholder.

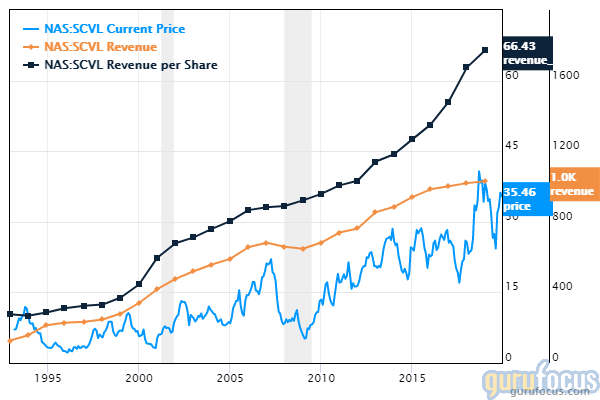

Shoe Carnival

Shoe Carnival Inc. (NASDAQ:SCVL) has a 3.5-star business predictability rank and, according to the DCF calculator, a 17.54% margin of safety at an average price of $36.99 per share.

The American footwear retailer has a $539.04 million market cap and an enterprise value of $749.95 million. Over the past five years, its revenue has increased 8.80% and its earnings per share have grown 7.90%.

The price was stable over the past 12 months. The stock is trading with a price-earnings ratio of 13.41 and a price-book ratio of 1.79. The price has been as high as $41.84 and as low as $21.47 in the last 52 weeks. As of Friday, the stock was trading 11.59% below its 52-week high and 72.29% above its 52-week low.

With 6.69% of outstanding shares, Chuck Royce (Trades, Portfolio) is the company's most notable shareholder, followed by Jeremy Grantham (Trades, Portfolio) with 2.07% and Philippe Laffont (Trades, Portfolio) with 0.32%.

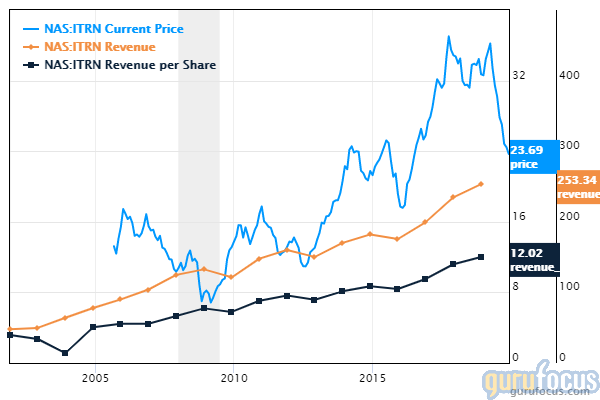

Ituran Location and Control

Ituran Location and Control Ltd. (NASDAQ:ITRN) has a 4.5-star business predictability rank and, according to the DCF calculator, a 31.87% margin of safety at an average price of $23.92 per share.

The company, which provides location-based services, has a market cap of $498.89 million and an enterprise value of $529.79 million. Over the past five years, its revenue has grown 8.50% and its earnings per share have increased 18.80%.

Shares have fallen 28.21% over the past 12 months. The stock is currently trading with a price-earnings ratio of 13.53 and price-book ratio of 3.33. The share price has been as high as $38.50 and as low as $22.51 in the last 52 weeks. As of Friday, the stock was trading 38.44% below its 52-week high and 5.29% above its 52-week low.

With 6.98% of outstanding shares, Simons' firm is the company's largest guru shareholder, followed by Royce with 0.24% and Pioneer Investments (Trades, Portfolio) with 0.15%.

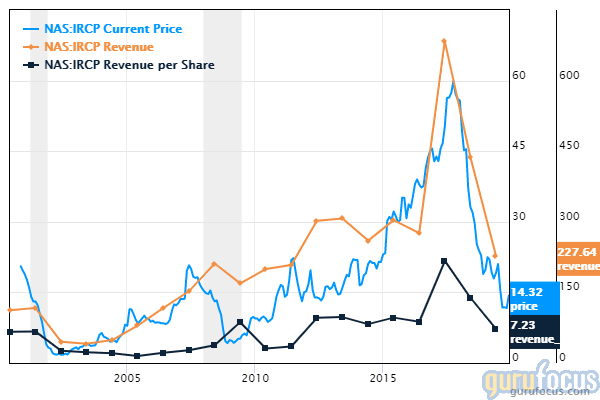

IRSA Propiedades Comerciales

IRSA Propiedades Comerciales SA (NASDAQ:IRCP) has a four-star business predictability rank.

The company, which operates in the real estate industry, has a $444.47 million market cap and an enterprise value of $702.43 million. Over the past five years, its revenue has grown 45.20%.

Shares have declined 29.45% over the past year. The stock is trading with a forward price-earnings ratio of 106.38 and a price-book ratio of 0.79. The price has been as high as $24 and as low as $9.82 in the last 52 weeks. As of Friday, the stock was trading 41.21% below its 52-week high and 43.69% above its 52-week low.

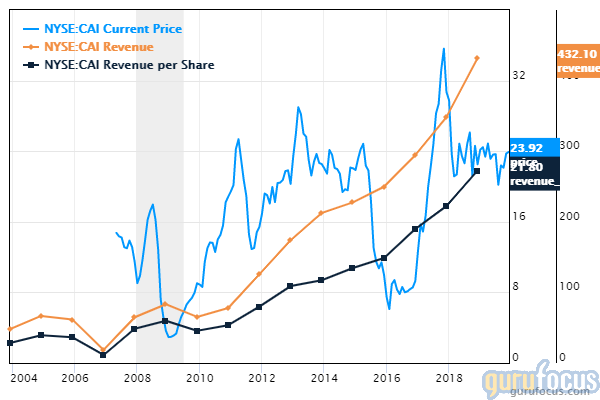

CAI International

CAI International Inc. (NYSE:CAI) has a three -star business predictability rank and, according to the DCF calculator, a 29.29% margin of safety at an average price of $24.14 per share.

The global transportation finance and logistics company has a market cap of $418.04 million and an enterprise value of $2.54 billion. Over the past five years, its revenue has grown 18.60% and its earnings per share have increased 2.20%.

Shares have risen 3.21% over the past 12 months. The stock is currently trading with a price-earnings ratio of 14.2 and price-book ratio of 0.71. The share price has been as high as $26.63 and as low as $17.87 in the last 52 weeks. As of Friday, the stock was trading 9.20% below its 52-week high and 35.31% above its 52-week low.

With 0.28% of outstanding shares, Donald Smith (Trades, Portfolio) is the company's largest guru shareholder, followed by Barrow, Hanley, Mewhinney & Strauss with 0.23%.

Disclosure: I do not own any stocks mentioned.

Read more here:

Largest Insider Trades of the Week

6 Underperforming Stocks in Gurus' Portfolios

6 Bargain Stocks Growing Earnings

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.