6 Reasons to Add Infosys (INFY) Stock to Your Portfolio

Infosys INFY is currently one of the top-performing stocks in the technology sector. The stock’s price rally highlights the company’s robust fundamentals. Therefore, if you haven’t taken advantage of the share-price appreciation yet, it’s time you add the stock to your portfolio.

The company has performed brilliantly over the trailing 12-months. It has the potential to sustain the momentum in the days ahead.

What Makes the Stock an Attractive Pick?

Share-Price Appreciation: Infosys’ price trend reflects that the stock has had an impressive run on the bourse over the past one year. Shares of the company have rallied 44.2% against the Zacks Computer – IT Services industry’s decline of 1.8%. Meanwhile, the S&P 500’s has rallied 24.6%.

Solid Rank & Growth Score: Infosys currently has a Zacks Rank #2 (Buy) and a Growth Score of B. Our research shows that stocks with a Growth Score of A or B, when combined with a Zacks Rank #1 (Strong Buy) or 2, offer the best investment opportunities for investors. Thus, the company appears to be a compelling investment proposition at the moment. You can see the complete list of today’s Zacks #1 Rank stocks here.

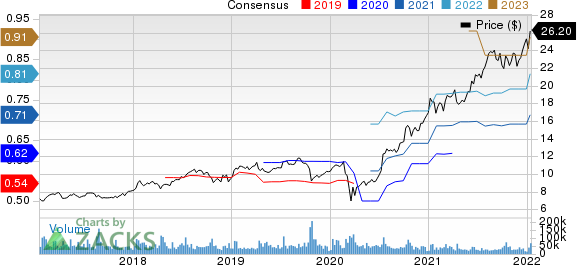

Northward Estimate Revisions: Analysts have raised the earnings estimates for fiscal 2022 and fiscal 2023 over the last seven days, reflecting their confidence in the company. During the same period, the Zacks Consensus Estimate for fiscal 2022 and 2023 has moved north by 2 cents and 3 cents, respectively.

Positive Earnings Surprise History: Infosys has an impressive earnings surprise history. The company outpaced earnings estimates in each of the trailing four quarters, the average surprise being 1.5%.

Solid Growth Prospects: The Zacks Consensus Estimate of 71 cents for fiscal 2022 earnings suggests growth of 16.4% from the year-ago period. For fiscal 2023, earnings are expected to increase 14.3% year over year and are likely to reach 81 cents per share. The long-term earnings per share growth rate is estimated to be 10%.

Growth Drivers: Infosys has been benefiting from growing demand as customers undergo a major digital transformation in the post-pandemic world. Solid demand for digital services, cloud, Internet of Things, security and data analytics solutions is a key growth driver for the IT major.

Infosys Limited Price and Consensus

Infosys Limited price-consensus-chart | Infosys Limited Quote

Infosys continues to gain from high investments by clients across workplaces in over 45 countries. It helps them to create and execute strategies for digitization, thus, expanding its presence in newer markets and solidifying its position in the highly competitive environment.

It is noteworthy that the COVID-19 mayhem is boosting the digital transformation market. Per the latest MarketsandMarkets report, the global digital transformation market size is projected to reach $1,247.5 billion by 2026, witnessing a CAGR of 19.1% between the forecast period (2021-2026).

Infosys’ digital revenues, which contributed 48.5% to the total revenues, grew 31.3% year over year (29.4% at cc) to $6.58 billion in fiscal 2021. We note that the company is looking to build a strong team of digital specialists in order to cater to clients across all verticals, whose key theme is digital transformation. Reportedly, it has built solutions, driven by artificial intelligence (“AI”) and machine learning, to digitize the data supply chain.

The company has been fortifying its core competencies by pursuing collaborations and acquisitions. Infosys’ alliance strategy is targeted at teaming up with leading technology providers, which allows it to cash in on the emerging technologies in a mutually advantageous and cost-competitive manner.

In order to boost digital, cloud, legacy modernization and automation business, Infosys cemented strategic tie-ups with companies like Google, Microsoft and Amazon Web Services. We believe such efforts in the digital-transformation business will aid the company to gain a competitive edge over its peers, including bigwigs like Accenture and Cognizant.

Other Stocks to Consider

Some other top-ranked stocks from the broader computer and technology sector include the largest global Customer Relationship Management vendor Salesforce CRM and Hewlett Packard Enterprise HPE, each flaunting a Zacks Rank #1, and Advanced Micro Devices AMD carrying a Zacks Rank #2.

The Zacks Consensus Estimate for Salesforce’s fourth-quarter fiscal 2022 earnings has been revised downward by 7.6% to 73 cents per share over the past 60 days. For fiscal 2022, earnings estimates have moved upward by 0.43% to $4.68 per share in the last 30 days.

Salesforce’s earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 44.2%. CRM stock has appreciated 8.5% in the past year.

The Zacks Consensus Estimate for HPE’s first-quarter fiscal 2022 earnings has been revised downward by 6.1% to 46 cents per share over the past 60 days. For fiscal 2022, earnings estimates have moved north by 1.5% to $2.03 per share in the past 90 days.

HPE’s earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 14.4%. Shares of HPE have rallied 40.1% in the past year.

The Zacks Consensus Estimate for Advanced Micro Devices’ fourth-quarter 2021 earnings has been revised upward by 7 cents to 75 cents per share over the past 90 days. For 2021, earnings estimates have moved north by a penny to $2.65 per share in the past 60 days.

Advanced Micro Devices’ earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 14%. Shares of AMD have rallied 55.2% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

salesforce.com, inc. (CRM) : Free Stock Analysis Report

Infosys Limited (INFY) : Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research