6 Stocks With Low Price-Earnings Ratios

According to the GuruFocus All-In-One Screener, a Premium feature, the following stocks were trading near their 52-week highs while also having low price-earnings ratios as of Jan. 23. These companies also have a good dividend yield.

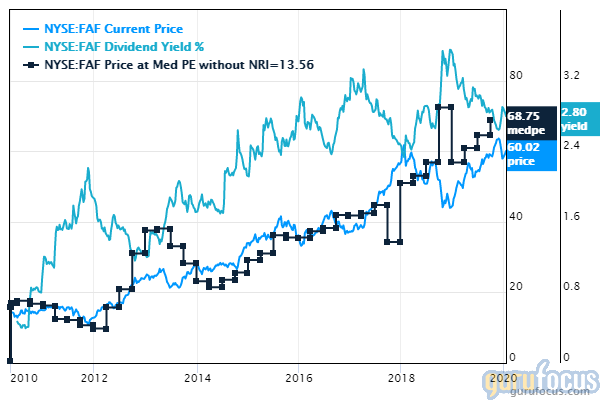

First American Financial

First American Financial Corp. (NYSE:FAF) was trading with a price-earnings ratio of 11.89, which is higher than 62% of companies in the insurance industry. The stock has climbed 29.82% over the past 12 months and is now trading 6.51% below its 52-week high.

The company, which offers title insurance as well as closing and escrow services, has a market cap of $6.76 billion. Its earnings per share have grown 16.90% over the past three years, while the industry's average growth rate was 1.95%.

The company has a dividend yield of 2.81% with an annualized rate of 2.47% over the past decade. The dividend payout ratio is 0.33.

The company's largest guru shareholder is John Rogers (Trades, Portfolio) with 3.34% of outstanding shares, followed by Ken Fisher (Trades, Portfolio) with 1.15%, Pioneer Investments (Trades, Portfolio) with 0.55% and Steven Cohen (Trades, Portfolio) with 0.44%.

Prosperity Bancshares

Prosperity Bancshares Inc. (NYSE:PB) was trading with a price-earnings ratio of 14.58, which is lower than 72% of companies in the banks industry. The stock was flat over the past 12 months and is now trading 8.29% below its 52-week high.

The bank has market cap of $6.54 billion. Its earnings per share have grown 4.10% over the past three years, while the industry's average growth rate was 9.5%.

The company has a dividend yield of 2.45% with an annualized rate of 1.86% over the past decade. The dividend payout ratio is 0.35.

With 0.86% of outstanding shares, Barrow, Hanley, Mewhinney & Strauss is the largest guru shareholder, followed by Fisher with 0.51%, Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.13% and Robert Olstein (Trades, Portfolio) with 0.12%.

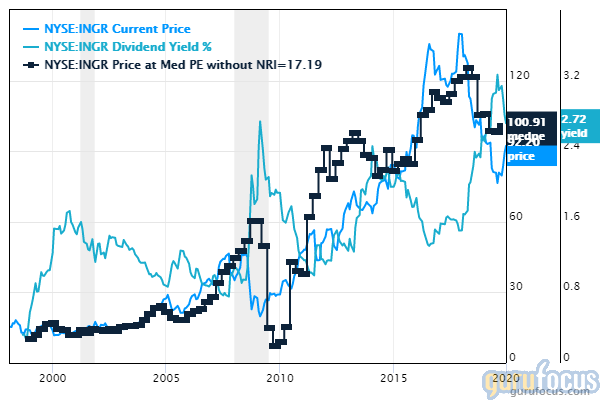

Ingredion

Ingredion Inc. (NYSE:INGR) was trading with a price-earnings ratio of 15.71, which is higher than 63% of companies in the consumer packaged goods industry. The stock has declined 3.25% over the past 12 months and is now trading 7.67% below its 52-week high.

The company, which provides ingredients for the food and beverage industry, has market cap of $6.16 billion. Its earnings per share have grown 3.80% over the past three years, while the industry's average growth rate was 6.0%.

The company has a dividend yield of 2.74% with an annualized rate of 1.78% over the past decade. The dividend payout ratio is 0.43.

The company's largest guru shareholder is Cohen with 0.47% of outstanding shares, followed by Simons' firm with 0.25%, Pioneer Investments with 0.16% and Mario Gabelli (Trades, Portfolio) with 0.08%.

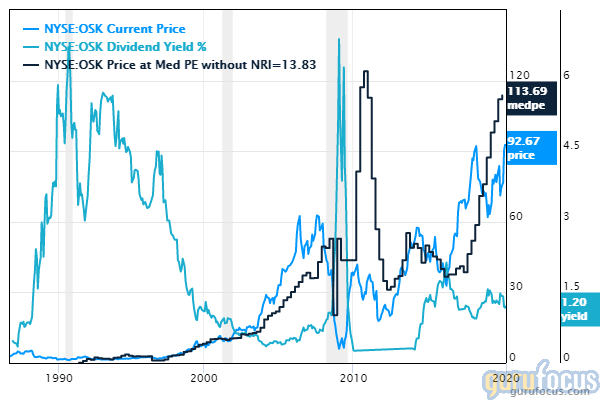

Oshkosh

Oshkosh Corp. (NYSE:OSK) was trading with a price-earnings ratio of 10.93, which is higher than 65% of companies in the farm and heavy construction machinery industry. The share price has risen 30.68% over the past 12 months and is now trading 6.14% below the 52-week high.

The company, which designs a broad range of specialty vehicles, has market cap of $6.13 billion. Its earnings per share have climbed 41.30% over the past three years, while the industry's average growth rate was 10.9%.

The company has a dividend yield of 1.22% with an annualized rate of 1.27% over the past decade. The dividend payout ratio is 0.13.

With 0.27% of outstanding shares, Mairs and Power (Trades, Portfolio) is the company's largest guru shareholder, followed by Pioneer Investments with 0.13%, Jeremy Grantham (Trades, Portfolio) with 0.03%, Scott Black (Trades, Portfolio) with 0.03% and Joel Greenblatt (Trades, Portfolio) with 0.01%.

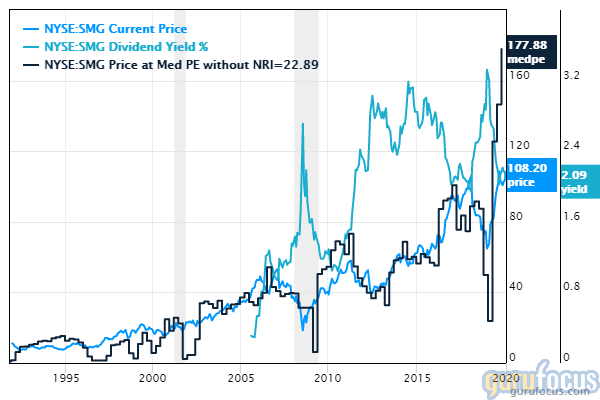

Scotts Miracle Gro

The Scotts Miracle Gro Co. (NYSE:SMG) was trading with a price-earnings ratio of 13.21, which is higher than 62% of companies in the agriculture industry. The stock has climbed 61.05% over the past 12 months and is now trading 5.24% below its 52-week high.

The gardening and lawncare products provider has a market cap of $6.06 billion. Its earnings per share have climbed 25% over the past three years, while the industry's average growth rate was 10.65%.

The company has a dividend yield of 2.08% and an annualized 10-year rate of 2.41%. The dividend payout ratio is 0.29.

The company's largest guru shareholder is First Eagle Investment (Trades, Portfolio) with 2.89% of outstanding shares, followed by Fisher with 2.58% and Tom Gayner (Trades, Portfolio) with 0.74%.

Synovus Financial

Synovus Financial Corp. (NYSE:SNV) was trading with a price-earnings ratio of 11.59, which is higher than 51% of companies in the banks industry. The share price has risen 15.79% over the past 12 months and is now trading 2.97% below the 52-week high.

The bank has market cap of $5.74 billion. Its earnings per share have grown 28.90% over the past three years, while the industry's average growth rate was 9.5%.

The company has a dividend yield of 3.05% with an annualized rate of 1.48% over the past decade. The dividend payout ratio is 0.34.

With 0.61% of outstanding shares, Richard Pzena (Trades, Portfolio) is the company's largest guru shareholder, followed by Private Capital (Trades, Portfolio) with 0.24%.

Disclosure: I do not own any stocks mentioned.

Read more here:

6 Guru Stocks Trading Below Peter Lynch Value

5 Guru Stocks Outperforming the Market

6 Cheap Stocks Trading With a Low Price-Earnings Ratio

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.