6 Yield-Paying Stocks Trading at Cheap Prices

According to the GuruFocus All-in-One Screener as of July 6, the following guru-held companies have high dividend yields and are trading with low price-earnings ratios.

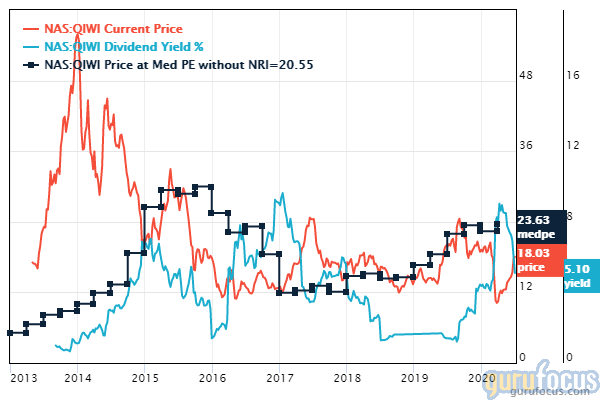

QIWI

QIWI PLC's (QIWI) dividend yield is 5.1% and the payout ratio is 0.89. Over the past 52 weeks, the stock price has decreased 3.61%. Shares are trading with a price-book ratio of 2.49 and a price-earnings ratio of 13.67. The company's average yield was 3.74% over the past 10 years.

The provider of electronic online payment systems has a market cap of $1.1 billion. The return on equity of 19% and return on assets of 7.33% are outperforming 85% of companies in the credit services industry. The cash-debt ratio of 27.58 is above the industry median of 0.25.

Jim Simons (Trades, Portfolio)' Renaissance Technologies is the company's largest guru shareholder with 3.19% of outstanding shares, followed by Jeremy Grantham (Trades, Portfolio) with 0.95%.

PACCAR

PACCAR Inc.'s (PCAR) dividend yield is 1.69% with a payout ratio of 0.21. The stock has gained 11.09% compared to a year ago. Shares are trading with a price-earnings ratio of 12.43 and a price-book ratio of 2.71. The company's average yield was 1.49% over the past 10 years.

The manufacturer of trucks has a $26.1 billion market cap. The return on equity of 22.04% and return on assets of 7.75 are outperforming 92% of competitors. The cash-debt ratio of 0.4 is underperforming 56% of competitors.

HOTCHKIS & WILEY is the company's largest guru shareholder with 0.45% of outstanding shares, followed by Pioneer Investments (Trades, Portfolio) with 0.33% and the T Rowe Price Equity Income Fund (Trades, Portfolio) with 0.33%.

Novartis

Novartis AG's (NVS) dividend yield is 3.53% with a payout ratio of 0.96. Over the past 52 weeks, the stock has declined 1.57%. Shares are trading with a price-book ratio of 3.86 and a price-earnings ratio of 16.

The manufacturer of healthcare products has a market cap of $200.9 billion. GuruFocus rated its profitability 7 out of 10. The return on equity of 23.54% and return on assets of 9.91% are outperforming 83% of competitors. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.14 is below the industry median of 0.9.

PRIMECAP Management (Trades, Portfolio) is the company's largest guru shareholder with 1.05% of outstanding shares, followed by Dodge & Cox with 1% and Ken Fisher (Trades, Portfolio) with 0.38%.

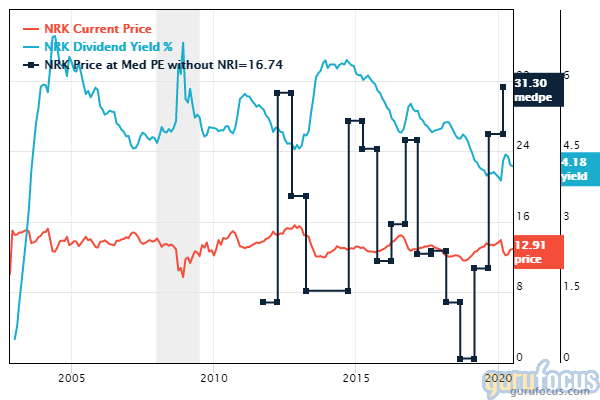

Nuveen

Nuveen New York AMT-Free Quality Municipal Income's (NRK) dividend yield is 4.21% with a payout ratio of 0.29. Over the past 52 weeks, the stock has increased 2.69% and shares are trading with a price-book ratio of 0.84 and a price-earnings ratio of 6.9. The company's average yield was 5.06% over the past 10 years.

The closed-end investment company has a market cap of $1.1 billion and a GuruFocus profitability rating of 3 out of 10. The return on equity of 12.56% and return on assets of 7.8% are outperforming 70% of competitors. Its financial strength is rated 4 out of 10 with an equity-asset ratio of 0.63.

Reliance Steel

Reliance Steel & Aluminum Co.'s (RS) dividend yield is 2.49% and the payout ratio is 0.27. Over the past 52 weeks, the stock has increased 2.25%. Shares are trading with a price-earnings ratio of 11.17 and a price-book ratio of 1.23.

The U.S.-based metal service center has a market cap of $6 billion. GuruFocus rated its profitability 8 out of 10. The return on equity of 14.19% and return on assets of 8.53% are outperforming 81% of competitors. Its financial strength is rated 6 out of 10. The cash-debt ratio of 0.1 is below the industry median of 0.32.

With 1.08% of outstanding shares, Chuck Royce (Trades, Portfolio) is the company's largest guru shareholder, followed by Pioneer Investments (Trades, Portfolio) with 0.98% and Renaissance Technologies with 0.29%.

Rush Enterprises

Rush Enterprises Inc.'s (RUSHA) dividend yield is 1.27% with a payout ratio of 0.15. Over the past 52 weeks, the stock has risen 14.04% and the shares are trading with a price-book ratio of 1.27 and a price-earnings ratio of 12.05. The company's average yield was 1.11% over the past 10 years.

The commercial truck dealer has a market cap of $1.4 billion and a GuruFocus profitability rating of 7 out of 10. The return on equity of 11.27% and return on assets of 3.75% are outperforming 62% of competitors. Its financial strength is rated 5 out of 10, with a cash-debt ratio of 0.08 and an equity-asset ratio of 0.36.

With 2.39% of outstanding shares, HOTCHKIS & WILEY is the company's largest guru shareholder, followed by Simons' firm with 1.26% and Ronald Muhlenkamp (Trades, Portfolio) with 0.69%.

Disclosure: I do not own any stocks mentioned.

Read more here:

5 Utilities Trading With Low Price-Earnings Ratios

5 Undervalued Stocks With Profitable Business

6 Insurance Companies Trading With Low Price-Sales Ratios

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.