7 Stocks John Rogers Continues to Buy

John Rogers (Trades, Portfolio), leader of Ariel Investment, bought shares of the following stocks in both the second and third quarters of fiscal 2019.

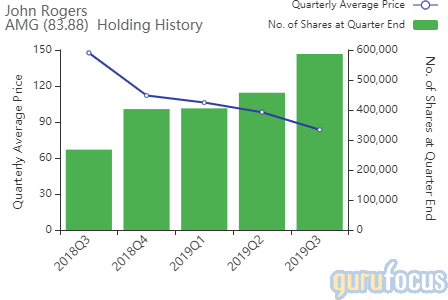

Affiliated Managers Group

The guru increased the Affiliated Managers Group Inc. (NYSE:AMG) position by 12.86% in the second quarter and then added 28.23% in the third quarter. The stock has a weight of 0.65% in the portfolio.

The investment strategies provider has a market cap of $4.16 billion. Its revenue of $2.24 billion has grown at an average rate of 0.80% per annum over the last five years.

Mason Hawkins (Trades, Portfolio)' Southeastern Asset Management is the company's largest guru shareholder with 2.93% of outstanding shares, followed by Jim Simons (Trades, Portfolio)' Renaissance Technologies with 1.93% and Rogers with 1.13%.

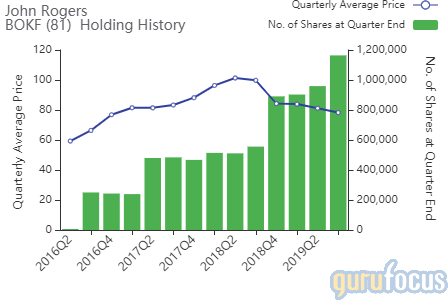

BOK Financial

Rogers boosted the BOK Financial Corp. (NASDAQ:BOKF) stake by 6.23% in the second quarter and added 21.34% in the third quarter. The stock has a weight of 1.23% in the portfolio.

The company, which operates in the banking industry, has a market cap of $5.75 billion. Its revenue of $1.73 billion has grown 5.60% over the last five years.

The company's largest guru shareholder is Rogers with 1.64% of outstanding shares, followed Diamond Hill Capital (Trades, Portfolio) with 0.88%, Chuck Royce (Trades, Portfolio) with 0.54% and Simons' firm with 0.17%.

Foot Locker

The investor boosted the Foot Locker Inc. (NYSE:FL) holding by 153.22% in the second quarter and added 24.67% in the third quarter. The stock has a total weight of 0.15% in the portfolio.

The company, which operates footwear retail stores, has a market cap of $4.60 billion. Its revenue of $217 million has risen 9.10% over the last five years.

Ray Dalio (Trades, Portfolio)'s Bridgewater Associates is the largest guru shareholder of the company with 0.77% of outstanding shares, followed by Lee Ainslie (Trades, Portfolio) with 0.32% and Richard Pzena (Trades, Portfolio) with 0.22%.

EOG Resources

In the second quarter, the guru boosted the EOG Resources Inc. (NYSE:EOG) position by 15.13% and increased it another 30.29% in the third quarter. The stock has a weight of 0.91% in the portfolio.

The oil and gas producer has a market cap of $41.03 billion. Its revenue of $17.45 billion has fallen 3.10% over the last five years.

The largest guru shareholders of the company is Barrow, Hanley, Mewhinney & Strauss with 1.87% of outstanding shares, followed by Pioneer Investments (Trades, Portfolio) with 0.45%, PRIMECAP Management (Trades, Portfolio) with 0.37% and Bill Nygren (Trades, Portfolio) with 0.31%.

Generac Holdings

Rogers raised the Generac Holdings Inc. (NYSE:GNRC) position by 32.56% in the second quarter and then boosted it by 10.14% in the third quarter. The stock has a weight of 0.49% in the portfolio.

The company, which manufactures power generation equipment and other engine-powered products, has a market cap of $5.93 billion. Its revenue of $2.17 billion has grown at an average annual rate of 9.0% over the last five years.

The largest guru shareholder of the company is Mairs and Power (Trades, Portfolio) with 1.01% of outstanding shares, followed by Pioneer Investments with 0.71% and Royce with 0.35%.

Korn Ferry

In the second quarter, the guru bolstered the Korn Ferry (NYSE:KFY) position by 12.15%, and increased it by 21.16% in the third quarter. The stock has a weight of 0.25% in the portfolio.

The management consulting company has a market cap of $2.17 billion. Its revenue of $1.99 billion has risen 12.50% on average every year over the last five years.

The largest guru shareholder of the company is Simons' firm with 0.98% of outstanding shares, followed by Royce with 0.95%, Hotchkis & Wiley with 0.31% and Ken Fisher (Trades, Portfolio) with 0.11%.

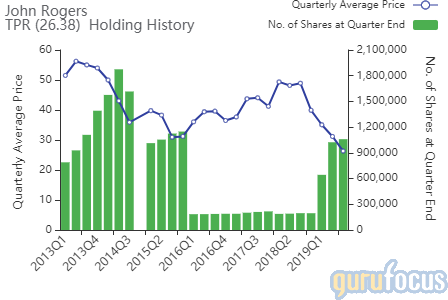

Tapestry

Rogers boosted the Tapestry Inc. (NYSE:TPR) position by 59.03% in the second quarter and then increased it 3.52% in the third quarter. The stock has a weight of 0.37% in the portfolio.

The company, which retails handbags, apparel, footwear and accessories, has a market cap of $7.34 billion. Its revenue of $6.0 billion has grown at an average annual rate of 5.40% over the last five years.

Other notable guru shareholders of the company include Larry Robbins (Trades, Portfolio) with 0.22% of outstanding shares, Pioneer Investments with 0.20% and Robert Olstein (Trades, Portfolio) with 0.12%.

Disclosure: I do not own any stocks mentioned.

Read more here:

Glenn Greenberg Exits Facebook, Trims Alphabet

Robertson's Tiger Management Buys Adobe, Facebook

8 Stocks Donald Smith Continues to Buy

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.