7 Stocks the Insiders Are Buying on Sale

[Editor’s Note: This article is updated each week with the latest insider purchasing. Check back regularly to see who’s making moves.]

An insider is a person who has access to confidential information about a company. And when I’m analyzing a company as a potential long-term investment, I always like to know what the insiders are doing. They have a much better idea of what is happening in the company than most analysts. When there is insider buying after the price of the stock has recently dropped, it could be a bullish signal.

Over the years, there have been numerous examples of insiders using this information to profit at the expense of uninformed investors. For example, suppose an insider knows that news is about to be released that will make the stock price go up. They can buy it from a shareholder who doesn’t have access to the news at a cheaper price then benefit from the gains.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

Because of these abuses, the SEC has established rules and procedures to prevent this type of activity. When an insider wants to buy or sell their company’s stock, they have to file a form with the SEC. This is public information, and it can lead to investment ideas.

There are numerous reasons why an insider of a company may need to sell their stock. They may need to raise money for things such as tuition or to buy a home. However, there is only one reason why an insider would buy their company’s stock — they believe that it is undervalued and they will make money.

These seven stocks have had significant insider buying recently and could be worth a look.

Stocks With Insider Buying: Church & Dwight (CHD)

Church & Dwight (NYSE:CHD) manufactures and sells household, personal care and specialty products.

CHD stock has been under pressure recently. Well-known short seller Ben Axler of Spruce Point Capital Management said that the company engages is “extreme financial engineering, aggressive accounting and material self-enrichment practices.” That sounds pretty bad.

Matthew Farrell is the president and CEO of Church & Dwight. Apparently he disagrees with this assessment. He must believe that the stock will soon recover because he just made a significant personal investment of $500,000. He bought 7,000 shares at $71.32.

Liberty TripAdvisor Holdings (LTRPA)

Liberty TripAdvisor Holdings (NASDAQ:LTRPA) engages in online travel research and online commerce business.

Over the past year, the price of LTRPA has fallen dramatically. Last November it traded as high as $20. Now it is trading below $10. Wall Street is neutral on the company. Only two firms follow it, and they each have hold ratings on it.

Gregory Maffei has been an officer of Liberty for five years. He is the chairman, president and CEO of the company. He must feel that the stock is a great value at current levels, because he just invested $160,000 when he paid $10.38 a share for over 15,000 shares.

Pacific Mercantile Bancorp (PMBC)

Pacific Mercantile Bancorp (NASDAQ:PMBC) operates as a holding company that provides a range of commercial banking and services to small- and medium-sized businesses.

After making a significant drop in price from last September through December, PMBC stock has been volatile but it has basically traded sideways.

The Board of Directors just announced that they have appointed Brad Dinsmore as the president and CEO of the company. From 2011 to 2017, Dinsmore was executive vice president of SunTrust Banks.

He must have a lot of confidence that he will be able to take actions that will cause the price of the stock to rise. He recently paid $7.98 for 28,000 shares. This is an investment of almost $225,000.

Pennsylvania Real Estate Investment Trust (PEI)

Pennsylvania Real Estate Investment Trust (NYSE:PEI) is a publicly traded REIT that owns and manages quality properties in compelling markets.

PEI stock has sold off significantly over the past year. Last August it was trading around $11 a share. It is currently trading around the $5.50 level.

Wall Street does not like this stock. Seven firms follow it. The average rating in underweight and the average price target is $5.25, which is below where it is currently trading.

Leonard Korman is a director of PEI. Apparently he believes that the stock will turn around because he just paid $5.29 for 30,000 shares. In August he also bought 30,000 shares as well. His total investment was about $300,000. There was also buying by other insiders as well.

Aldeyra Therapeutics (ALDX)

Aldeyra Therapeutics (NASDAQ:ALDX) is a biotechnology company that develops and commercializes medicines for immune-mediated ocular and systemic diseases.

ALDX stock has lost over 50% of its value in the past year. This isn’t surprising because the company loses a lot of money. Last quarter it reported losses of $13 million and in the prior quarter the loss was more than $15 million.

Todd Brady, the president and CEO of Aldeyra, invested roughly $85,000 into the company on Sept. 18, buying 14.288 shares at $5.91 per share. In addition, on Sept. 9 and Sept. 10 he paid an average of $5.14 for 20,000 shares. This was a $100,000 investment.

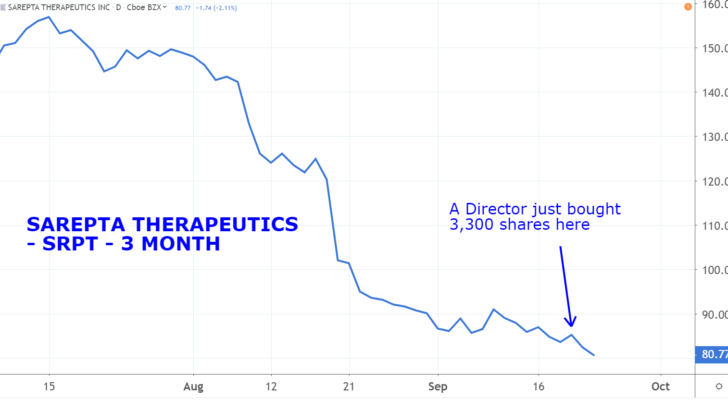

Sarepta Therapeutics (SRPT)

Sarepta Therapeutics (NASDAQ:SRPT) focuses of the discovery and development of medicines for rare diseases.

Over the past two months, the price of SRPT stock has lost 50% of its value. It dropped from levels around $160 to current levels around $80.

This is primarily due to the fact that the company received some disappointing news from the FDA. First, one of their drugs that is in a clinical trial caused serious side effects. Second, another drug has to be delayed beyond when it was supposed to hit the market.

Richard Barry is a director of the company. He must believe that this selling has created a buying opportunity. He just invested almost $290,000 when he bought 3,309 shares at $87.49.

Lexicon Pharmaceuticals (LXRX)

Lexicon Pharmaceuticals (NASDAQ:LXRX) is a biopharmaceutical company that develops and sells pharmaceutical products.

The price of LXRX stock had been trending lower for almost a year. Then at the end of July it reported that its partnership with Sanofi (NASDAQ:SNY) had terminated the partnership and plunged from $6 to $2.

The insiders of the company must believe that this selling was overdone because they have been making significant purchases of the stock.

Lonnel Coats is the president and CEO of Lexicon Pharmaceuticals. He invested over $300,000 in the stock when he acquired 100,000 shares for an average price of around $3.11. Raymond Debbane is a director of the company. He just made an investment of about $700,000 when he bought about 290,000 shares. There have been purchases by other insiders as well.

At the time of this writing Mark Putrino did not hold any positions in the aforementioned securities.

More From InvestorPlace

The post 7 Stocks the Insiders Are Buying on Sale appeared first on InvestorPlace.