7 Stocks the Vanguard Health Care Fund Keeps Buying

The Vanguard Health Care Fund (Trades, Portfolio), which invests at least 80% of its assets in stocks of companies principally related to the health care industry, bought shares of the following stocks in both the second and third quarters.

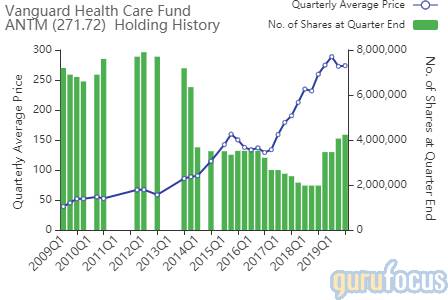

Anthem Inc. (NYSE:ANTM)

The fund increased its position by 17.36% in the second quarter and then raised it by 4.17% in the third quarter. The stock has a weight of 2.45% in the portfolio.

The American managed-care organization has a market cap of $68.90 billion. Its revenue of $100.17 billion has grown at an average rate of 8.60% per annum over the last five years.

Andreas Halvorsen (Trades, Portfolio) is the largest guru shareholder of the company with 2.03% of outstanding shares, followed by Barrow, Hanley, Mewhinney & Strauss with 1.49% and First Eagle Investment (Trades, Portfolio) with 0.66%.

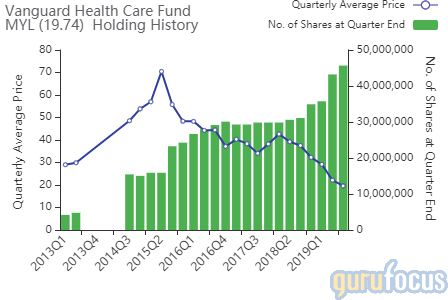

Mylan NV (NASDAQ:MYL)

Vanguard increased its stake by 20.82% in the second quarter and added 5.69% in the third quarter. The stock has a weight of 2.17% in the portfolio.

The generic pharmaceutical manufacturer has a market cap of $10.18 billion. Its revenue of $11.28 billion has grown at an average annual rate of 5.0% over the last five years.

Another notable guru shareholder of the company is Richard Pzena (Trades, Portfolio) with 3.76% of outstanding shares, followed by John Paulson (Trades, Portfolio) with 2.13% and First Pacific Advisors (Trades, Portfolio) with 1.18%.

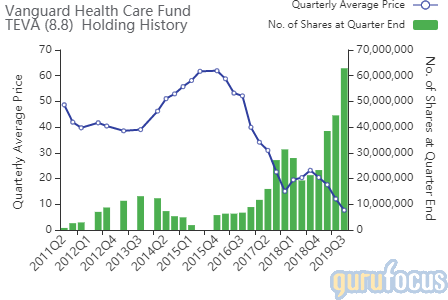

Teva Pharmaceutical Industries Ltd. (NYSE:TEVA)

The Health Care Fund increased its holding by 15.79% in the second quarter and by 41.11% in the third quarter. The stock has a total weight of 1.04% in the portfolio.

The company, which develops and sells branded pharmaceuticals, has a market cap of $9.61 billion. Its revenue of $17.72 billion has fallen 4.20% on average every year over the last five years.

Warren Buffett (Trades, Portfolio) is another notable guru shareholder of the company with 3.96% of outstanding shares, followed by David Abrams (Trades, Portfolio) with 1.65% and Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.90%.

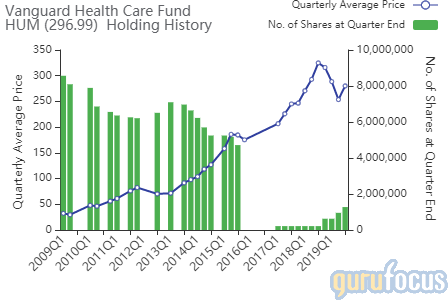

Humana Inc. (NYSE:HUM)

In the second quarter, the fund increased its position by 52.48% and then boosted it by 33.52% in the third quarter. The stock has a weight of 0.78% in the portfolio.

The company, which provides government-sponsored health care plans, has a market cap of $40.12 billion. Its revenue of $60.72 billion has grown 8.40% on average every year over the last five years.

The largest guru shareholder of the company is Simons' firm with 2.18% of outstanding shares, followed by Larry Robbins (Trades, Portfolio) with 1.30% and Lee Ainslie (Trades, Portfolio) with 1.15%.

Alkermes PLC (NASDAQ:ALKS)

Vanguard bolstered its position by 23.98% in the second quarter and by 0.46% in the third quarter. The stock has a weight of 0.61% in the portfolio.

The biotechnology company has a market cap of $3.18 billion. Its revenue of $1.07 billion has grown at an average annual rate of 11.20% over the last five years.

The largest guru shareholder of the company is PRIMECAP Management (Trades, Portfolio) with 14.80% of outstanding shares, followed by Simons' firm with 2.51%, Paul Tudor Jones (Trades, Portfolio) with 0.10% and Steven Cohen (Trades, Portfolio) with 0.08%.

Centene Corp. (NYSE:CNC)

In the second quarter, the fund raised its stake by 20.66% and by 15.28% in the third quarter. The stock has a weight of 0.48% in the portfolio.

The American health care plans provider has a market cap of $21.40 billion. Its revenue of $72.33 billion has grown 25.90% on average every year over the last five years.

The largest guru shareholder of the company is Halvorsen with 4.03% of outstanding shares, followed by Ainslie with 1.77% and Daniel Loeb (Trades, Portfolio) with 0.72%.

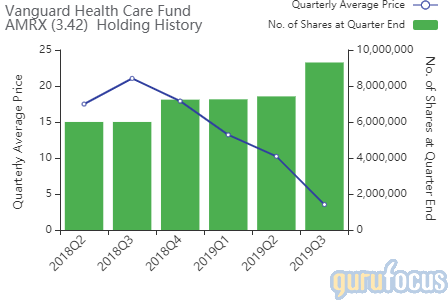

Amneal Pharmaceuticals Inc. (NYSE:AMRX)

The fund increased its position by 2.24% in the second quarter and by 25.38% in the third quarter. The stock has a weight of 0.06% in the portfolio.

The drugmaker has a market cap of $1.09 billion.

Another notable guru shareholder of the company is Cohen with 1.11% of outstanding shares, followed by the Simons' firm with 0.02% and Joel Greenblatt (Trades, Portfolio) with 0.01%.

Disclosure: I do not own any stocks mentioned.

Read more here:

David Carlson Trims Charles Schwab, Exits Verizon

Diamond Hill Continues to Buy Baidu, Deere

Kahn Brothers Trims Merck, Exits Sterling Bancorp

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.