9 Simple Steps to Land a Mortgage and Buy Your First Home

So, you think you may be ready for your first home? Make the leap!

"Interest rates are on their way up. If you have been thinking of buying, this is a good time," says Amy Schmidt, associate professor of economics and business at Saint Anselm College in New Hampshire.

But before we pull out the champagne and celebrate your new address, you'll have to get a mortgage. That can seem intimidating, but this simple nine-step plan can help.

1. Find out your credit score

Do you know your credit score and income-to-debt ratio?

Sure, maybe you’ve gotten this "adulting" thing down. You’re paying your bills on time, doing laundry, and cooking more than just frozen pizza. But do you know your credit score?

It's a three-digit number that reflects how well you handle money. You'll need to see it before you apply for a home loan because the higher your score, the more banks will be willing to work with you, and the lower your mortgage rate will be.

Your credit card issuer may give you a free peek at your credit score, or there are other ways to see your credit score without paying a fee.

If your score needs some help, pay down debt and take other steps to raise it.

2. Pull together your pay stubs

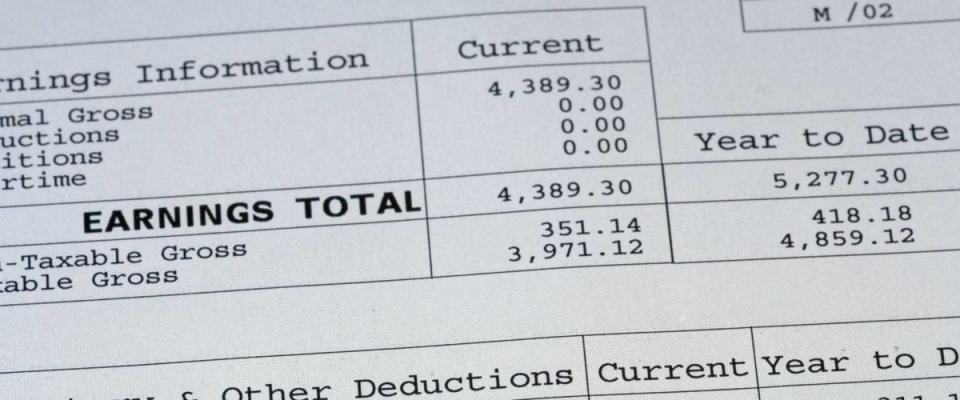

A mortgage lender will want to review your most recent pay stubs.

This one may seem obvious, but a lender is going to need to see proof of your income before it will give you a mortgage.

As you get ready to become a first-time homebuyer, grab a folder and start gathering the necessary paperwork.

You'll need at least several months of pay stubs, as well as proof of how long you've been at your job. Your original employment contract might come in handy, if you have it.

If you have income from any sources other than your job, like alimony or dividends from stocks you own, it’s important to bring proof of all of that as well.

3. Collect your recent bank statements

A lender will want to see how much you have in the bank.

Unless you've opted for paperless banking, you probably get your bank account statements mailed to you each month. A mortgage lender will want to look at the most recent statements to see what you have in the bank and how much you earn.

If you've already shredded your printed statements, don’t panic. You can go to your bank's website and print out new ones yourself. If you don’t have access to a printer, you can walk into your bank and ask for new copies.

Lenders also will try to get some insight into your spending habits. So don't make any big, crazy purchases as you apply for a mortgage.

4. Grab your tax returns

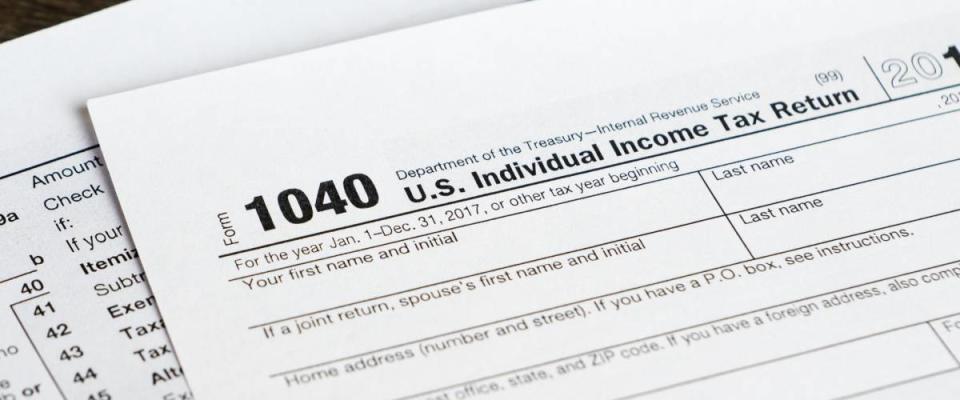

A mortgage lender will want to peek at your tax returns, too.

Banks want to look at the past two years of your tax returns, because they want to see that you earn money consistently over time.

If you've misplaced your tax documents (something you should NEVER do), the IRS allows you to request a transcript from previous years.

However, keep in mind that it will take a few weeks to show up, which could slow your quest for a mortgage.

Want more MoneyWise? Sign up for our weekly newsletter.

5. Be able to show you're stable

If you're thinking about changing jobs, wait until after you secure your mortgage.

You want to give the bank the impression that you are a reliable person and won’t flake out on your mortgage when times get tough. This means you want to show that you've been in your current residence for a year or more.

If a lender sees you tend to break your lease every six months, or if you have any history of eviction, that can be a huge red flag.

If an eviction is on your record, the lender will dig deep into your past and may even contact your former landlord.

Another way to look stable and responsible to a lender is if you've stayed at your job for at least two years. If you're thinking about changing jobs, wait until after you secure your mortgage.

6. Know how much house you can afford

If you're married, or if you are buying a house together with your partner, your gross income gets combined.

After the economic crisis of 2008, over 10 million families lost their homes to foreclosures. A big reason was that banks had given out too many mortgages borrowers couldn't handle.

Today, there are laws to make sure a lender cannot offer you a mortgage that will cost more than 35% of your monthly income. But to be on the safe side, never take out a mortgage that will eat up more than 28% percent of what you make each month.

If you earn $50,000 a year, you’re bringing in roughly $4,166 a month. That means your mortgage should never go above $1,167.

Use our calculator to find out how much house is within your budget.

7. Get preapproved for a loan

It’s important to know how much financing you qualify for before you go house shopping.

Shop around for your mortgage. Never apply to just one mortgage company or bank. And find a lender who will preapprove you for a loan, even before you've looked at any homes. Getting preapproved allows you to know your budget upfront.

Don't be tempted by loans with teaser rates, Professor Schmidt cautions.

"Beware of adjustable-rate mortgages (ARMs) that have a low introductory rate. Often, these are tied to one-year Treasury bills, and those rates will be rising," she says.

"If you are likely to be in a home for fewer than five years, then a 5/1 ARM may worth a look," Schmidt adds. "Your interest rate only readjusts after five years."

8. Find a real estate professional

When you call a real estate company to get a tour of a house, you are usually talking to an agent, and their boss is a broker.

When you call a real estate company to start touring homes, you are usually talking to an agent, and his or her boss is a broker.

Real estate agents and brokers both make money on commission, meaning they want you to buy your dream house just as much as you do.

These real estate pros can give you great advice about the homebuying process in your particular area. They can look at your financial situation and help steer you in the right direction.

Find a good agent or broker by getting referrals from people you know.

9. Be ready to sign and sign and sign

If you actually get approve on a mortgage, congratulations!

Once you've found a home and have landed a mortgage, you're closer to popping open that champagne. However, you still face a lot of paperwork and process.

The house needs to be inspected, the deed or "title" of the house must be transferred, and so on. Much of this will be handled by your real estate broker or even a lawyer, if you choose to hire one.

But you can expect to pay a few thousand dollars in related fees and sign a big stack of documents when it's time to close on your house and officially take ownership.

And then — once you have the keys in hand — it will finally be time for that toast!

Subscribe now to our free weekly newsletter. Don’t miss out!