These are the 9 stocks with the highest correlation to bitcoin and ethereum, according to JPMorgan

The lack of a spot bitcoin ETF means some investors are looking for other ways to gain exposure to cryptocurrencies.

Investors can buy stocks that have exposure to the crypto sector via mining and direct holdings.

These are the 9 stocks with the highest correlation to bitcoin and ether, according to JPMorgan.

Other than buying it directly, US-based investors have few options to gain exposure to cryptocurrency tokens like bitcoin and ether.

While multiple futures-based bitcoin ETFs launched over the past two months, they come with high tradings costs that could deviate from the underlying return of bitcoin. And the SEC is showing no signs of giving in to allowing a spot-based bitcoin ETF, which would directly own the underlying cryptocurrency similar to gold and silver ETFs.

But there is one way investors can easily gain exposure to cryptocurrencies without buying the coins directly, and that's through individual stocks, according to JPMorgan. Companies like MicroStrategy and Coinbase, among others have significant exposure to the success crypto broadly and bitcoin specifically.

"Such listed companies have become increasingly popular vehicles for investors to get exposure to the crypto industry," JPMorgan said in a note last week.

These are the 9 stocks with the highest correlation to bitcoin and ether, according to JPMorgan. Relative performance charts were sourced from Koyfin.

9. Bit Minin

Ticker: BTCM

Market Capitalization: $503.6 million

3 Month Correlation to Bitcoin: 57.5%

3 Month Correlation to Ether: 54.1%

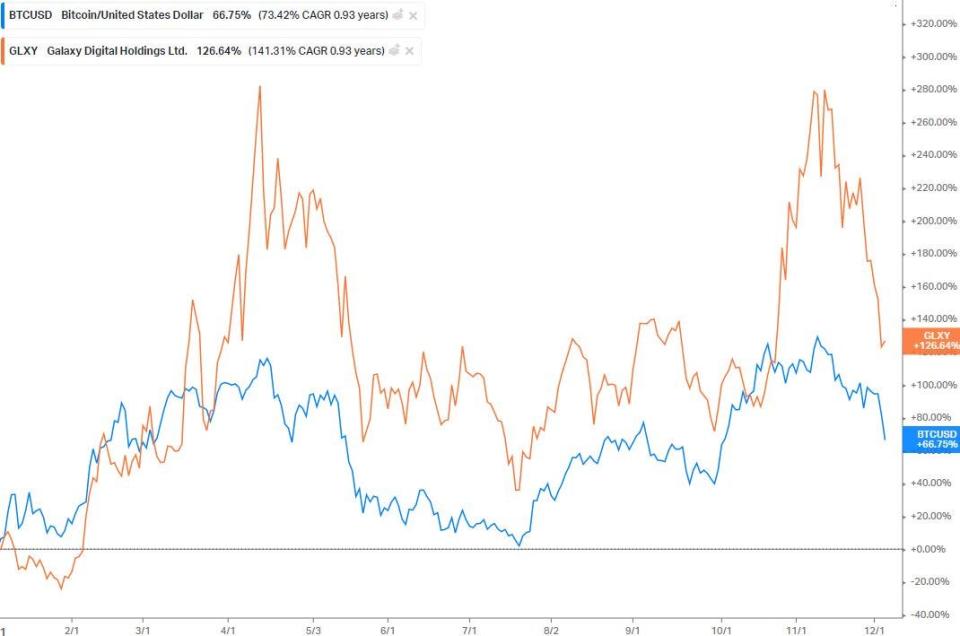

8. Galaxy Digital

Ticker: GLXY

Market Capitalization: $2.5 billion

3 Month Correlation to Bitcoin: 52.7%

3 Month Correlation to Ether: 60.6%

7. Marathon Digital

Ticker: MARA

Market Capitalization: $5.0 billion

3 Month Correlation to Bitcoin: 61.8%

3 Month Correlation to Ether: 53.4%

6. Hut 8 Mining

Ticker: HUT

Market Capitalization: $2.2 billion

3 Month Correlation to Bitcoin: 61.5%

3 Month Correlation to Ether: 58.2%

5. Riot Blockchain

Ticker: RIOT

Market Capitalization: $3.8 billion

3 Month Correlation to Bitcoin: 65.3%

3 Month Correlation to Ether: 58.7%

4. Hive Blockchain

Ticker: HIVE

Market Capitalization: $1.7 billion

3 Month Correlation to Bitcoin: 63.3%

3 Month Correlation to Ether: 65.4%

3. Coinbase

Ticker: COIN

Market Capitalization: $61.3 billion

3 Month Correlation to Bitcoin: 64.6%

3 Month Correlation to Ether: 55.3%

2. Bitfarms

Ticker: BITF

Market Capitalization: $1.8 billion

3 Month Correlation to Bitcoin: 70.8%

3 Month Correlation to Ether: 68.5%

1. Microstrategy

Ticker: MSTR

Market Capitalization: $7.1 billion

3 Month Correlation to Bitcoin: 75.8%

3 Month Correlation to Ether: 73.6%

Read the original article on Business Insider