ACM Research's (NASDAQ:ACMR) Wonderful 529% Share Price Increase Shows How Capitalism Can Build Wealth

While ACM Research, Inc. (NASDAQ:ACMR) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 23% in the last quarter. But over the last three years the stock has shone bright like a diamond. The longer term view reveals that the share price is up 529% in that period. As long term investors the recent fall doesn't detract all that much from the longer term story. The only way to form a view of whether the current price is justified is to consider the merits of the business itself.

Anyone who held for that rewarding ride would probably be keen to talk about it.

See our latest analysis for ACM Research

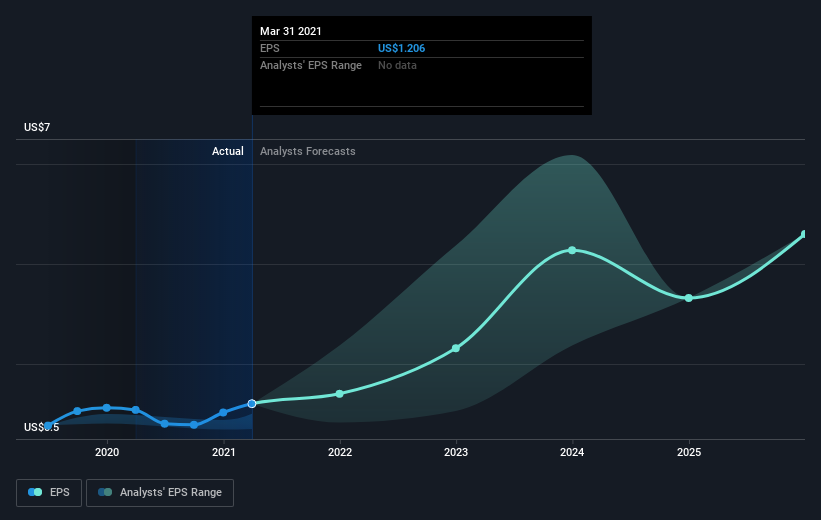

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During three years of share price growth, ACM Research moved from a loss to profitability. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It is of course excellent to see how ACM Research has grown profits over the years, but the future is more important for shareholders. You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's nice to see that ACM Research shareholders have gained 63% (in total) over the last year. The TSR has been even better over three years, coming in at 85% per year. It's always interesting to track share price performance over the longer term. But to understand ACM Research better, we need to consider many other factors. Take risks, for example - ACM Research has 3 warning signs we think you should be aware of.

We will like ACM Research better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.