Activision Blizzard Bookings Beat Estimates on Call of Duty

(Bloomberg) -- Activision Blizzard Inc. reported bookings that beat analysts’ estimates on the strength of a new Call of Duty release as well as several other big titles.

Most Read from Bloomberg

Russia Blames US for Nord Stream Blasts, Threatens Consequences

Commodity Trader Trafigura Faces $577 Million Loss After Uncovering Nickel Fraud

China’s Balloon Was Capable of Spying on Communications, US Says

Chinese Balloon Was Part of Years-Long Spying Program, US Says

Meta Asks Many Managers to Get Back to Making Things or Leave

The video game publisher, which is in the process of being purchased by Microsoft Corp. for $69 billion, reported net bookings rose 43% to $3.57 billion in the fourth quarter. Analysts had estimated $3.08 billion, according to data compiled by Bloomberg. It was the biggest jump in bookings in nine quarters and signals a rebound for the gaming industry after a sluggish 2022. Adjusted earnings per share were $1.87 in the three months ended Dec. 31, compared with estimates of $1.52.

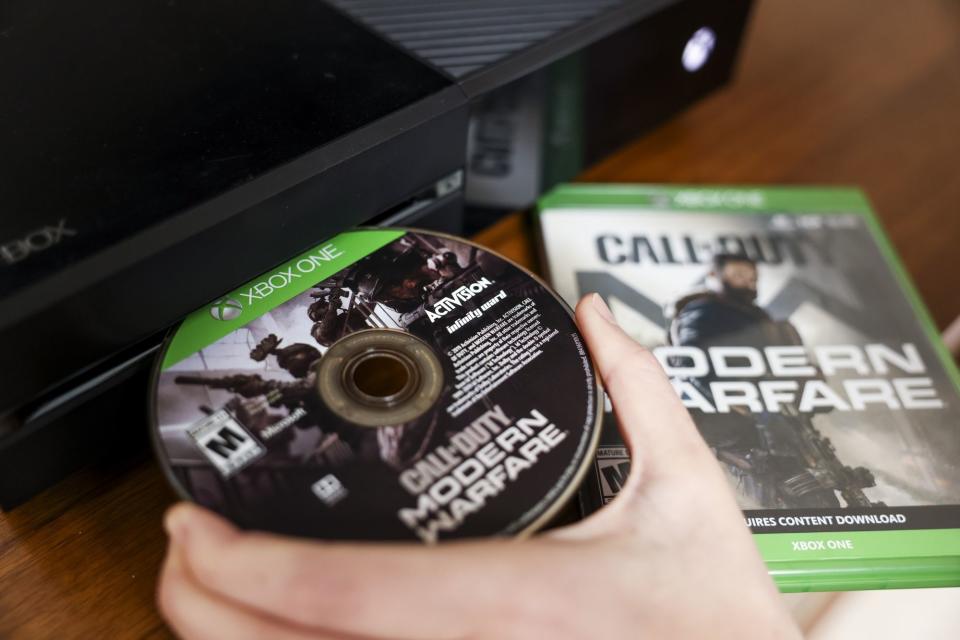

In October, Activision released Call of Duty: Modern Warfare II, the latest entry in the lucrative shooter series. It sold $1 billion in 10 days and was the best-selling video game of 2022, according to industry researcher NPD Group. In the same quarter, Activision subsidiary Blizzard Entertainment also released Overwatch 2, a free-to-play sequel to the popular multiplayer game, and Dragonflight, a new expansion to the long running online game World of Warcraft. Activision said that Dragonflight did not sell as well as the previous expansion, 2020’s Shadowlands.

The video game industry is poised to rebound this year with pent-up demand for games after many anticipated titles were delayed in 2022. Overall spending on video game content declined 4.3% in 2022 to $184.4 billion, according to estimates from gaming analytics firm NewZoo.

This year in lieu of a brand new Call of Duty game, Activision will release a continuation of Modern Warfare II, developed by Sledgehammer Games, Bloomberg has reported. Santa Monica, California-based Activision will also release Diablo 4, the latest entry in Blizzard’s action role-playing game series, in June. The previous entry sold more than 30 million copies, making it one of the best-selling games in history.

Activision said it had 389 million active monthly users for the quarter.

In January 2022, Microsoft announced its plans to buy Activision, but the transaction must pass through regulatory approvals in 16 jurisdictions and is far from a done deal. In December, the US Federal Trade Commission sued to block the transaction, saying Microsoft’s ownership of Activision could hurt other players in the $200 billion gaming market by limiting rivals’ access to the company’s biggest games.

Last week, European regulators sent a list of concerns to Microsoft, setting out potential reasons for blocking the deal if no remedies are offered. And the UK Competition and Markets Authority is expected in the coming days to issue its provisional findings, signaling whether it aims to block the deal or clear it with specific remedies. The acquisition contract stipulates that the deal must close by July 18.

Activision said “the two parties are continuing to engage with regulators reviewing the transaction and are working toward closing it in Microsoft’s fiscal year.”

The shares were little changed in extended trading after the financial results were reported. They ended the day down 4.9% at $71.58 amid antitrust concerns that the deal may be blocked.

Activision said it “remains cognizant of risks, including those related to our execution, economic conditions, the labor market, and exchange rates,” but expects “at least high-teens year-over-year growth” for net revenue, and “at least high-single digit year-over-year growth in net bookings and total segment operating income for 2023.”

(Updates with shares and outlook in final paragraph.)

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.