Is Adani Power (NSE:ADANIPOWER) A Risky Investment?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Adani Power Limited (NSE:ADANIPOWER) makes use of debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Adani Power

How Much Debt Does Adani Power Carry?

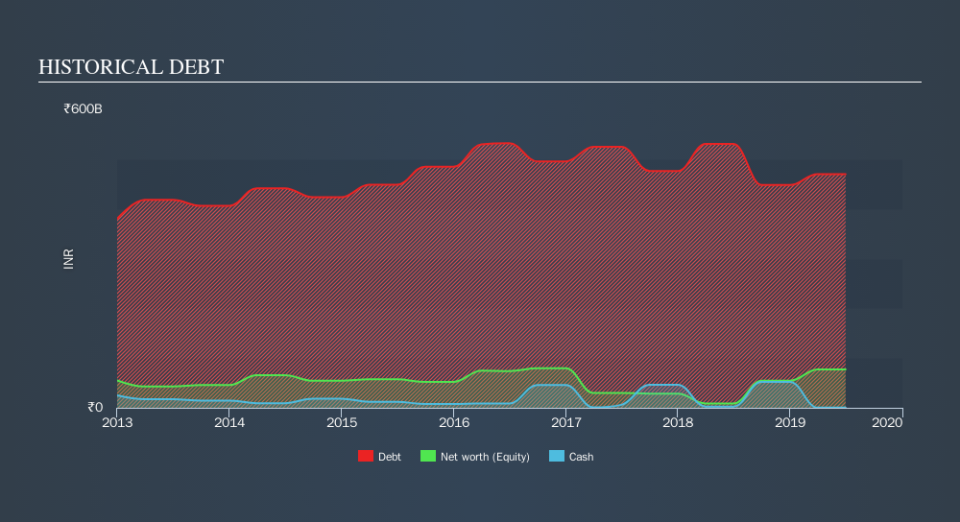

You can click the graphic below for the historical numbers, but it shows that Adani Power had ₹469.8b of debt in March 2019, down from ₹530.4b, one year before. And it doesn't have much cash, so its net debt is about the same.

A Look At Adani Power's Liabilities

Zooming in on the latest balance sheet data, we can see that Adani Power had liabilities of ₹181.6b due within 12 months and liabilities of ₹421.1b due beyond that. On the other hand, it had cash of ₹272.5m and ₹100.4b worth of receivables due within a year. So it has liabilities totalling ₹502.1b more than its cash and near-term receivables, combined.

This deficit casts a shadow over the ₹265.0b company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt At the end of the day, Adani Power would probably need a major re-capitalization if its creditors were to demand repayment.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Weak interest cover of 1.4 times and a disturbingly high net debt to EBITDA ratio of 6.4 hit our confidence in Adani Power like a one-two punch to the gut. The debt burden here is substantial. Looking on the bright side, Adani Power boosted its EBIT by a silky 68% in the last year. Like a mother's loving embrace of a newborn that sort of growth builds resilience, putting the company in a stronger position to manage its debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Adani Power can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, Adani Power actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

We feel some trepidation about Adani Power's difficulty level of total liabilities, but we've got positives to focus on, too. To wit both its conversion of EBIT to free cash flow and EBIT growth rate were encouraging signs. Taking the abovementioned factors together we do think Adani Power's debt poses some risks to the business. So while that leverage does boost returns on equity, we wouldn't really want to see it increase from here. While Adani Power didn't make a statutory profit in the last year, its positive EBIT suggests that profitability might not be far away.Click here to see if its earnings are heading in the right direction, over the medium term.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.