Is Admicom Oyj's (HEL:ADMCM) Share Price Gain Of 167% Well Earned?

Unless you borrow money to invest, the potential losses are limited. On the other hand, if you find a high quality business to buy (at the right price) you can more than double your money! For example, the Admicom Oyj (HEL:ADMCM) share price had more than doubled in just one year - up 167%. On top of that, the share price is up 13% in about a quarter. Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

See our latest analysis for Admicom Oyj

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

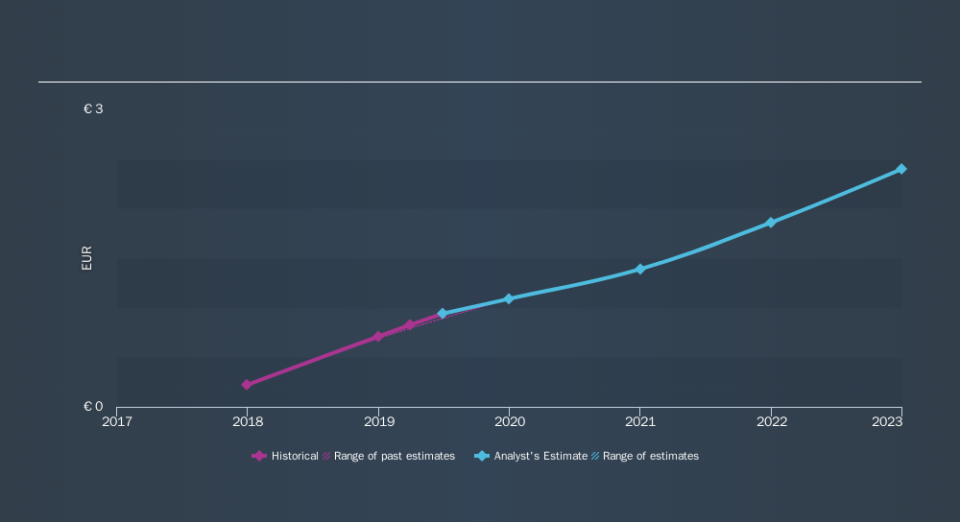

Admicom Oyj was able to grow EPS by 103% in the last twelve months. This EPS growth is significantly lower than the 167% increase in the share price. This indicates that the market is now more optimistic about the stock. The fairly generous P/E ratio of 56.49 also points to this optimism.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that Admicom Oyj has improved its bottom line lately, but is it going to grow revenue? Check if analysts think Admicom Oyj will grow revenue in the future.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Admicom Oyj's TSR for the last year was 172%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's nice to see that Admicom Oyj shareholders have gained 172% over the last year , including dividends . The more recent returns haven't been as impressive as the longer term returns, coming in at just 13%. It seems likely the market is waiting on fundamental developments with the business before pushing the share price higher (or lower). Is Admicom Oyj cheap compared to other companies? These 3 valuation measures might help you decide.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FI exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.