Is Adverum Biotechnologies, Inc. (ADVM) A Good Stock To Buy?

We can judge whether Adverum Biotechnologies, Inc. (NASDAQ:ADVM) is a good investment right now by following the lead of some of the best investors in the world and piggybacking their ideas. There's no better way to get these firms' immense resources and analytical capabilities working for us than to follow their lead into their best ideas. While not all of these picks will be winners, research shows that these picks historically outperformed the market when we factor in known risk factors.

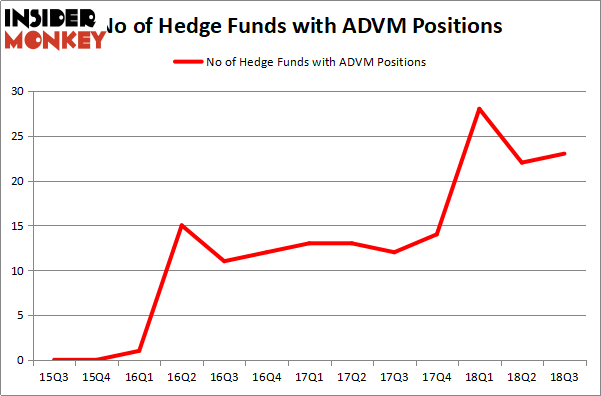

Adverum Biotechnologies, Inc. (NASDAQ:ADVM) has experienced an increase in enthusiasm from smart money lately. ADVM was in 23 hedge funds' portfolios at the end of September. There were 22 hedge funds in our database with ADVM positions at the end of the previous quarter. Our calculations also showed that ADVM isn't among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey's flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That's why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let's take a look at the key hedge fund action encompassing Adverum Biotechnologies, Inc. (NASDAQ:ADVM).

What does the smart money think about Adverum Biotechnologies, Inc. (NASDAQ:ADVM)?

At the end of the third quarter, a total of 23 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 5% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards ADVM over the last 13 quarters. So, let's find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Jim Simons's Renaissance Technologies has the number one position in Adverum Biotechnologies, Inc. (NASDAQ:ADVM), worth close to $21.4 million, amounting to less than 0.1%% of its total 13F portfolio. Coming in second is Phill Gross and Robert Atchinson of Adage Capital Management, with a $18.2 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Remaining members of the smart money that are bullish encompass Richard Driehaus's Driehaus Capital, Gilchrist Berg's Water Street Capital and Josh Donfeld and David Rogers's Castle Hook Partners.

Now, key money managers were breaking ground themselves. Water Street Capital, managed by Gilchrist Berg, established the biggest position in Adverum Biotechnologies, Inc. (NASDAQ:ADVM). Water Street Capital had $7 million invested in the company at the end of the quarter. Malcolm Fairbairn's Ascend Capital also initiated a $2.1 million position during the quarter. The other funds with brand new ADVM positions are Vishal Saluja and Pham Quang's Endurant Capital Management, Ari Zweiman's 683 Capital Partners, and Michael Platt and William Reeves's BlueCrest Capital Mgmt..

Let's now review hedge fund activity in other stocks - not necessarily in the same industry as Adverum Biotechnologies, Inc. (NASDAQ:ADVM) but similarly valued. These stocks are Assertio Therapeutics, Inc. (NASDAQ:ASRT), Gladstone Investment Corporation (NASDAQ:GAIN), NeoPhotonics Corp (NYSE:NPTN), and American Software, Inc. (NASDAQ:AMSWA). This group of stocks' market valuations are similar to ADVM's market valuation.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position ASRT,11,86694,-6 GAIN,6,5885,3 NPTN,10,60383,0 AMSWA,6,29991,-2 Average,8.25,45738,-1.25 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 8.25 hedge funds with bullish positions and the average amount invested in these stocks was $46 million. That figure was $93 million in ADVM's case. 0 is the most popular stock in this table. On the other hand Gladstone Investment Corporation (NASDAQ:GAIN) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks Adverum Biotechnologies, Inc. (NASDAQ:ADVM) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index